Forex

11 Trading Strategies Every Trader Should Know

Written by Nathalie Okde

Fact checked by Rania Gule

Updated 10 December 2024

Table of Contents

Trading strategies are the backbone of successful market participation. Whether you just joined the trading space, or you’ve got years of experience up your sleeve, you need a trading strategy to follow.

This article presents the best and most popular trading strategies for you to choose the one that suits you best.

Key Takeaways

-

A trading strategy is a structured plan to maximize profits while managing risks.

-

Popular strategies include news trading, trend trading, and scalping.

-

Every strategy has unique benefits and risks, so choose based on your style and goals.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Are Trading Strategies?

A trading strategy is a systematic approach to buying and selling in the financial markets. It’s like a game plan that traders use to maximize returns while managing risks.

There are multiple trading strategies that differ based on timing, technical level, and personal trading style.

Trading Strategies Key Components

Every successful trading strategy relies on a few critical components that ensure its effectiveness and sustainability.

Risk management is at the heart of trading success, helping you safeguard your capital by minimizing losses. Trading strategies also help in setting clear stop limits on how much you are willing to risk on any single trade.

Alongside this, technical analysis plays a vital role in forecasting price movements. By interpreting charts, indicators, and patterns, traders can make informed decisions about when to enter or exit the market.

Lastly, a solid trading plan ties everything together. This plan serves as a roadmap, outlining your entry and exit strategies, position sizing, and overall trading goals.

Together, these elements form the foundation of a winning strategy, providing the structure and discipline needed to navigate the complexities of the market effectively.

Top 11 Trading Strategies

Trading strategies are very versatile and what works for me might not work for you.

However, whether prefer fast-paced trades or long-term investments, there’s a strategy tailored to your goals.

Below are some of the most popular trading strategies:

-

News Trading Strategy

-

Trend Trading Strategy

-

Range Trading Strategy

-

Day Trading Strategy

-

End-of-Day Trading Strategy

-

Swing Trading Strategy

-

Scalping Trading Strategy

-

Position Trading Strategy

-

Gap Trading Strategy

-

Price Action Trading Strategy

-

Algorithmic Trading Strategy

News Trading Strategy

News trading is centered around market events and economic news. It revolves around reacting to significant market news that can make prices skyrocket or fall dramatically.

Think of things like political news, interest rate announcements, job reports, or company earnings calls.

The market thrives on news, and if you’re quick enough, you can capitalize on these sudden movements.

For example, according to The Economics Time, the US dollar surged to its highest level in four months on Wednesday following Donald Trump's victory in the U.S. presidential election.

Therefore, you could’ve made good profits if you quickly reacted to the news.

However, the trick here isn’t just speed, it’s about knowing which news matters and how it might impact the market.

4 News Trading Strategy Tips

News trading is one of the top trading strategies, so here are some tips to help you out:

-

Stay Informed: Use reliable sources like financial news platforms or economic calendars to track upcoming events.

-

Stick to Liquid Markets: Trade in assets with high liquidity, such as forex or large-cap stocks, to ensure smooth entry and exit.

-

Prepare in Advance: Anticipate potential market reactions by analyzing past events.

-

Use Stop-Loss Orders: Protect yourself from sudden reversals by setting clear stop-loss levels.

Benefits and Risks of the News Trading Strategy

The news trading is one of the best trading strategies presenting many benefits but it also has some risks.

Benefits

-

Quick Profits: Market reactions to news can lead to rapid price changes, offering immediate opportunities.

-

Frequent Opportunities: News events happen regularly, giving traders consistent chances to act.

Risks

-

Unpredictability: Markets don’t always react as expected, making outcomes uncertain.

-

Stressful: The need for quick decision-making and constant monitoring can be overwhelming.

