Forex

What Is a Stock Market Bubble? Causes, Effects, and Predictions

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 8 August 2024

Table of Contents

A stock market bubble occurs when stock prices rise way beyond their true value, driven by market hype and excitement. These bubble levels in the market, marked by rapid price hikes followed by sudden crashes, can have huge impacts on the economy.

In this article, we'll break down what a bubble in the stock market is all about, look at some historical examples, and explore what causes and effects these bubbles have.

Key Takeaways

-

Stock market bubbles occur when prices rise far beyond their true value due to hype and speculation, leading to rapid price hikes and sudden crashes.

-

Bubbles are driven by economic factors, investor psychology, technological innovations, and regulatory influences, and they have significant impacts when they burst.

-

Recognize bubbles through signs like rapid price increases and speculation. Use predictive tools to navigate and protect investments during these volatile periods.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Is a Stock Market Bubble?

A stock market bubble occurs when stock prices climb much higher than their actual value, usually driven by excited investors and rampant speculation.

Picture a balloon inflating more and more until it finally pops. That's what happens in the stock market when a bubble forms and then bursts.

These bubbles are often caused by overly optimistic investor behavior, where everyone is eager to buy stocks, driving prices to unsustainable levels.

Eventually, when people realize that prices can't keep going up forever, the stock market bubble bursts, leading to a sharp market correction.

Causes of Stock Market Bubbles

Stock market bubbles, which can lead to a stock market crash and contribute to broader economic bubbles, arise from a combination of various factors.

Here's a closer look at what drives these phenomena:

