Forex

Shelf Offerings and Mixed Shelf Offerings: A Trader’s Guide

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 4 February 2025

Table of Contents

Shelf offerings and mixed shelf offerings are financial strategies that allow companies to raise capital by issuing securities over time without the need to issue them all at once.

Key Takeaways

-

Shelf offerings let companies register and sell securities over time, while mixed shelf offerings include various types of securities and offer greater flexibility.

-

Companies can issue parts of their registered securities as needed, avoiding market flooding and timing sales to benefit from favorable conditions.

-

Shelf offerings can dilute stock prices, but effects depend on market perception. Types include primary, secondary, and combined offerings, each serving different needs.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

Shelf Offerings and Mixed Shelf Offerings

Let’s take a look at the specifics of these capital-raising methods and how they function in the financial markets.

What Are Shelf Offerings?

A shelf offering is a method companies use to raise capital by registering a new issue of securities without selling the entire offering immediately.

Instead, the company can "shelve" or delay the sale of the securities for up to three years, selling portions of the securities when market conditions are favorable.

This flexibility makes shelf offerings a popular choice for companies that want to efficiently manage their capital-raising process without overwhelming the market with many new shares all at once.

Shelf Offerings vs. Traditional Offerings

When companies aim to raise capital, they often face a critical decision: whether to pursue a shelf offering or a traditional securities offering. Both methods serve as avenues to secure funding but differ significantly in structure, timing, and flexibility.

1. Timing and Flexibility

-

Shelf Offerings: Allow companies to sell securities incrementally over up to three years, offering flexibility to time sales during favorable market conditions.

-

Traditional Offerings: Require securities to be sold all at once, providing immediate capital but lacking flexibility to adapt to market changes.

2. Market Impact

-

Shelf Offerings: Minimize market disruption by avoiding large, immediate sales that can dilute share value.

-

Traditional Offerings: Can flood the market, often leading to greater stock price volatility.

3. Regulatory Process

-

Shelf Offerings: Involve a single SEC registration for multiple future sales, reducing administrative burdens over time.

-

Traditional Offerings: Require individual registrations for each sale, increasing costs and time requirements.

What Are Mixed Shelf Offerings?

Mixed shelf offerings, or hybrid shelf offerings, are a variation of the standard shelf offering.

A mixed shelf offering definition includes a company registering multiple types of securities, such as common stock, preferred stock, debt securities, and warrants, under a single shelf registration.

This allows the company to offer a combination of these securities to investors as needed, providing even greater flexibility in capital raising.

By using automatic mixed securities shelf offerings, companies can attract a broader range of investors, each with different risk tolerances and investment goals.

Mixed Shelf Offerings vs. ATM Offerings

An at-the-market (ATM) offering involves the gradual sale of common stock directly into the market at current prices, allowing the company to raise funds steadily over time.

The key difference lies in timing and market impact. Mixed shelf offerings provide flexibility to sell in large or small amounts based on market conditions, which can cause bigger price fluctuations.

ATM offerings, on the other hand, involve smaller, more frequent sales that typically have a lower impact on stock prices.

While mixed shelf offerings offer versatility, they require more regulatory work. ATM offerings are simpler and more cost-effective, making them ideal for companies seeking a steady cash flow with minimal market disruption.