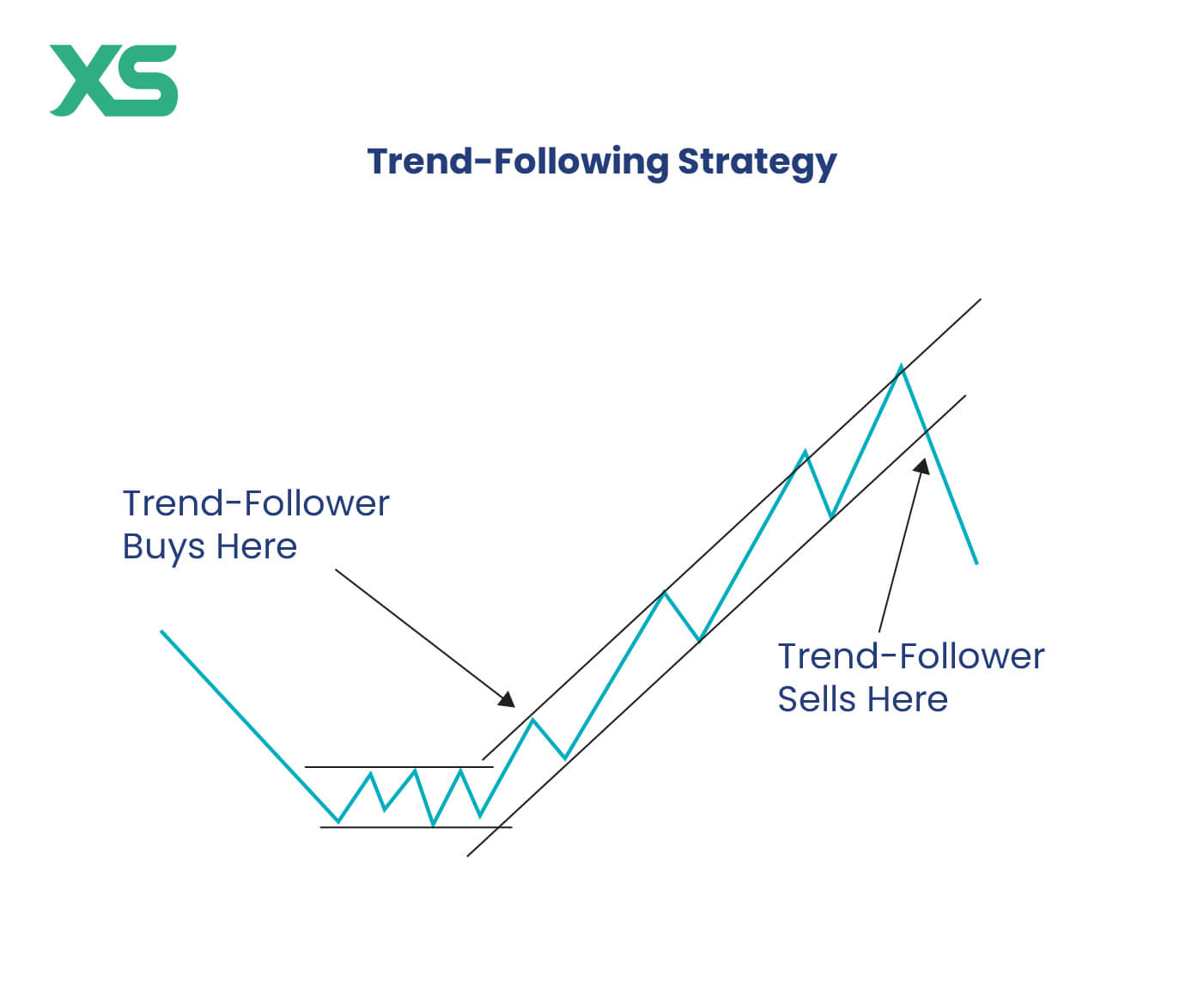

Trend Trading Strategy

Trend trading focuses on identifying and riding market trends, whether upward or downward. It’s similar to news trading but focuses on broader price movements in the market and is less time-sensitive.

This strategy is ideal for traders who want to capitalize on sustained price movements rather than short-term fluctuations.

For example, during the post-pandemic recovery in 2021, global equity markets experienced a strong upward trend as investors anticipated economic growth.

Trend traders who identified this momentum early could have profited significantly by holding long positions in key indices or sectors.

Trend Trading Strategy Tips

To successfully trade trends, keep these tips in mind:

-

Use Technical Indicators: Tools like moving averages, MACD, or RSI can help confirm trends and spot potential reversals.

-

Stick to the Timeframe: Focus on your preferred timeframe, whether daily, weekly, or monthly, and avoid distractions from shorter-term price movements.

-

Ride the Trend: "The trend is your friend." Stay invested until indicators suggest a clear reversal.

-

Set a Stop-Loss: Protect your position by setting stop-loss levels below recent lows (for uptrends) or above recent highs (for downtrends).

Benefits and Risks of the Trend Trading Strategy

While trend trading is one of the most widely used trading strategies, it comes with both advantages and challenges.

Benefits

-

Simplicity: Easy to understand, making it ideal for beginners.

-

High Success Rate: Works well in strongly trending markets.

-

Scalable: Can be applied to various timeframes and asset classes.

Risks

-

False Trends: Sudden reversals or choppy markets can lead to losses.

-

Patience Required: Trends can take time to fully develop, requiring traders to wait before realizing profits.

Range Trading Strategy

Range trading focuses on markets that move within a predictable range, bouncing between support (the price floor) and resistance (the price ceiling) levels.

It focuses on breakout points beyond these levels.

Traders aim to buy at support and sell at resistance, capitalizing on the repeating price patterns.

For instance, if a stock consistently trades between $50 and $60, a trader might buy at $50 and sell at $60, repeating this cycle as long as the range holds.

This strategy works best in stable markets where prices move sideways rather than trending up or down.

Range Trading Strategy Tips

Range trading thrives in stable markets with predictable price levels. Here’s how to make it work:

-

Identify Clear Ranges: Use support and resistance levels on the chart to define the range.

-

Trade Near Key Levels: Buy near support and sell near resistance for maximum profit.

