Forex

Short Term Trading: What Is It And How To Get Started

Written by Nathalie Okde

Fact checked by Rania Gule

Updated 4 December 2024

Table of Contents

Short-term trading focuses on capitalizing on small price movements in a matter of hours, days, or weeks.

It’s a fast-paced strategy that demands precision and the right tools. This article explains short term trading and presents the actionable strategies to start trading.

Key Takeaways

-

Short-term trading focuses on quick profits from price fluctuations in hours, days, or weeks.

-

Common types include day trading, swing trading, scalping, and intraday trading.

-

Essential tools include moving averages, RSI, MACD, and Bollinger Bands.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Is Short Term Trading?

Short-term trading refers to buying and selling financial instruments like stocks, or forex within a short period, often hours, days, or weeks.

The main goal is to capitalize on small price fluctuations.

Short-Term vs. Long-Term Trading

The key difference between short and long term trading lies in the timeline and goals.

Short-term trading is all about quick moves within hours or days, while long-term trading the period usually ranges from months to years.

Moreover, short-term trading often relies on technical analysis tools and real-time market data. Long-term trading, on the other hand, focuses on fundamental analysis and holding assets through market ups and downs.

For instance, a short-term trader might capitalize on stock market volatility caused by earnings announcements, while a long-term investor waits for the company’s overall growth to play out.

Medium-Term Trading vs. Long-Term Trading

Medium-term trading strikes a balance between the two, holding positions for weeks to months.

It’s less intense than short-term trading but demands more active management than long-term investing.

Medium-term traders often blend technical and fundamental analysis to identify opportunities.

Types of Short-Term Trading

Short-term trading includes various approaches, each catering to different trading styles and market conditions, mainly day trading, swing trading, scalping, and intra-trading.