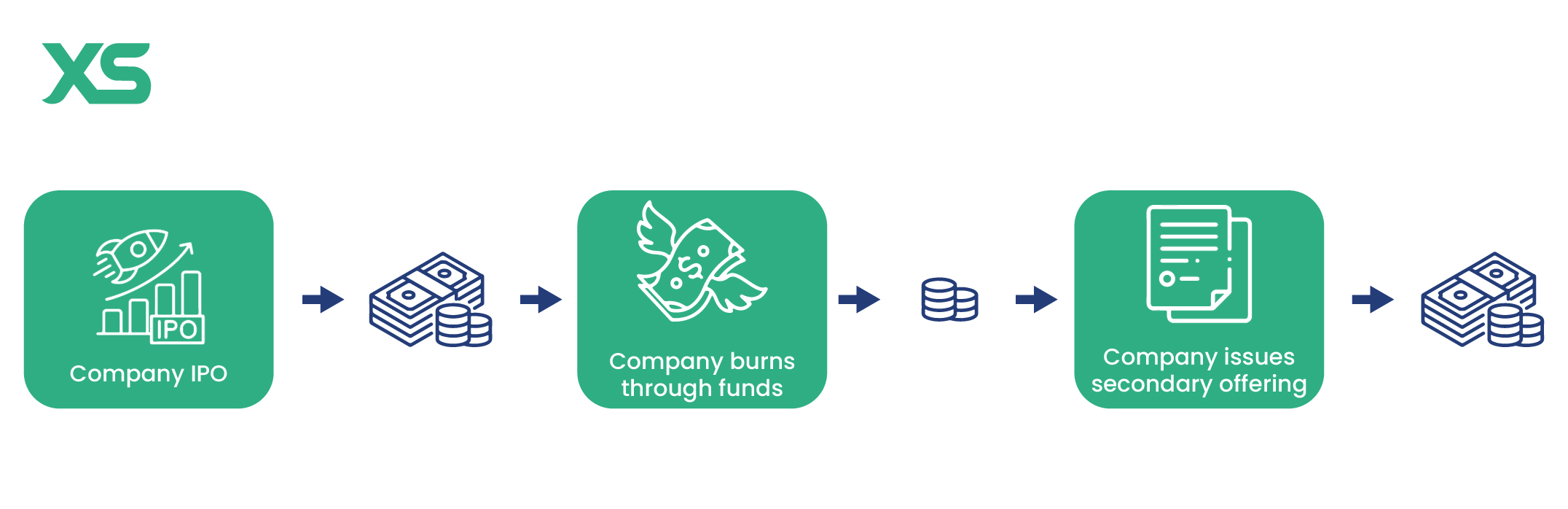

Here’s an example of how shelf offerings and mixed shelf offerings work:

-

Company IPOs: The process starts with the company going public by launching an Initial Public Offering (IPO) to raise capital.

-

Capital Raised: After the IPO, the company raises funds from investors who purchase shares.

-

Company Burns Through Funds: Over time, the company uses the funds raised from the IPO for various purposes, such as operations, expansion, or other investments.

-

Need for Additional Capital: As the company burns through the initial funds, it might need more capital.

-

Company Issues Secondary Offering: To raise additional funds, the company issues a secondary offering, which involves selling more shares to the public.

-

Additional Funds Raised: The secondary offering results in the company raising more capital, similar to the initial IPO, but this time from the secondary market.

Types of Shelf Offerings and Mixed Shelf Offerings

Understanding the different types of shelf offerings and mixed shelf offerings is crucial for identifying the right investment opportunities and managing risks effectively.

Types of Shelf Offerings

Shelf offerings come in various forms, each tailored to meet specific corporate needs. The most common types include:

-

Primary Shelf Offering: In this type, a company sells newly issued securities directly to raise capital for business operations, expansion, or debt repayment.

-

Secondary Shelf Offering: This involves existing shareholders, such as company insiders, selling their shares to the public. The company does not receive any proceeds from these sales.

-

Combined Shelf Offering: A mixture of primary and secondary offerings, where both the company and existing shareholders sell their shares.

Types of Securities in Mixed Shelf Offerings

Mixed shelf offerings can include a range of securities, allowing companies to tailor their capital raising strategy based on market conditions and investor demand:

-

Common Stock: Equity shares that represent ownership in the company.

-

Preferred Stock: Shares that provide dividends and priority over common stockholders in the event of liquidation.

-

Debt Securities: Bonds or notes issued to raise funds, which the company agrees to repay with interest.

-

Warrants: Derivatives that give investors the right to purchase the company’s stock at a specific price in the future.