-

Monitor for Breakouts: Stay cautious if prices approach the edges of the range, as breakouts can invalidate the strategy.

-

Use Oscillators: Tools like RSI or Stochastic Oscillator can confirm overbought or oversold conditions.

Benefits and Risks of the Range Trading Strategy

Range trading offers predictability by relying on stable price movements within clear support and resistance levels, making it ideal for steady markets. However, sudden breakouts beyond the range can lead to unexpected losses, and the limited profit potential may not suit all traders.

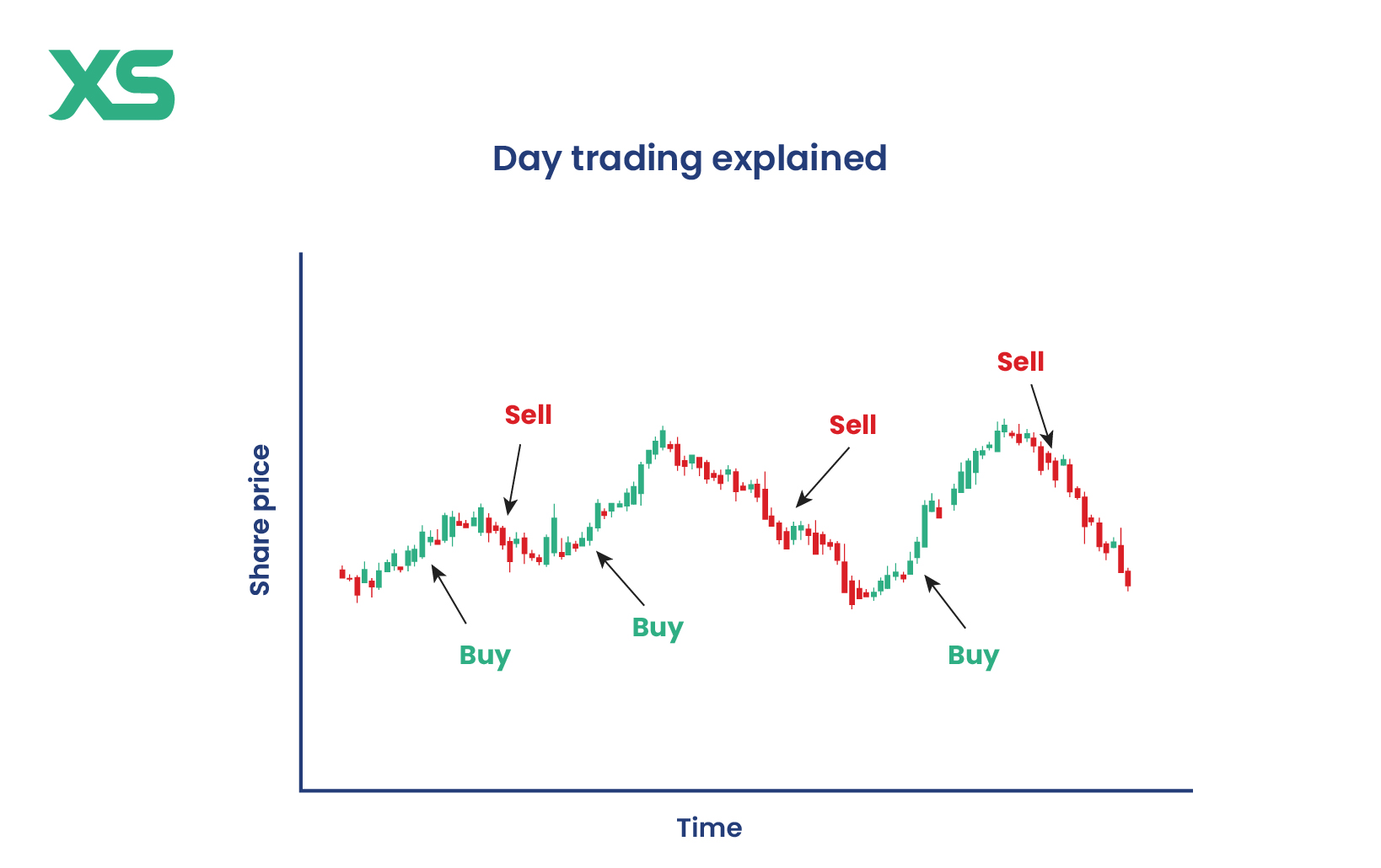

Day Trading Strategy

Day trading involves buying and selling securities within a single trading day, aiming to capitalize on short-term price fluctuations. It’s a fast-paced strategy that requires sharp decision-making and close monitoring of the markets.

For example, a day trader might notice a sudden spike in a tech stock early in the day and buy shares, expecting the momentum to continue.

Later, they sell the stock before the market closes to avoid overnight risks.

Day trading is popular due to its potential for quick profits, but it demands discipline, focus, and robust risk management.

4 Day Trading Strategy Tips

Day trading requires speed and discipline. Follow these tips:

-

Trade Liquid Assets: Focus on forex, large-cap stocks, or indices with high trading volume.