Economic Factors

-

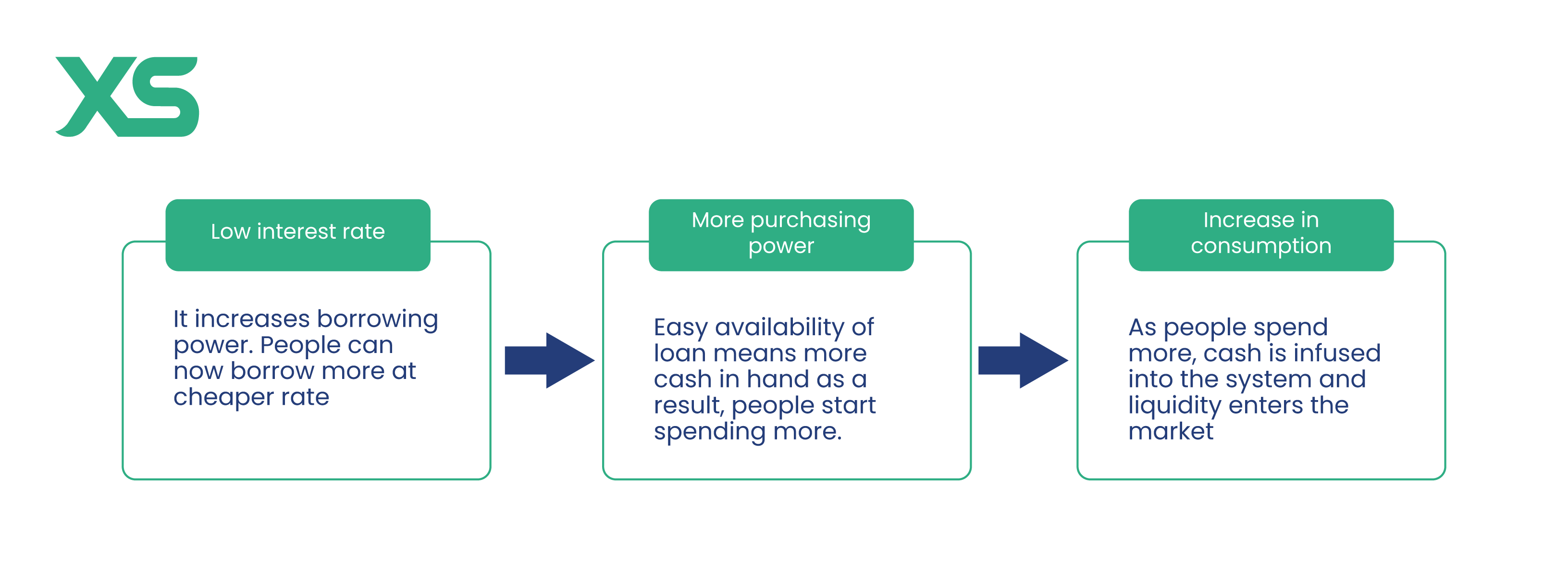

Low Interest Rates: When interest rates are low, borrowing money becomes cheaper. This encourages investors to take on more debt to invest in stocks, driving up prices and potentially leading to a bubble.

-

Excessive Liquidity: An abundance of money in the financial system, often due to central bank policies, can lead to excessive investment in the stock market, inflating prices beyond their intrinsic value.

Market Psychology

-

Herd Mentality: Investors often follow the crowd, buying stocks because others are doing so. This herd behavior can drive stock prices up rapidly, contributing to a bubble.

-

Overconfidence and Speculation: When investors are overly confident in the market's continued rise, they tend to speculate more. This speculative activity can further inflate stock prices.

Technological Innovations

-

Emergence of New Technologies: New and exciting technologies can spark investor enthusiasm, increase buying, and inflate stock prices. This was seen during the dot-com bubble.

-

Impact of Social Media and Trading Platforms: Modern trading platforms and social media can amplify trends and spread information quickly, sometimes fueling speculative behavior and contributing to the formation of bubbles.

Regulatory and Policy Influence

-

Government Policies: Government actions, such as tax incentives or deregulation, can encourage investment in the stock market, potentially leading to bubbles.

-

Central Bank Actions: Policies set by central banks, such as quantitative easing, can increase liquidity and lower interest rates.