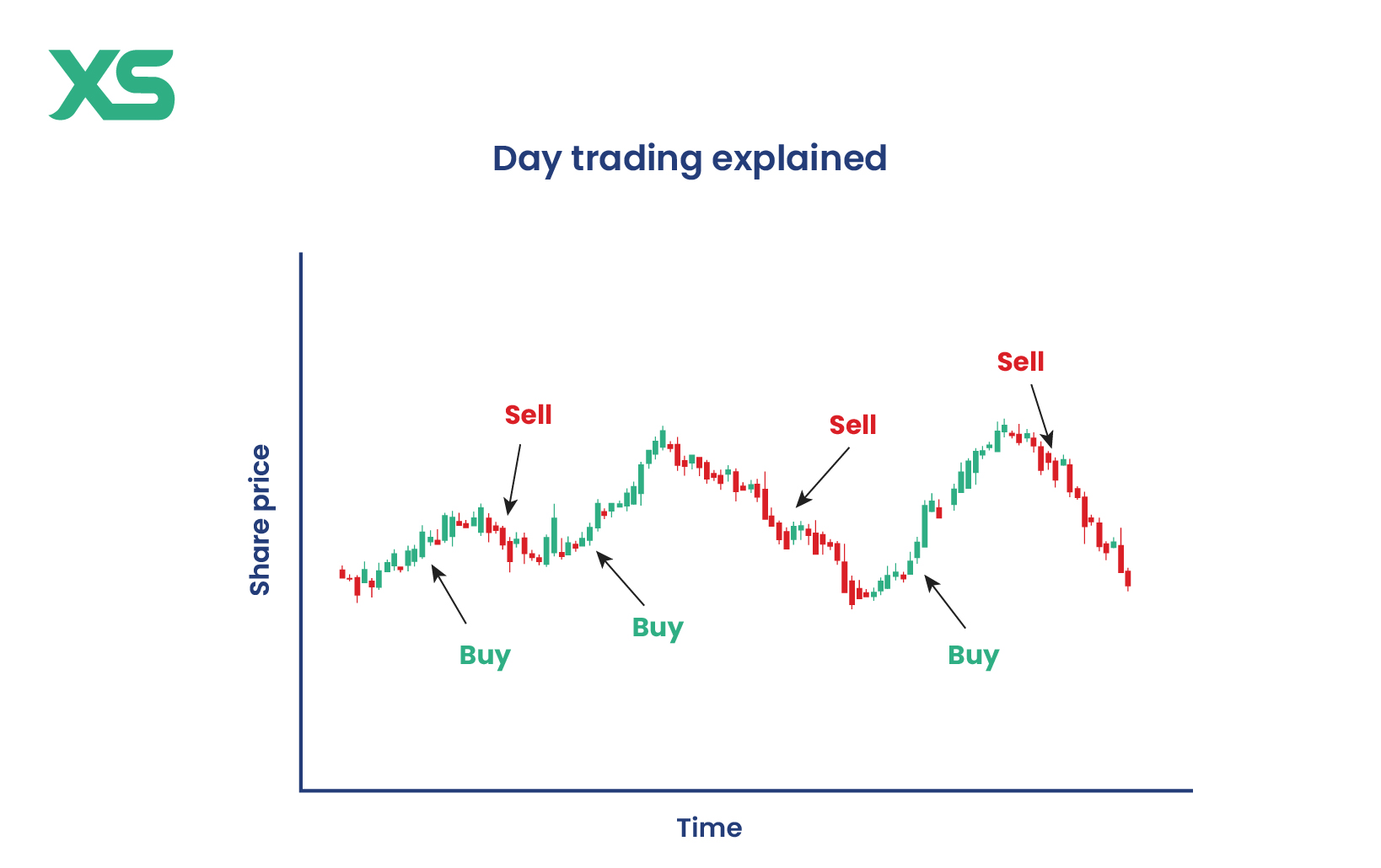

Day Trading

This involves closing all positions by the end of the trading day to avoid overnight risks.

Day traders actively monitor market movements throughout the day, seeking opportunities in high-volatility stocks or forex pairs.

Success relies heavily on technical analysis and quick decision-making.