-

Monitor the Market Constantly: Stay alert for price movements during the trading day.

-

Stick to a Risk-Reward Ratio: Maintain at least a 1:2 ratio to ensure potential profits outweigh risks.

Benefits and Risks of the Day Trading Strategy

Day trading allows traders to avoid overnight risks and profit quickly from intraday price movements. However, it requires intense focus, quick decision-making, and can lead to high transaction costs, which may reduce overall profitability.

End-of-Day Trading Strategy

End-of-day trading focuses on market analysis and decisions made near the close of the trading day. Traders use this strategy to analyze the day’s data, such as closing prices and candlestick patterns, and place trades that will execute the next day.

For instance, a trader notices that a stock's daily candlestick pattern indicates a bullish reversal and enters a buy order.

Since this strategy doesn’t require constant monitoring during the day, it’s ideal for part-time traders. However, it carries overnight risks due to potential market gaps.

End-of-Day Trading Strategy Tips

End-of-day trading is perfect for part-time traders. Here’s how to succeed:

-

Focus on Daily Charts: Analyze daily candlestick patterns for key signals.

-

Plan Trades Ahead: Use closing prices to set orders for the next trading day.

-

Stay Informed: Monitor macroeconomic events that might affect overnight positions.

-

Use Wide Stop-Loss Levels: Account for potential overnight gaps.

Benefits and Risks of the End-of-Day Trading Strategy

End-of-day trading is less time-intensive and allows traders to focus on reliable daily trends, making it suitable for part-time participants. On the downside, overnight market gaps can lead to losses, and the fewer trading opportunities may limit growth.

Swing Trading Strategy

Swing trading is one the day trading strategies that targets medium-term price movements, holding positions for days or weeks to capture "swings" in market momentum.

Traders look for opportunities after pullbacks in uptrends or bounces in downtrends.

For example, a swing trader identifies a stock in an uptrend but notices a temporary dip in price.

They buy during the dip, hold for a few days as the price recovers, and sell for a profit once the momentum peaks.

This strategy strikes a balance between quick trades and long-term investing, making it suitable for traders who can’t monitor markets constantly but want more action than position trading.

Swing Trading Strategy Tips

Swing trading captures medium-term market movements. Maximize your success with these tips:

-

Identify the Trend: Use moving averages to confirm the overall market direction.

-

Time Entries with Indicators: Use tools like RSI or Fibonacci retracements for precise entry points.

-

Be Patient: Allow trades to develop over several days or weeks.

-

Set Target Prices: Define profit and stop-loss levels based on swing highs or lows.

Benefits and Risks of the Swing Trading Strategy

Swing trading balances flexibility and profitability by targeting medium-term price movements, offering larger gains per trade than intraday strategies. However, market fluctuations and holding positions overnight can expose traders to risks from unforeseen events.

Scalping Trading Strategy

Scalping, another one the day trading strategies, is a high-speed trading strategy aimed at making small, frequent profits by capitalizing on minute price movements.

Scalpers hold positions for only a few seconds or minutes, trading in highly liquid markets to ensure quick entry and exit.

For instance, a scalper might buy shares of a stock at $100.10 and sell them moments later at $100.15, earning a small but consistent profit.

While scalping can be profitable when done skillfully, it requires intense focus, rapid decision-making, and high-frequency trading tools to execute trades efficiently.

4 Scalping Trading Strategy Tips

Scalping is all about precision and speed. Here’s how to get it right:

-

Focus on Liquidity: Trade highly liquid markets like forex or large-cap stocks.

-

Use Tight Spreads: Ensure minimal cost per trade by selecting assets with low spreads.

-

Set Quick Targets: Aim for small, frequent gains with tight stop-loss orders.

-

Leverage Technology: Use fast trading platforms and tools for efficient execution.

Benefits and Risks of the Scalping Trading Strategy

Scalping provides frequent profit opportunities and low exposure to market risks due to short trade durations. Nonetheless, it demands intense focus, rapid execution, and can incur significant transaction costs due to the volume of trades.