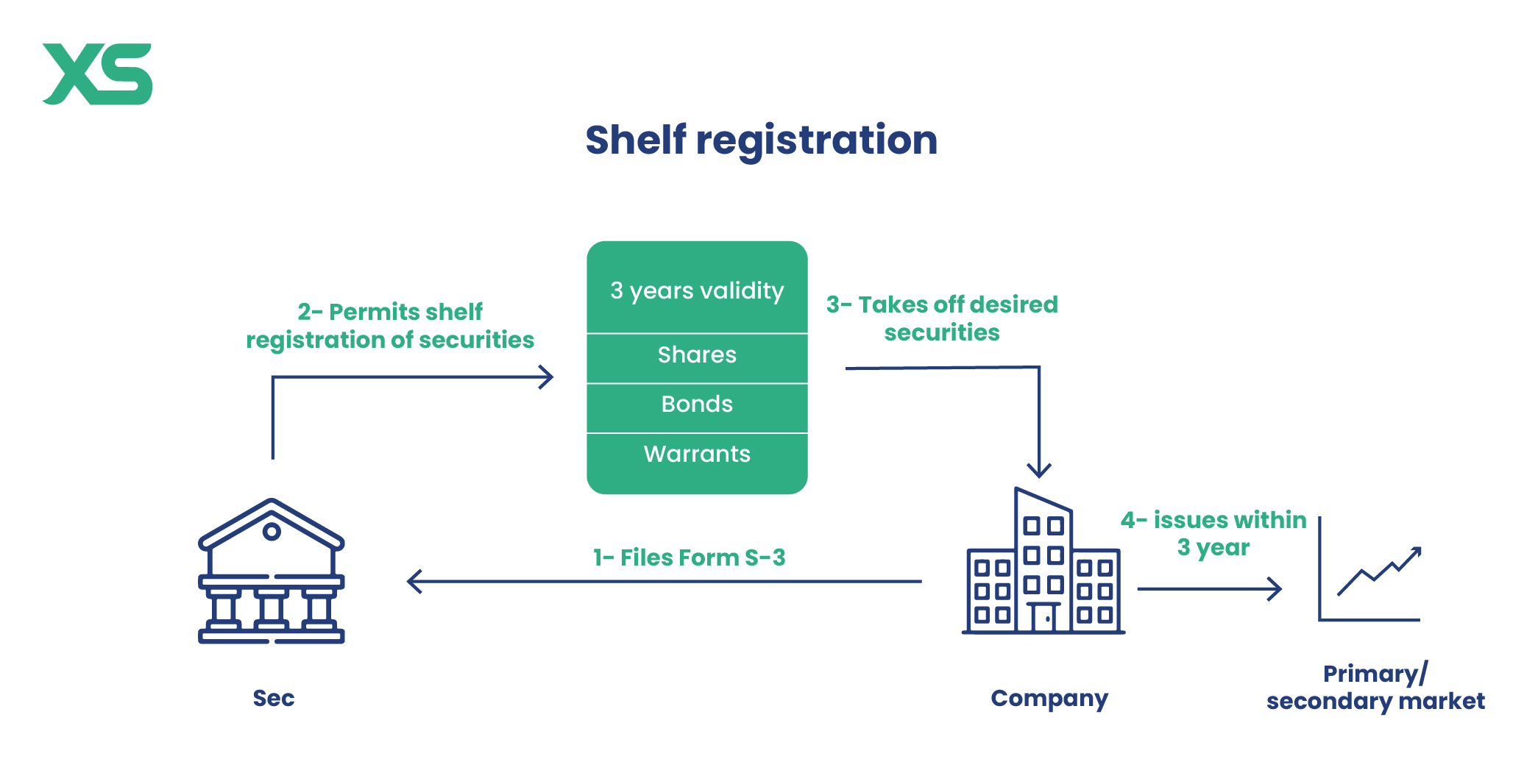

What Is a Shelf Registration?

A shelf registration is a regulatory process that allows companies to register a new issue of securities with the Securities and Exchange Commission (SEC) and sell them incrementally over a set period, typically up to three years.

By filing a shelf registration, a company can "pre-register" a batch of securities, including common stock, preferred stock, bonds, or even a combination of these, and then issue them as needed when market conditions are most favorable.

To be eligible for shelf registration, companies must meet certain requirements set by the Securities and Exchange Commission (SEC). These eligibility requirements typically include the following:

-

Public Company: Must be a publicly traded company.