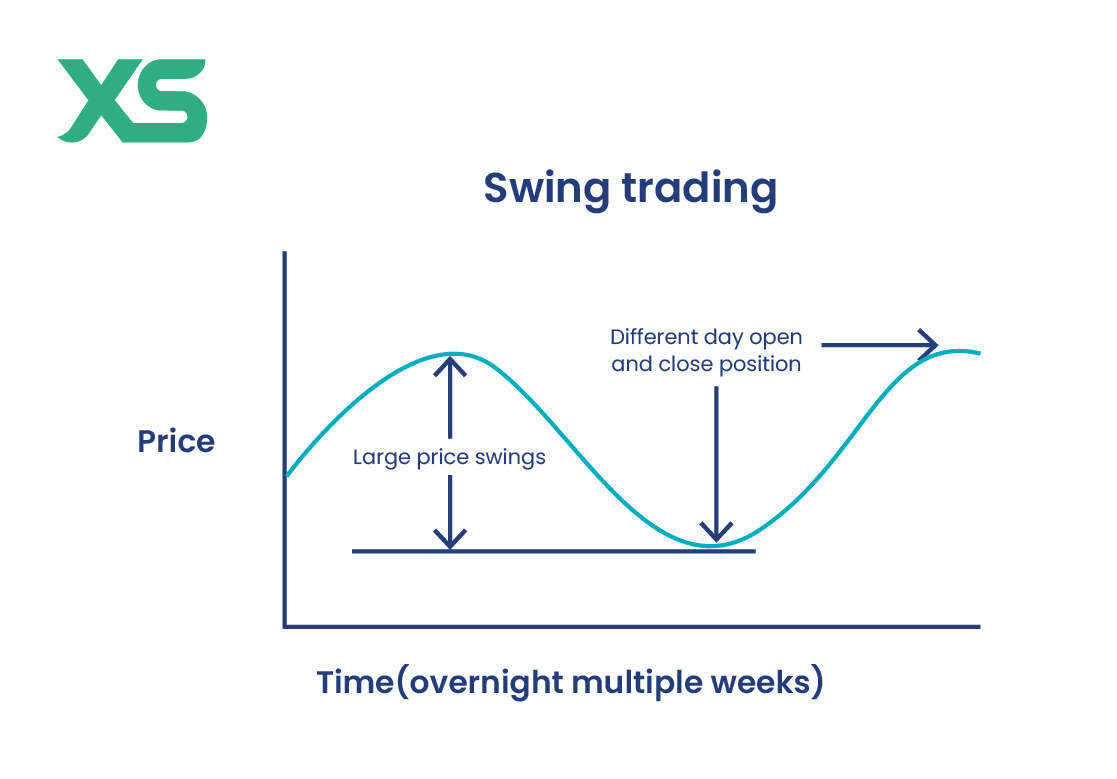

Swing Trading

Swing traders hold positions for several days, aiming to profit from short-term price swings.

This type of trading suits those who prefer a more relaxed pace than day trading but still want faster results than long-term investing.

Swing traders often use technical and fundamental analysis to predict market trends.

Scalping

Scalpers aim to profit from small price changes by executing multiple trades within minutes or even seconds.

It requires intense focus, fast execution, and a high level of discipline to minimize losses.

Scalping is best suited for highly liquid markets like forex or major stocks.

Intraday Trading

Similar to day trading, intraday trading involves buying and selling securities within the same trading session.

Traders capitalize on intraday price fluctuations and typically rely on intraday trading strategies and tools like candlestick charts and moving averages.

Each type requires specific strategies, technical tools, and a strong grasp of trading psychology to navigate the fast-paced nature of short-term markets effectively.

How Can You Start Short-Term Trading?

Getting started is simpler than you think. Here’s how:

-

Choose the Right Platform: Research platforms for short-term trading that offer low fees, solid tools, and fast execution.

-

Learn the Basics: Familiarize yourself with short-term trading strategies for beginners and technical analysis tools.

-

Practice with a Demo Account: Most platforms provide this feature, letting you test your skills without financial risk.

-

Set a Budget: Determine how much money you’re willing to trade with and stick to it.

How To Trade in the Short Term

Short term trading is relatively risky because it involves making decisions within a short time period.

Therefore, it is essential to know what patterns to look for and what indicators to use to minimize the risks.

Short-Term Trading Indicators

Short term trading indicators help you identify trends in the fast-moving markets. Here are the popular ones.