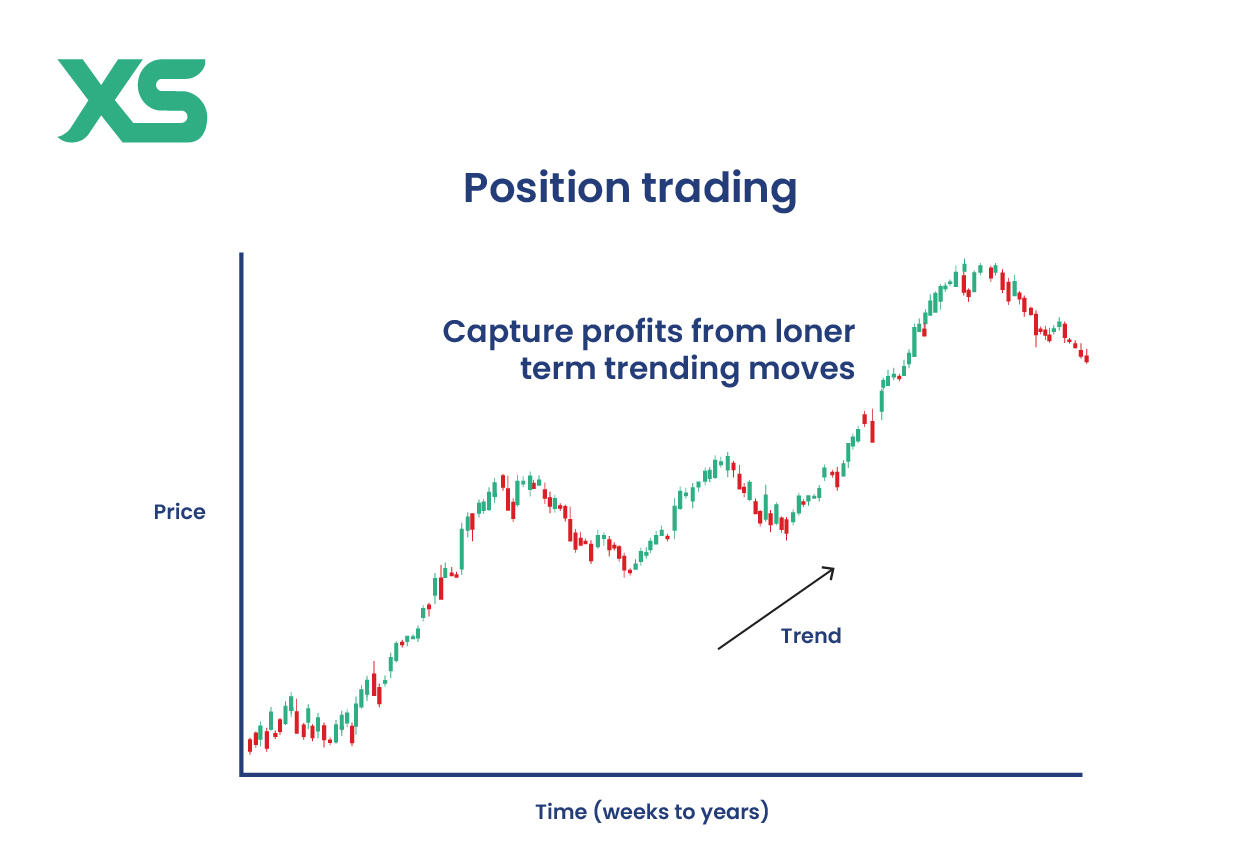

Position Trading Strategy

Position trading is a long-term approach where traders hold positions for weeks, months, or even years, aiming to profit from significant market trends or fundamental changes.

This strategy is less about daily price movements and more about the broader market direction.

For example, a trader might buy shares of a growing tech company based on its strong fundamentals and hold them as the company expands over the next year.

Position trading requires patience and a deep understanding of fundamental and technical analysis, but it’s ideal for those who prefer less frequent trades.

Position Trading Strategy Tips

Position trading is ideal for long-term investors. Here’s how to succeed:

-

Use Fundamental Analysis: Focus on long-term economic indicators and company fundamentals.

-

Stay Updated on Macroeconomics: Monitor factors like interest rates and GDP growth.

-

Ignore Short-Term Fluctuations: Stay focused on the bigger picture.

-

Diversify Your Portfolio: Reduce risk by investing in various asset classes.

Benefits and Risks of the Position Trading Strategy

Position trading allows investors to capitalize on long-term market trends with minimal time commitment. However, extended holding periods can expose traders to market volatility and tie up capital, limiting liquidity.