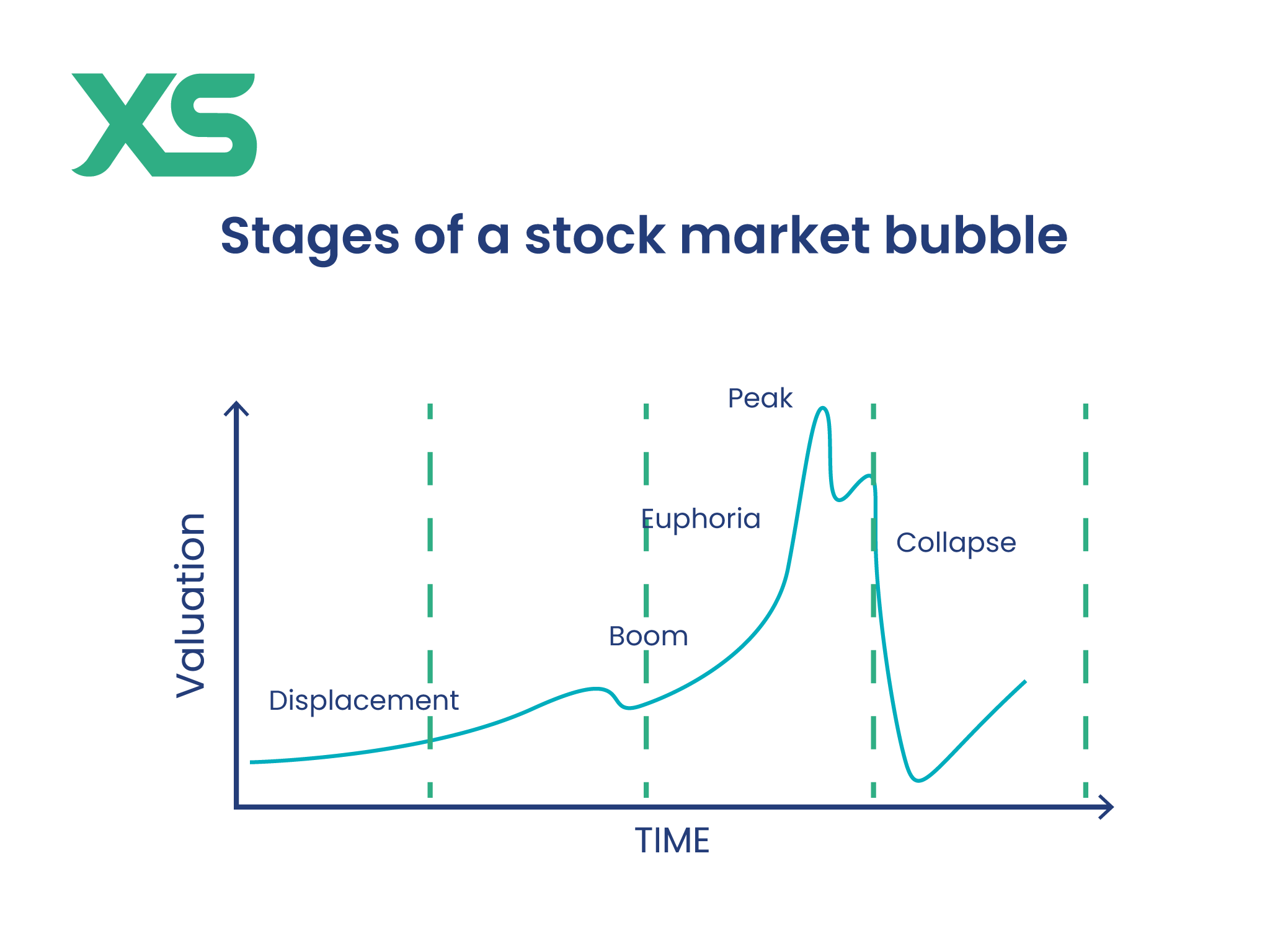

5 Stages of a Stock Market Bubble

Understanding the typical lifecycle of a stock market bubble can help investors recognize and respond to these phenomena.

Here are the common stages of a stock market bubble:

1. Displacement

A bubble often begins with a displacement, where a new innovation, technology, or favorable economic condition sparks interest in a particular sector or the overall market

.Investors believe this new trend will lead to substantial future growth.

2. Boom

As more investors become aware of the new opportunity, stock demand increases, leading to rising prices.

During this stage, optimism and positive sentiment drive further investment.

3. Euphoria

In the euphoria stage, stock prices reach irrational levels as speculative behavior dominates. Investors buy stocks with the expectation that prices will continue to rise indefinitely.

4. Profit-Taking

Eventually, some investors begin to realize that prices have reached unsustainable levels and start to take profits by selling their stocks.

This can cause price volatility and slow the upward momentum.

5. Panic

The final stage of a bubble is marked by panic, where a sudden shift in sentiment leads to a sharp decline in stock prices.

As prices fall, investors rush to sell their holdings to minimize losses, leading to a market crash.

Famous Stock Market Bubbles in History

Examining famous stock market bubbles in history helps us understand how these economic bubbles form and burst, often leading to significant financial crises.

Here are some of the most well-known examples:

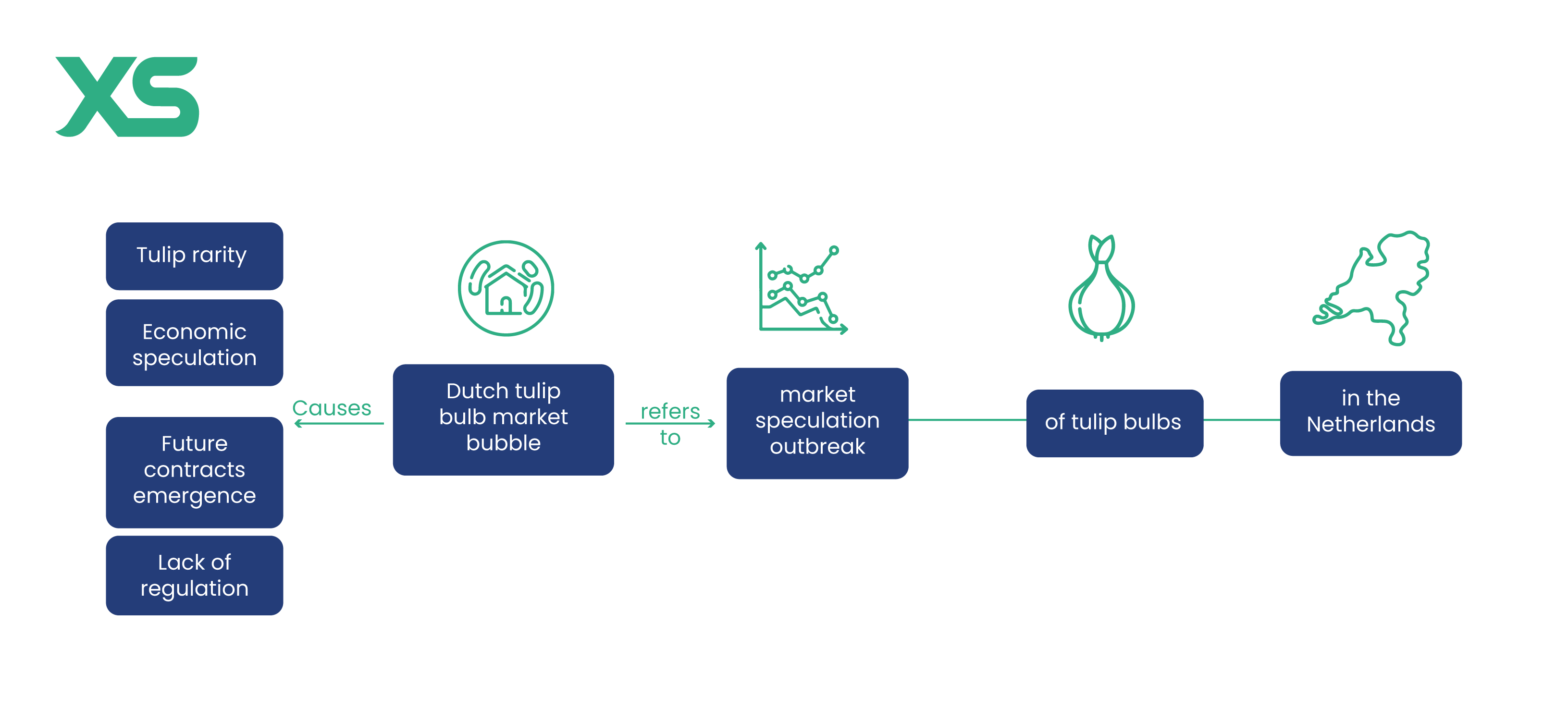

The Dutch Tulip Mania (1636-1637)

The Dutch Tulip Mania is often cited as the first recorded speculative bubble.

During this period, the price of tulip bulbs in the Netherlands soared to extraordinary heights due to intense demand and speculative trading.

At the peak of the mania, a single tulip bulb could cost more than a house. However, when prices suddenly crashed, many investors were left with worthless bulbs, leading to a financial collapse.