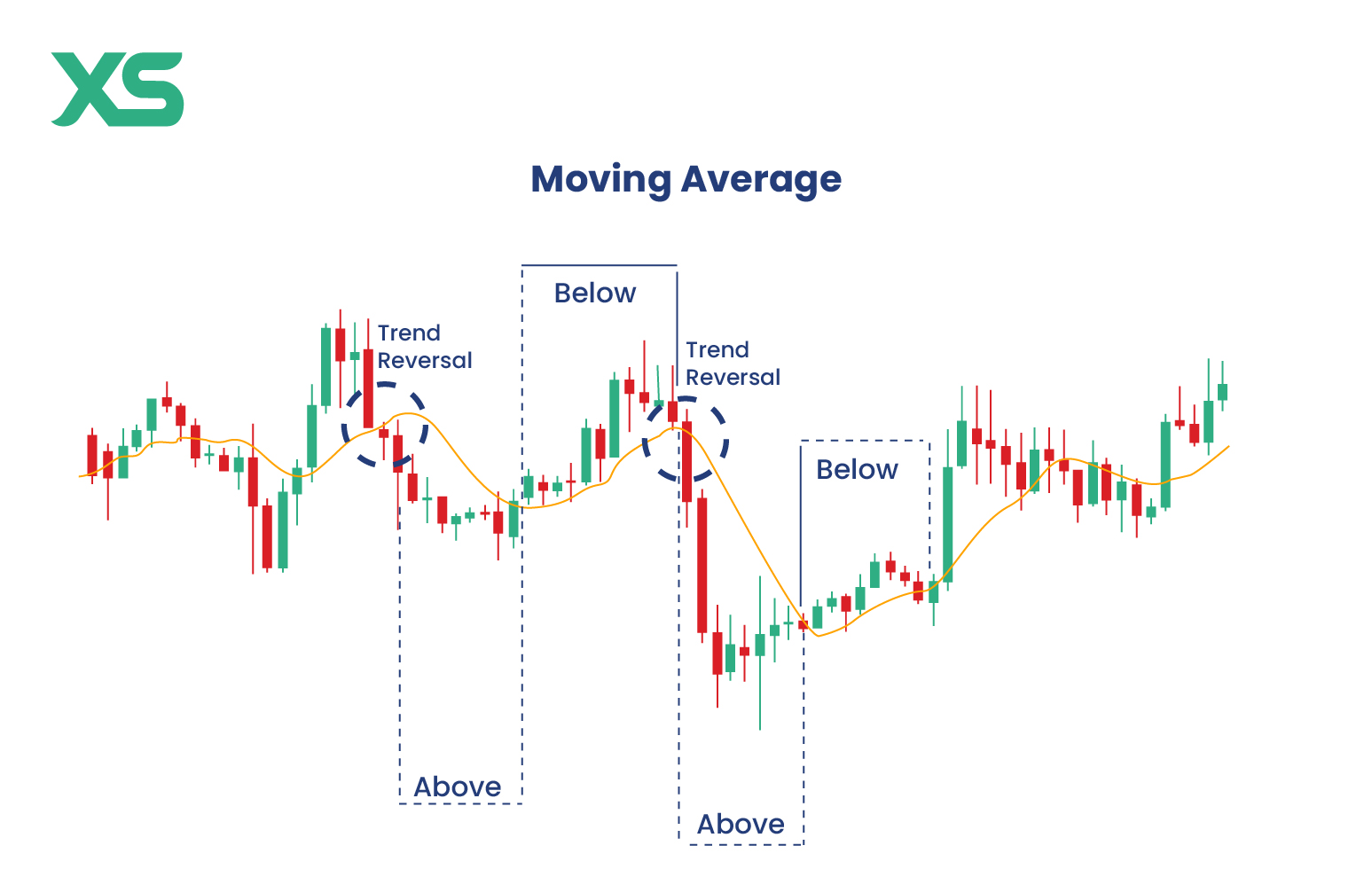

Moving Averages

Moving averages are designed to smooth out price fluctuations over a set period, giving you a clearer view of the market’s overall direction.

-

Simple Moving Average (SMA): Calculates the average price over a specific time frame, providing a straightforward look at trends.

-

Exponential Moving Average (EMA): Places more weight on recent data, making it more responsive to sudden price changes.

Traders rely on these tools to spot upward or downward trends, helping them decide when to enter or exit a trade.