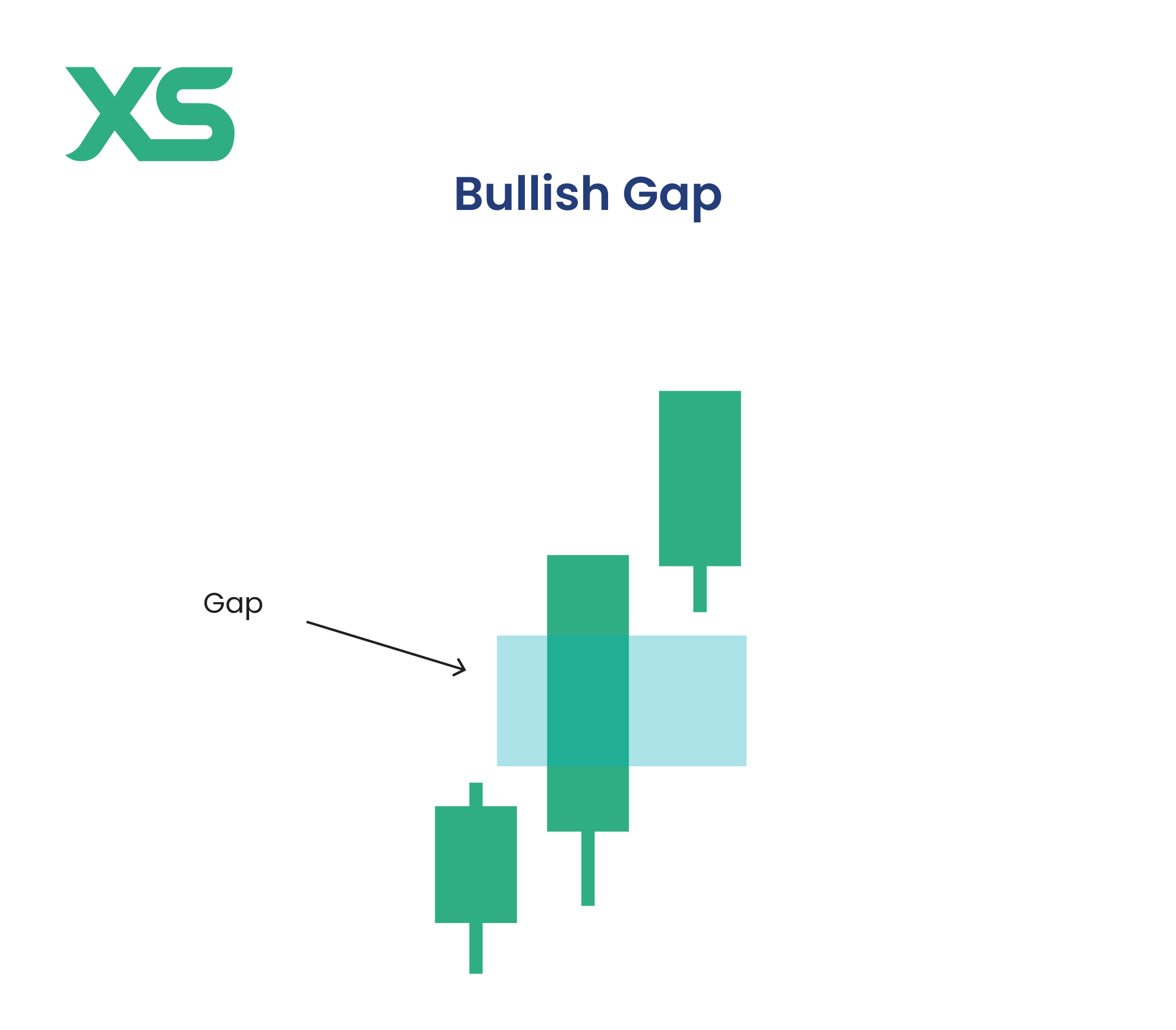

Gap Trading Strategy

Gap trading focuses on price gaps that occur when an asset opens significantly higher or lower than its previous close, often due to after-hours news or events.

Traders look to profit from the subsequent price adjustments.

For example, if a stock closes at $90 and opens the next day at $95 due to strong earnings, a trader might buy expecting the upward momentum to continue.

Alternatively, they might short the stock, predicting a correction.

This strategy is not very beginner-friendly and is best suited for experienced traders who can quickly analyze and act on market conditions.

Gap Trading Strategy Tips

Gap trading leverages overnight price gaps. Here’s how to succeed:

-

Use Pre-Market Data: Analyze price action before the market opens.

-

Confirm Gaps: Ensure the gap is caused by significant news or volume changes.

-

Set Tight Stops: Protect against reversals by limiting losses.

-

Trade Liquid Assets: Focus on stocks or forex pairs with high trading volume.

Benefits and Risks of the Gap Trading Strategy

Gap trading can yield quick profits as markets adjust to overnight price gaps caused by significant news. However, price gaps can also reverse unexpectedly, making it a strategy that demands swift and precise action.

