Forex

Short Selling: How to Short a Stock

Written by Nathalie Okde

Fact checked by Rania Gule

Updated 21 November 2024

Table of Contents

Short selling is a strategy that lets traders profit when stock prices fall. Instead of the classic “buy low, sell high” approach, short selling involves selling high first, then buying low to complete the trade.

It sounds simple, but short selling requires a margin account, which comes with risks and obligations. So why take on this challenge, and how does it differ from a traditional long position?

Let’s explore the essentials of short selling, its strategies, and the risks to consider.

Key Takeaways

-

Short selling is a strategy to profit from declining stock prices.

-

You borrow shares, sell them, and aim to repurchase them at a lower price.

-

A margin account is required to short sell, adding both opportunity and risk.

-

Key strategies include short squeezes, event-driven shorts, and trend trading.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What is Short Selling?

In simple terms, short selling is a strategy where you profit if the price of a stock goes down.

Instead of buying low and selling high, you’re aiming to sell high and buy low.

Essentially, you borrow shares from a broker, sell them on the open market, and hope to buy them back at a lower price to return to the lender. You profit by pocketing the difference.

However, to borrow shares from a broker, you need a margin account, which acts as collateral for the loan. This type of account requires you to maintain a minimum balance, known as margin, which helps cover any potential losses if the trade goes against you.

Margin adds a layer of risk but also makes short selling possible.

But why would traders do this, and how does it compare to traditional, “long” positions?

Short Selling Vs. Long Positions

In traditional investing, a long position is the classic approach: you buy a stock, hold onto it, and hope its price rises over time so you can sell it for a profit.

However, short selling takes the opposite stance. If long positions are like rooting for a team to win, short positions are like betting against a team.

So, in short selling, instead of hoping for the stock to rise, you’re betting it will drop.

Moreover, short selling isn't as straightforward as a long position because it requires borrowing shares, paying interest, and managing the constant risk of rising prices.

Both strategies have a place in a well-rounded portfolio, but short selling is considered more sophisticated, as it demands precise timing and deeper market knowledge.