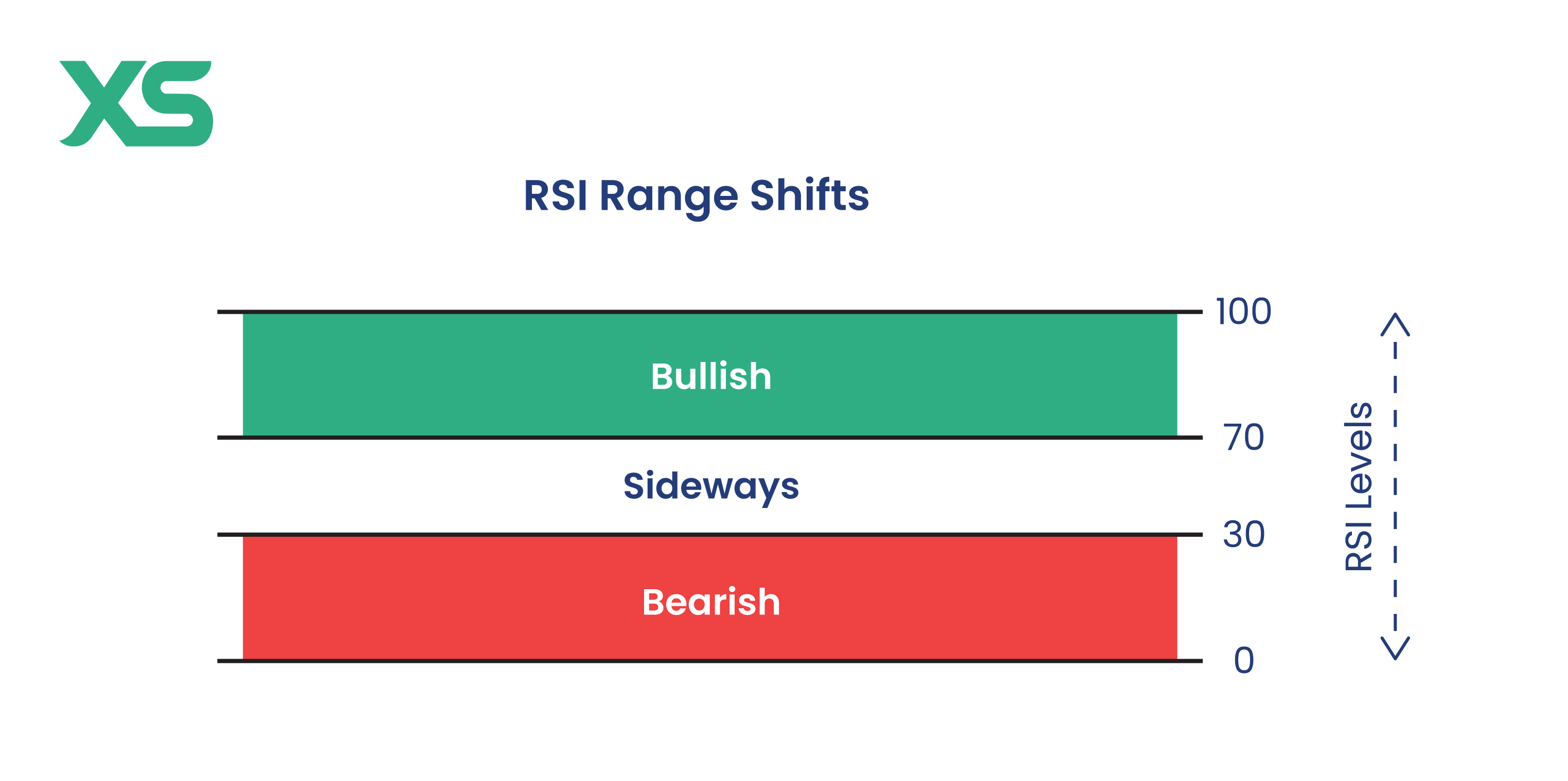

Relative Strength Index (RSI)

The relative strength index (RSI) acts as a test for a stock’s momentum, ranging from 0 to 100.

-

Above 70: The stock may be overbought, signaling a possible downturn.

-

Below 30: The stock could be oversold, suggesting a potential rebound.

This indicator helps traders anticipate reversals and assess whether a market is overextended in either direction.