Algorithmic Trading Strategy

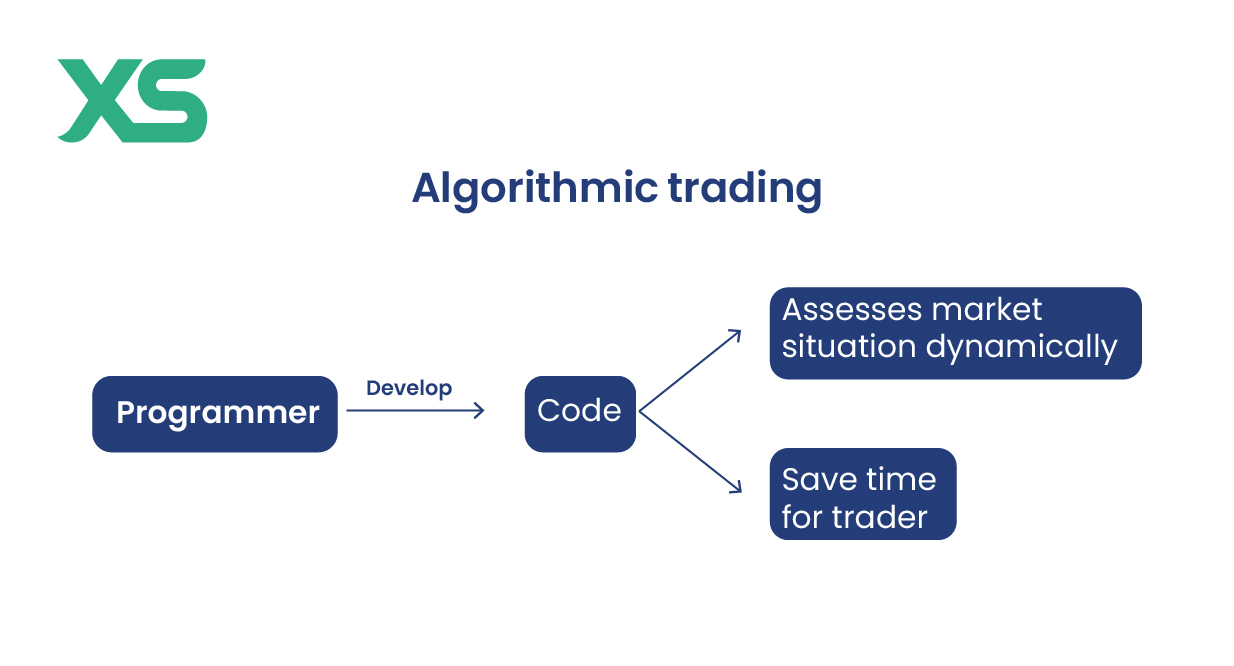

Algorithmic trading uses computer algorithms to execute trades based on pre-programmed criteria like price, volume, or timing. These strategies range from simple rule-based systems to advanced machine learning models.

For instance, an algorithm might automatically buy a stock when it crosses a 50-day moving average and sell when it hits a profit target.

Algorithmic trading is popular for its speed and precision, but it requires access to sophisticated technology and careful monitoring to avoid malfunctions or unexpected market conditions.

4 Algorithmic Trading Strategy Tips

Algorithmic trading leverages technology. Here’s how to optimize it:

-

Define Clear Rules: Program algorithms with precise criteria for trading.

-

Backtest Thoroughly: Test strategies on historical data to ensure effectiveness.

-

Monitor Performance: Regularly check for algorithm errors or market changes.

-

Stay Updated: Adapt algorithms to evolving market conditions.

Benefits and Risks of the Algorithmic Trading Strategy

Algorithmic trading provides speed, consistency, and emotion-free execution, making it highly efficient. However, it is vulnerable to technical failures, and over-reliance on backtested results may lead to poor real-world performance.