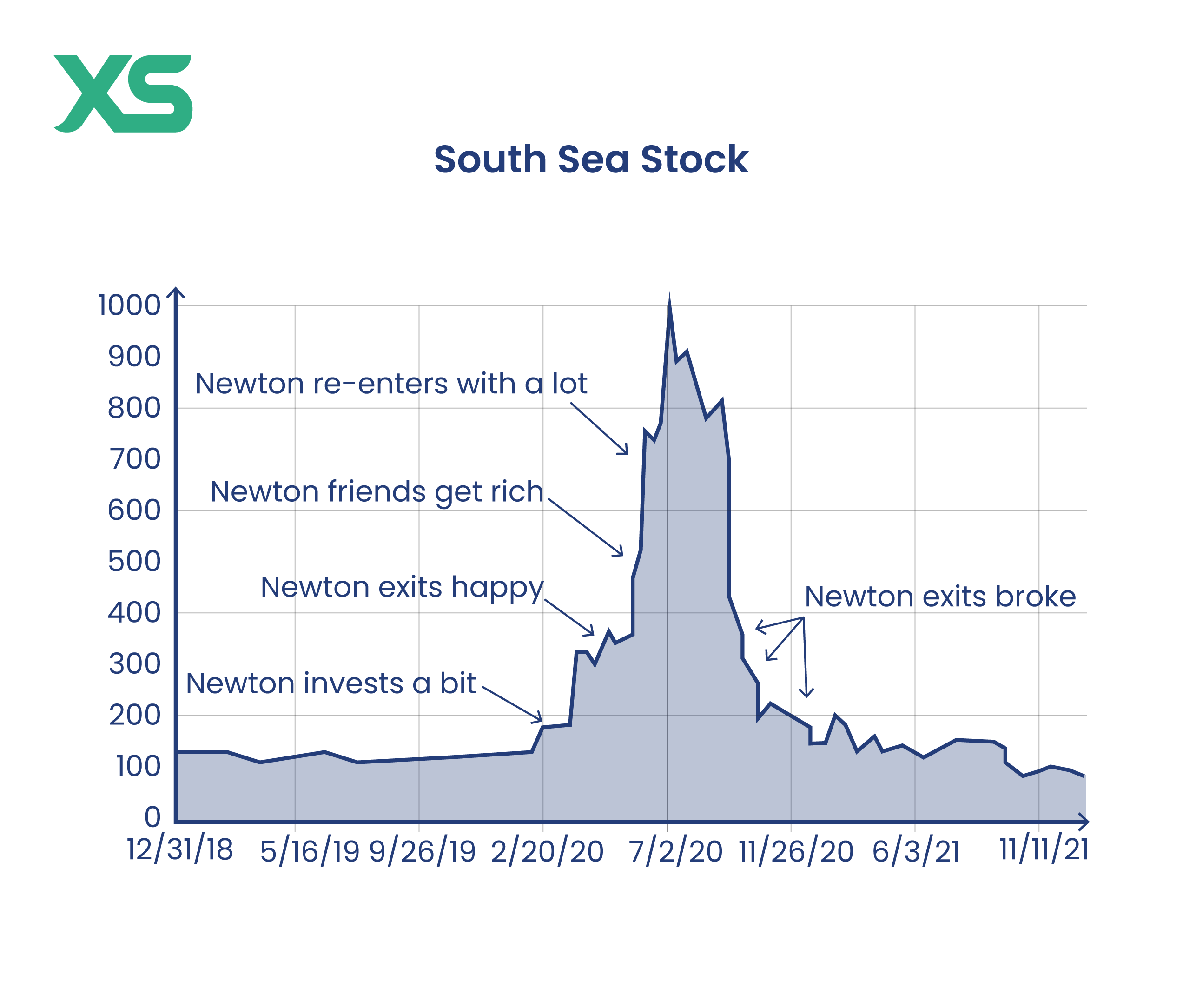

The South Sea Bubble (1720)

The South Sea Bubble occurred in 18th-century Britain and centered around the South Sea Company.

This company was granted a monopoly on trade with South America, and its stock prices skyrocketed as investors bought into the hype and speculative frenzy.

However, the company's profits did not justify the inflated stock prices. When reality set in, the bubble burst, leading to a catastrophic market crash and severe financial losses for many investors, including prominent figures such as Sir Isaac Newton.