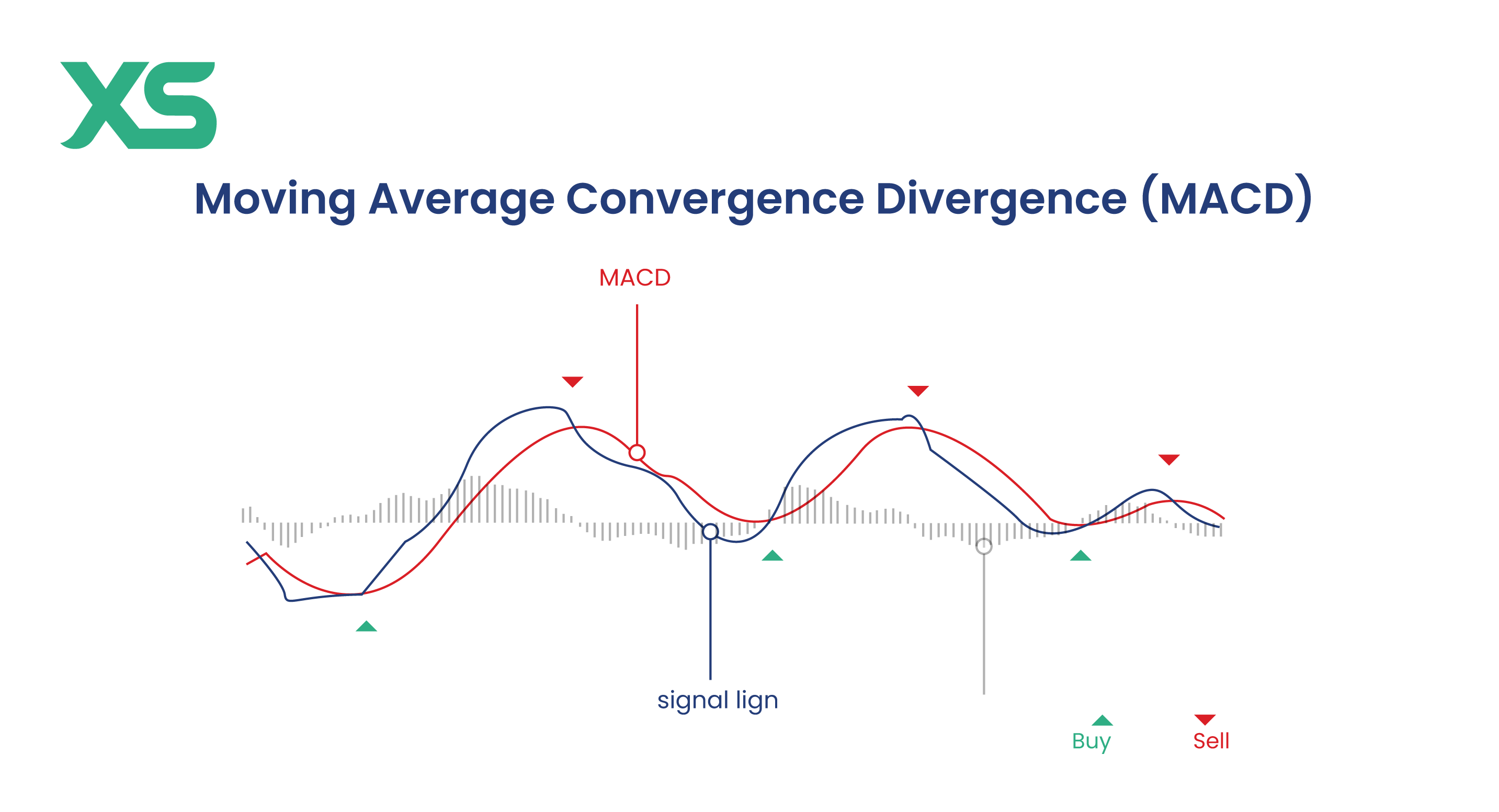

MACD (Moving Average Convergence Divergence)

The MACD is a short term trading indicator that measures the relationship between two moving averages.

It helps traders identify changes in momentum and the strength of a trend.

-

Bullish Signal: When the MACD line crosses above the signal line, it suggests potential upward momentum.

-

Bearish Signal: Conversely, a cross below the signal line may indicate downward momentum.

The MACD’s combination of trend and momentum analysis makes it a go-to tool for many short-term traders.