Price Action Trading Strategy

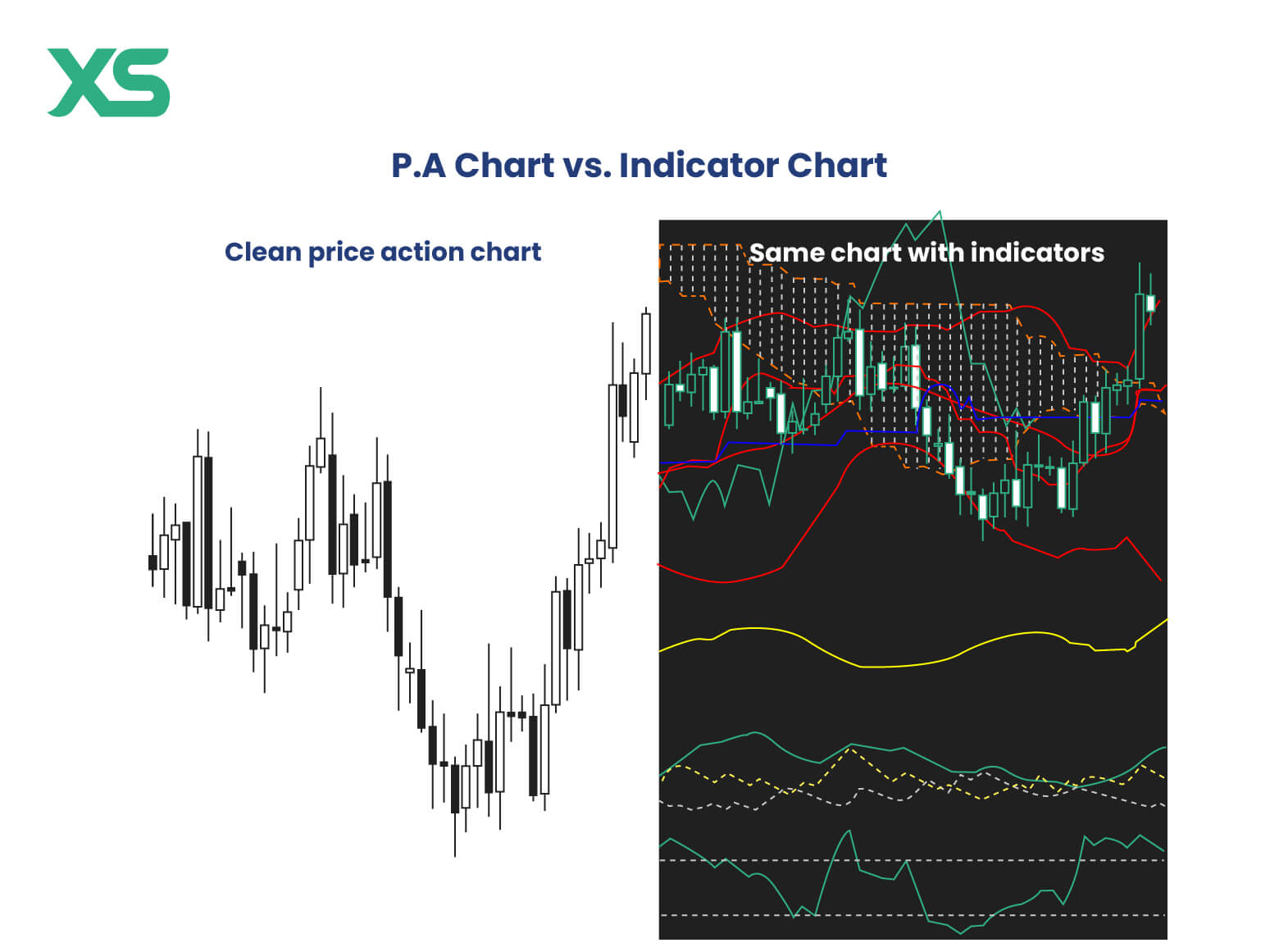

Last but not least, price action trading focuses on analyzing raw price movements rather than relying heavily on indicators or algorithms.

Traders observe patterns such as candlestick formations, support and resistance levels, and trendlines to make decisions.

For example, if a trader spots a bullish engulfing pattern near a support level, they might enter a long position, expecting a price increase.

Price action trading is versatile and works across various timeframes, but it requires strong analytical skills and experience to interpret patterns correctly.

Price Action Trading Strategy Tips

Price action relies on pure chart analysis. Here’s how to excel:

-

Focus on Patterns: Learn common formations like pin bars and engulfing candles.

-

Use Support and Resistance: Trade based on price reactions at key levels.

-

Simplify Indicators: Avoid overloading charts with unnecessary tools.

-

Understand Context: Consider the broader market trend when analyzing price action.

Benefits and Risks of the Price Action Trading Strategy

Price action trading is straightforward and versatile, relying on raw price movements without the need for complex indicators. The downside is that interpreting patterns can be subjective, requiring experience and a deep understanding of market behavior.

Best Trading Strategies Summary

The table below provides a concise overview of the above mentioned trading strategies, highlighting their core approach, key advantages, and potential drawbacks.

|

Strategy |

Description |

Pros |

Cons |

|

News Trading |

Trades on market-moving news and events. |

Quick profits, frequent opportunities. |

Unpredictable & stressful |

|

Trend Trading |

Follows sustained market trends over time. |

Simple, scalable, effective in trends |

False trends, requires patience |

|

Range Trading |

Buys at support and sells at resistance in stable markets. |

Predictable, frequent opportunities |

Risk of breakouts, limited profit |

|

Day Trading |

Multiple trades within a single day, avoiding overnight positions. |

Quick profits, avoids overnight risks |

High stress, transaction costs |

|

End-of-Day Trading |

Trades based on daily analysis near market close. |

Less time-intensive, reliable trends |

Overnight gaps, fewer opportunities |

|

Swing Trading |

Targets medium-term price movements over days or weeks. |

Larger gains, flexible for part-time |

Fluctuations, overnight risks |

|

Scalping |

Profits from small price movements in very short trades. |

Low risk exposure, frequent trades |

High costs, intense focus required |

|

Position Trading |

Long-term trades held for weeks, months, or years. |

Low effort, captures big trends |

Market volatility, capital lock-up |

|

Breakout Trading |

Profits from price breaking support or resistance levels. |

High potential, clear signals |

False breakouts, volatile movements |

|

Gap Trading |

Exploits price gaps from overnight news. |

Quick profits, clear opportunities |

Risk of reversals, fast execution needed |

|

Algorithmic Trading |

Automated trading using pre-programmed rules. |

Fast, consistent, emotion-free |

Technical failures, backtest limitations |

Conclusion

Following trading strategies is essential for navigating the complexities of financial markets. Whether you prefer short-term approaches like scalping or long-term methods like position trading, there’s a strategy tailored to your goals.

By understanding the pros and cons of each, you can confidently create a plan that aligns with your style and risk tolerance.

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

The best strategy depends on your trading style and goals. Beginners often start with trend trading or swing trading.

This rule focuses on managing position size and risk over short, medium, and long-term trades.

The main types include scalping, day trading, swing trading, and position trading.

This strategy suggests risking only 2% of your trading capital on a single trade to limit potential losses.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.