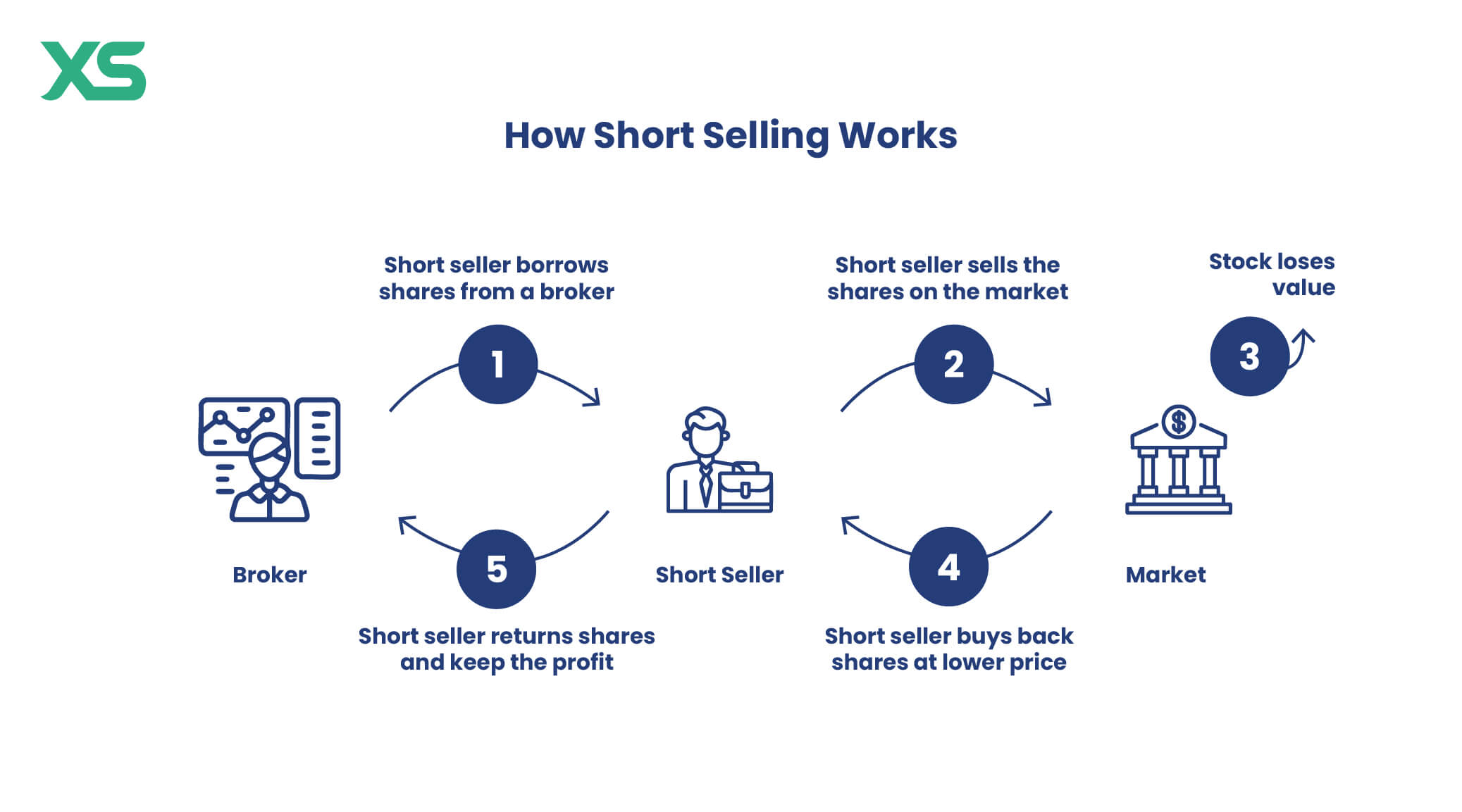

How Short Selling Works

To understand how short selling actually works, let’s start with the basics.

Here’s the general flow:

-

Borrow Shares: You borrow shares of a stock from your broker, who holds them in your margin account.

-

Sell the Shares: Immediately sell these borrowed shares in the market.

-

Wait for Price Drop: If the price drops as you anticipated, you buy the same number of shares at this new, lower price.

-

Return the Shares: You give back the shares to your broker, keeping the difference as your profit.

Sounds simple, right? But there’s more to it. Because you're dealing with borrowed assets, there’s added pressure to manage risks, especially if the stock price rises instead of falls.

A Step-by-step Process For Short Selling

Here’s a more detailed guide on how to short a stock:

-

Research and Select a Stock: Analyze which stocks might drop in price. This is where understanding bearish market strategy comes in.

-

Contact Your Broker: Let your broker know you want to borrow shares of that stock.

-

Sell the Borrowed Shares: Execute a sell order for the borrowed shares.

-

Monitor the Stock Price: Keep an eye on the price to know when to repurchase.

-

Buy to Cover: When the price is low enough to profit, buy the shares back.

-

Return and Profit: Return the shares to your broker and keep the difference.

Short Selling Example

Let’s take it a step further and look at a short selling example. Imagine you believe a stock, currently priced at $100, will decline.

You borrow 10 shares from your broker and sell them, making $1,000 (10 * 100 = 1000).

Later, when the price drops to $70, you repurchase the shares for $700 ( 70 * 10 = 700) and return them, pocketing the $300 (1000 - 700 = 300) difference (minus any fees or interest).

This, in a nutshell, is how short selling works.

Short Selling Regulations

While short selling might seem simple, it comes with several regulations.

Short selling is a high-stakes strategy with significant risks, both for traders and the market which necessitates regulation.

Let’s break down a few of the critical rules.

Are Short Sales Legal?

Yes, short selling is legal in most markets, though regulations vary. It’s a legitimate trading strategy, especially for those experienced in managing high-risk trading.

However, because of its impact on stock price and potential for volatility, regulatory bodies keep a close eye on short-selling practices.

Who Regulates Short Selling?

Short selling is regulated by financial authorities worldwide to ensure fair trading, transparency, and market stability.

Key regulators include:

-

U.S. (SEC): The SEC enforces Regulation SHO to prevent abuses like naked short selling and mandates that shares be located before shorting.

-

U.K. (FCA): The FCA requires disclosure of large short positions and can restrict short selling during market stress.

-

EU (ESMA): ESMA mandates transparency and allows bans in crises, with rules applicable across all EU countries.

-

Japan (FSA) & China (CSRC): Both require disclosure, limit short selling to reduce volatility, and prohibit naked short sales.

-

Australia (ASIC): ASIC requires position disclosure and can restrict short selling during extreme volatility.

These regulators aim to prevent manipulation, maintain stability, and protect investors across global markets.

What Is Naked Short Selling, and Why Is It Illegal?

As we said above, short selling is legal and regulated but there’s a type of it deemed illegal: naked short selling.

Unlike regular short selling, where traders borrow shares before selling, naked short selling involves selling shares that haven’t actually been borrowed yet.

For example, let’s say you decide to sell 1,000 shares of a popular tech stock. Normally, in a regular short sale, you would borrow these shares first, sell them, and then buy them back later to return to the lender.

But with naked short selling, you skip the borrowing step and sell shares you don’t actually own.

How is this possible? Essentially, you’re selling with the promise to deliver the shares later, which means you’ll eventually have to buy them to give to the buyer.

-

Profit: If the stock price drops, you can buy them back at a lower price.

-

Loss: If the price goes up, you’ll face a loss when you buy them at the higher price.

This practice can lead to “phantom shares” flooding the market, creating an artificial supply that can distort stock prices and destabilize the market. Because of these risks, naked short selling is illegal in many regions.

What is Regulation SHO?

Regulation SHO, established by the U.S. SEC, targets market abuses like naked short selling.

This regulation enforces strict rules to ensure shares are borrowed before short sales occur and imposes certain trading restrictions when stocks hit a “threshold” level of fails-to-deliver transactions.