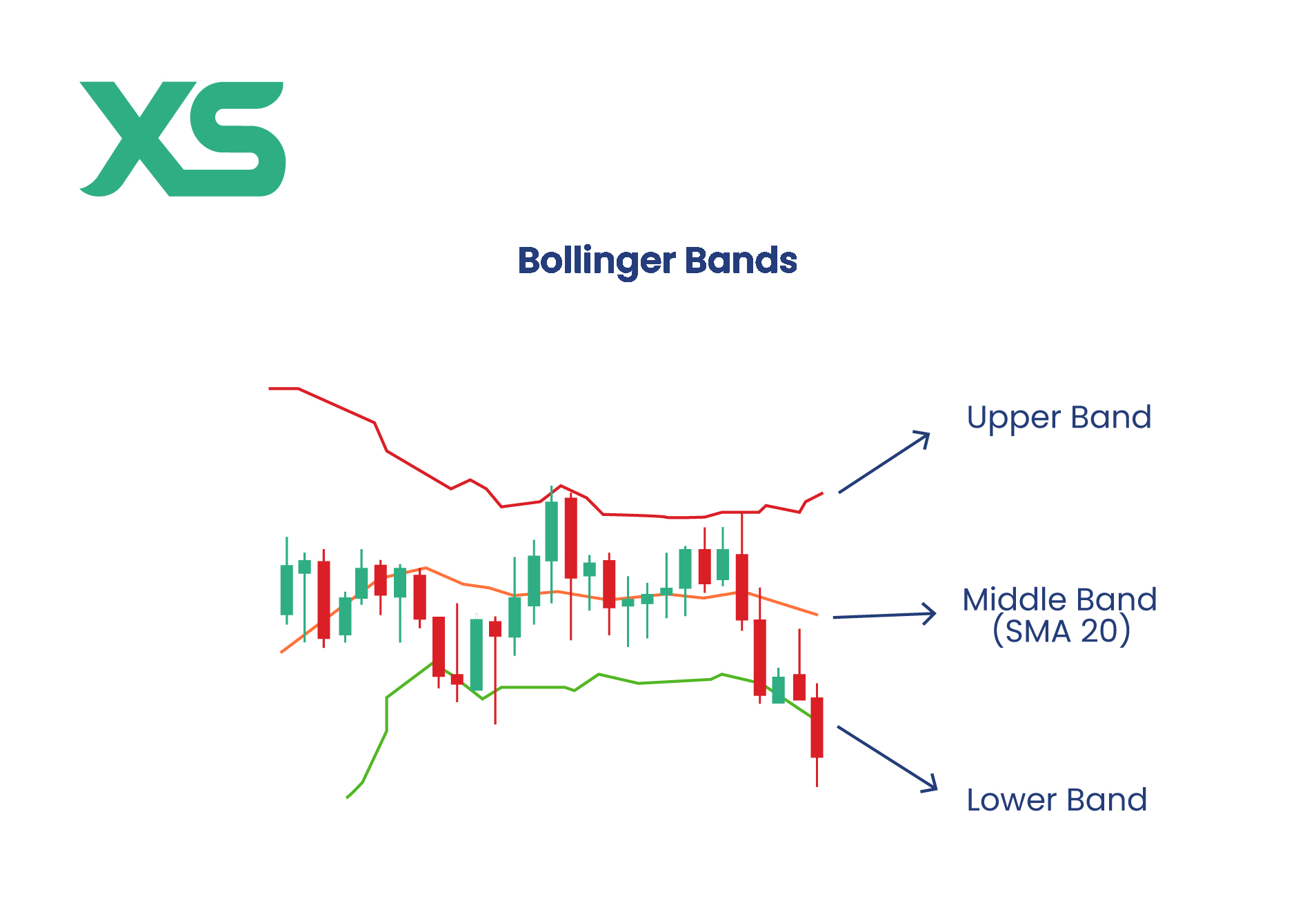

Bollinger Bands

Bollinger Bands provide a visual representation of price volatility by plotting upper and lower bands around a moving average.

-

Prices Near the Upper Band: May indicate overbought conditions.

-

Prices Near the Lower Band: Could signal oversold conditions.

These bands help traders anticipate potential breakouts or reversals, especially in highly volatile markets

Short-Term Trading Patterns

Patterns in the market majorly help you

Here are some key ones to keep an eye on:

-

Flags: They usually signal a continuation of the trend, making them handy for identifying when to jump back in.