Newton famously lost a substantial amount of money, reportedly saying, "I can calculate the motions of the heavenly bodies, but not the madness of people."

The Dot-com Bubble (1995-2000)

The Dot-com Bubble of the late 1990s was fueled by the rapid growth and excitement surrounding internet-based companies.

As investors poured money into tech startups, stock prices soared to unsustainable levels.

Many of these companies had little to no profits, but their stock prices rose based on future growth expectations.

When the bubble burst in 2000, many tech stocks plummeted, leading to significant losses and a prolonged market downturn.

The Housing Bubble and Financial Crisis (2007-2008)

The Housing Bubble and Financial Crisis of 2007-2008 was one of the most severe economic downturns since the Great Depression.

It was driven by a combination of high-risk mortgage lending, speculative real estate investment, and complex financial instruments.

As housing prices soared, many investors believed the upward trend would continue indefinitely. When the housing market collapsed, it triggered a chain reaction, leading to widespread financial instability, bank failures, and a global recession.

Types of Stock Market Bubbles

Stock market bubbles can take various forms depending on the asset class, sector, or geographic area involved. Here are the main types:

1. Asset Bubbles

Asset bubbles occur when prices of specific assets, like stocks, real estate, or commodities, rise rapidly due to speculation rather than intrinsic value. Common examples include:

-

Stock Bubbles: Driven by investor enthusiasm, as seen in the Dot-com Bubble.

-

Real Estate Bubbles: Such as the 2007-2008 housing crisis, caused by easy credit and speculative buying.

-

Commodity Bubbles: Fueled by rapid price increases in commodities like oil or gold.

2. Sector-Specific Bubbles

These bubbles form within particular industries, driven by technological trends or high investor optimism:

-

Tech Bubbles: Like the Dot-com era or the recent surge in tech stocks during the COVID-19 pandemic.

-

Biotech Bubbles: Occur when breakthrough expectations inflate stock prices beyond realistic valuations.

-

Clean Energy Bubbles: Rising due to investor interest in sustainability and government incentives.

3. Regional Bubbles

Regional bubbles impact specific countries or areas due to local economic conditions or policies:

-

Japanese Asset Price Bubble (1986-1991): A burst led to decades of economic stagnation.

-

Asian Financial Bubble (1997): Affected multiple Asian markets due to speculative foreign investments.

-

Emerging Market Bubbles: Often driven by rapid growth and foreign investments in countries like China and Brazil.

4. Macro-Economic Bubbles

These large-scale bubbles impact multiple asset classes and the broader economy, often due to systemic issues like monetary policy or widespread speculation:

- Global Financial Bubble (2007-2008): A complex bubble involving housing and financial markets that led to a global recession.

How to Identify a Stock Market Bubble?

Identifying a stock market bubble before it bursts can be challenging, but there are several key indicators and signs to watch for.

Rapid Price Increases

One of the most obvious signs of a stock market bubble is the rapid increase in stock prices over a short period.

When prices rise much faster than the underlying company's earnings or intrinsic value, it suggests that speculation, rather than fundamentals, is driving the market.

High Valuation Metrics

Valuation metrics such as the Price-to-Earnings (P/E) ratio can provide insight into whether stock prices are over-inflated.

Extremely high P/E ratios, especially when compared to historical averages, can indicate that stocks are being priced beyond their true value, signaling a potential bubble.

Excessive Speculation

Another key indicator of a bubble is a surge in speculative trading, where investors buy stocks with the hope of selling them at higher prices rather than based on the company’s fundamentals.

Increasing Margin Debt

When investors borrow money to buy stocks, the debt margin increases.

A significant rise in margin debt can be a warning sign of a bubble, as it indicates that people are taking on more risk in anticipation of continued price increases.

If the market turns, these leveraged positions can lead to rapid sell-offs and a sharp market decline.