Essentially, it aims to maintain fairness and reduce the likelihood of manipulation.

Short Selling Strategies

Now that we’ve covered the basics of short selling, let’s look at some strategies.

Short selling strategies offer traders different ways to profit from falling stock prices, depending on the market environment and timing. Here are some common approaches:

Short Squeeze Stocks

One of the boldest strategies in short selling is targeting short squeeze stocks.

Imagine you’re surfing, and you see a massive wave forming. Instead of panicking, you position yourself just right to ride it all the way to shore.

A short squeeze is like that wave: a sudden rush of buying pressure that skyrockets a stock’s price, leaving short sellers scrambling.

Here’s how it works:

When a stock has a high short interest (meaning many traders have shorted it), it only takes a spark, like an unexpected product launch, to trigger panic buying.

Short sellers, fearing losses, start buying shares to cover their positions. Remember, short sellers profit when the price drops, hence why they’d panic buy if they think the price will increase.

This, however, only pushes the price higher, further intensifying the squeeze.

Traders who anticipate these squeezes can profit by buying into the stock before the wave hits, potentially riding the price surge as shorts are squeezed out.

It’s a high-risk, high-reward strategy that requires precise timing and a good read on market sentiment, but when it works, it can generate substantial returns.

Event-Driven Shorts

An event-driven short strategy is more calculated, almost like laying a careful trap. Here, you’re betting that specific news or events will drive a stock’s price down.

This approach requires a keen eye for corporate announcements and a good grasp of how certain news impacts stock prices.

For instance, let’s say a company is about to report earnings, and based on its past performance or industry challenges, there’s a good chance of disappointing results.

You short the stock ahead of the earnings release, aiming to profit if the news causes the stock to drop.

Other events could include regulatory investigations, product recalls, or CEO departures, basically anything that could cast a shadow over the company’s future.

While the potential for profit is there, this strategy demands research and the discipline to act quickly, as markets often react sharply to new information.

Trend Trading in Bearish Markets

Sometimes, markets just have a gloomy vibe, the economy’s slowing down, or sectors are struggling, and certain stocks are already in a freefall.

In these conditions, trend trading allows traders to short stocks that are consistently moving downward. So, you’re going with the flow of the river that’s going south.

With this approach, you identify stocks showing a clear downtrend and open a short position, expecting the trend to continue.

This strategy works especially well in bearish markets, where the overall mood is negative and fewer factors are likely to reverse a downward trend. However, timing is crucial.

A stock’s downward momentum might stall if it reaches a support level, or broader market conditions could shift unexpectedly.

Yet for those who can read the charts and understand momentum, trend trading in bearish markets can be an effective way to capitalize on sustained price declines.

Ethics of Short Selling

While we’ve covered that short selling is legal and there are strategies that could be profitable, we must cover its ethical side.

The ethics of short selling is often debated. Some argue that shorting stocks serves as a “check” on overvalued companies, helping reveal true market values.

Others say it’s a way for traders to profit from a company’s struggles, potentially worsening a downward trend.

So, is short selling ethical? While opinions vary, most agree that ethical short selling lies in transparency.

When done within regulations, short selling can play a legitimate role in a balanced market, revealing overhyped stocks and encouraging realistic valuations.

Benefits of Short Selling

Despite the debate around the ethics of short selling, there are notable benefits to short selling:

-

Profit in Bear Markets: Short selling lets traders profit when the market drops, providing a way to navigate bear markets.

-

Hedge Against Losses: Short selling can act as a hedge, balancing out potential losses in long positions.

-

Market Balance: Short selling can help deflate overpriced stocks, contributing to market stability.

Risks Of Short Selling

Short selling has its perks, but it’s also incredibly risky. Here are some of the main hazards:

-

Unlimited Losses: If the stock price rises, potential losses can theoretically be limitless, as there’s no cap on how high a stock can go.

-

Short Squeeze: A short squeeze can trap short sellers in a rising market, forcing them to cover positions at high prices.

-

Margin Calls: Brokers often require traders to maintain a minimum margin, and if the stock moves against you, they may demand more funds or liquidate your position.

Conclusion

Short selling is an advanced trading strategy that can generate profits when stock prices fall, making it an attractive option in bearish markets.

This approach opens up opportunities but comes with risks, including margin requirements, potential for unlimited losses, and strict regulations.

With the right knowledge and timing, short selling can be a valuable tool, but it demands caution and a solid understanding of the market.

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

Short selling involves borrowing shares, selling them at the current price, waiting for the price to drop, and then repurchasing them at the lower price before returning the shares to the lender.

Borrowing ensures that traders have real shares to sell, maintaining market stability and preventing manipulation through “naked” selling.

Short selling has a reputation for being aggressive and potentially harmful to companies, as it benefits from stock declines and can contribute to market volatility.

If you sell borrowed shares of a $100 stock and it drops to $70, you can buy them back and return them to the lender, profiting from the $30 difference per share.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.