-

Pennants: Similar to flags, but shaped like small triangles. They often follow sharp price movements and indicate a potential continuation of the trend.

-

Double Tops and Bottoms: A double top signals a reversal after a bullish trend, while a double bottom suggests a trend reversal after a bearish phase.

What Are the Different Short-Term Trading Markets?

Short-term trading isn’t limited to just stocks, there are several markets where traders can quickly buy and sell assets to capitalize on small price movements.

Let’s explore the most popular ones:

-

Stock Market: The go-to choice for many traders. It involves buying and selling shares of companies, often within a single day or a few weeks.

-

Forex Market: This is the global currency trading market, known for its high liquidity and 24-hour trading opportunities. Perfect for those looking to trade currencies like the US Dollar or Euro.

-

Futures Market: In this market, traders deal with contracts that speculate on the future price of assets like commodities, indices, or even currencies.

-

Cryptocurrency Market: Rapidly growing in popularity, this market operates 24/7, offering high volatility and quick trading opportunities with assets like Bitcoin or Ethereum.

Each market has its own risks and rewards, so understanding how they work can help you choose the best fit for your trading goals.

Short-Term Trading Fees

When it comes to short-term trading, fees can eat into your profits quickly if you’re not careful.

Here’s what you need to consider:

-

Brokerage Fees: Most platforms charge a fee for every trade you make, whether you’re buying or selling.

-

Spread Costs: In Forex and certain other markets, you’ll pay the difference between the buying and selling price, called the spread.

-

Commissions: Some brokers charge a flat commission per trade, which can add up for frequent traders.

-

Overnight Fees: If you hold a position overnight, some platforms charge interest or carrying costs.

To maximize profits, look for brokers with competitive fee structures and consider how frequently you plan to trade. Even small savings on fees can make a big difference over time.

Best Stocks for Short-Term Trading

Not all stocks are ideal for short-term trading. Blue-chip stocks like Apple or Microsoft are stable but still offer short-term price swings, making them reliable for active traders.

Small-cap stocks often show sharper movements, offering high rewards but greater risk.

Tech stocks are dynamic, with rapid changes driven by news or earnings, while penny stocks, though volatile, can provide dramatic gains.

Successful short-term trading depends on researching stocks that match your risk tolerance and strategy.

Benefits of Short-Term Trading

Short-term trading can be exciting and rewarding for those who enjoy fast-paced decision-making.

Some of the biggest perks include:

-

Quick Returns: Unlike long-term investing, you can realize profits within days or even hours.

-

Flexibility: Short-term trading allows you to adapt quickly to market conditions without being tied to a long-term commitment.

-

Opportunities in Any Market: You can profit whether the market is going up or down by leveraging strategies like short selling or trading derivatives.

Limitations of Short-Term Trading

While short-term trading has its advantages, it’s not without challenges.

Here are some of the drawbacks to keep in mind:

-

High Risk: Rapid price changes can result in significant losses, especially for inexperienced traders.

-

Stressful: The fast pace requires constant attention, which can be mentally exhausting.

-

Fees Add Up: Frequent trading often leads to higher costs in commissions, spreads, or overnight fees.

Conclusion

Short-term trading offers opportunities for quick profits but requires strategy, discipline, and risk management.

By understanding the tools, patterns, and markets involved, you can make informed decisions and navigate the challenges of this fast-moving approach.

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

Short-term trading involves buying and selling financial instruments like stocks, currencies, or futures within a short time frame, often ranging from minutes to a few weeks.

It depends on your goals and risk tolerance. Short-term trading can be profitable for disciplined traders who stay informed and manage risks well.

However, it’s not ideal for everyone due to its high-stress nature and potential for losses.

Yes, many short-term traders make money, but it requires skill, a clear strategy, and strict risk management.

It’s important to understand that not all trades will be profitable, and consistent success often comes with experience.

The amount varies depending on the market and broker. While you can start with as little as $100 in some markets like Forex or cryptocurrencies, stock trading may require more due to minimum account requirements and fees.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.