Media Hype and Public Participation

Widespread media coverage and public enthusiasm about the stock market can also signal a bubble.

When investing becomes a hot topic in the news and everyday conversations, and when novice investors start entering the market in large numbers, it suggests that sentiment is reaching extreme levels.

What are the Effects of a Stock Market Bubble?

When a stock market bubble bursts, it can have wide-ranging effects on the economy, investors, and the broader financial system.

Economically, the initial rise in stock prices creates a wealth effect, leading to increased consumer spending and economic growth, but the subsequent crash can result in a sharp contraction as wealth diminishes and spending drops.

For investors, bubbles impact psychology by fostering overconfidence and risky behavior during the boom, followed by panic and substantial financial losses when the market collapses.

Financial institutions can also suffer, facing liquidity issues if they hold large amounts of overvalued assets, potentially leading to broader financial instability. In response to the fallout, regulatory bodies often implement stricter regulations and reforms to prevent future bubbles, such as tighter lending practices and improved market oversight.

Can You Predict the Stock Market Bubble?

It is difficult to predict a stock market bubble with precision, but there are methods and indicators that can help investors gauge the likelihood of a bubble forming.

While no prediction is foolproof, understanding these tools can provide valuable insights.

Firstly, predicting a stock market bubble is challenging due to the complex nature of markets and human behavior.

Market dynamics involve numerous variables, including economic indicators, investor psychology, and geopolitical events.

Additionally, investors' irrational behavior, often driven by fear and greed, adds another layer of unpredictability.

Predictive Models and Approaches

Several models and approaches have been developed to identify potential bubbles:

-

Quantitative Models: These use statistical techniques and historical data to predict market trends. For example, the Shiller P/E ratio, which adjusts the traditional P/E ratio for inflation, is often used to assess whether the market is overvalued.

-

Expert Opinions and Forecasts: Financial analysts and economists often provide forecasts based on their understanding of market conditions and historical patterns. While these opinions can be insightful, they are not always accurate.

Role of Economic Indicators

Certain economic indicators can signal the potential for a financial bubble:

Tools like the Fear & Greed Index measure investor sentiment and can indicate whether the market is overly optimistic or pessimistic. Extreme levels of greed can signal a bubble.

Broad economic measures such as GDP growth, unemployment rates, and inflation can provide context for market conditions.

In conclusion, while you cannot completely predict a stock market bubble, combining quantitative models, expert opinions, economic indicators, and the ability to read charts can improve your ability to anticipate and prepare for potential market downturns.

Conclusion

Understanding stock market bubbles is crucial for investors and anyone involved in financial markets. These bubbles, driven by various economic factors, market psychology, technological innovations, and regulatory influences, can have profound effects on the economy and individual investors when they burst.

Although predicting a bubble with certainty is challenging, staying informed and vigilant can help you navigate these volatile periods. It’s advisable to look for a broker to navigate these unpredictable phenomena. Keep up with XS for more expert tips and educational insights!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

It's hard to say for sure; it depends on various factors, such as market conditions and investor sentiment. Keep an eye on valuation metrics and market trends.

Predicting exact market movements is tricky. It could go either way, depending on economic indicators, interest rates, and global events.

The Dot-com Bubble of the late 1990s and early 2000s is often considered the biggest, with tech stocks skyrocketing before crashing hard.

The Dow Jones Industrial Average's highest single-day gain was on March 24, 2020, when it jumped 2,1112.98 points amid COVID-19 volatility.

Stock market bubbles can have a ripple effect on the broader economy. When a bubble bursts, it can lead to significant financial losses, reduced consumer spending, and lower business investments.

This often triggers economic slowdowns, job losses, and, in severe cases, recessions.

Yes, bubbles can occur in any sector where speculation drives prices beyond their fundamental value. Common sectors include technology, real estate, biotech, and even new emerging industries like cryptocurrencies and clean energy.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.