-

SEC Compliance: Must have filed all required SEC reports on time for at least 12 months.

-

Market Capitalization: Must meet a minimum market cap, often $700 million for WKSI.

-

No Defaults: Cannot be in material default on financial obligations.

-

Audited Financials: Must have audited financial statements with no adverse opinions.

-

U.S. Incorporation: Must be a U.S. company or a qualifying foreign entity.

Eligibility Criteria for Shelf Offerings

For a company to use a shelf offering, it must meet certain rules set by the U.S. Securities and Exchange Commission (SEC). These rules ensure the company is reliable and financially stable before it can sell securities over time.

The main requirements include:

-

Public Company Status:

-

The company must already be publicly traded (meaning its shares are available for purchase on a stock exchange).

-

-

Good Standing with the SEC:

-

The company must have regularly submitted all required reports (such as earnings statements and financial disclosures) to the SEC on time for at least the past 12 months.

-

-

Minimum Market Value:

-

In some cases, the company's total market value (the total worth of all its shares) must meet a minimum amount, usually $700 million, for large companies classified as "Well-Known Seasoned Issuers" (WKSIs). Smaller companies may have lower requirements.

-

-

No Serious Financial Problems:

-

The company should not have any major unpaid debts or financial issues that could put it at risk of bankruptcy.

-

-

Audited Financial Statements:

-

The company must have its financial records checked and verified by an independent auditor to confirm accuracy.

-

-

U.S. Registration or Qualification:

-

The company should be based in the U.S. or qualify under SEC rules if it's a foreign company.

-

Meeting these criteria allows a company to register securities in advance and sell them gradually when market conditions are right. If any of these requirements are not met, the company may need to go through a longer, more complex approval process.

How Shelf Offerings Are Sold

The company files a shelf registration statement detailing the types and amounts of securities it might sell, such as stocks, bonds, or warrants.

Once approved, the company can choose to offer these securities at various times within the registration period, typically up to three years. Depending on the company's preference, the actual sale occurs through underwriters or directly to investors.

So, once the shelf registration is effective, companies can sell their securities through various methods:

-

At-the-Market Offerings (ATM): Securities are sold incrementally at current market prices.

-

Block Trades: In a block trade, large amounts of securities are sold in a single transaction, usually at a discount to market price.

-

Bought Deals: Underwriters agree to purchase the entire offering from the company and then sell it to investors.

Impact of Shelf Offerings on Shareholders

Shelf offerings can significantly affect shareholders, with outcomes depending on the company's execution and market perception.

1. Dilution of Ownership

When new shares are issued, existing shareholders may experience dilution, reducing their ownership percentage. However, issuing securities incrementally can help limit this impact compared to a large, immediate sale.

2. Stock Price Fluctuations

Market reactions to shelf offerings vary:

-

Negative Impact: Investors might interpret the offering as a signal of financial need, leading to a decline in stock price.

-

Positive Impact: If the capital is used for growth or strategic initiatives, it may boost investor confidence and stock value.

3. Long-Term Value

While dilution is a short-term concern, successful use of funds from shelf offerings (e.g., expansion, debt reduction) can enhance long-term shareholder value.

For shareholders, understanding the company's intentions and market conditions is essential to gauging the impact of a shelf offering.

How Does a Mixed Shelf Offering Affect Stock Price?

This question depends on how the market views the company’s intent. A mixed security shelf offering may stabilize value if it’s seen as part of a strategic growth plan.

Investor Strategies for Shelf Offerings

Investors can take several approaches when dealing with shelf offerings to make informed decisions and manage potential risks.

The first step is to understand why the company is issuing new securities. If the funds are intended for growth, such as expanding operations or paying off debt, it may signal a positive opportunity.

However, if the offering is to cover financial difficulties, it could raise concerns about the company's stability.

Key strategies investors can use include:

-

Monitoring the Timing of Sales: Since shelf offerings allow companies to sell shares gradually, investors should pay attention to when and how many shares are being issued. A large, sudden sale could push stock prices down, whereas smaller, spaced-out sales may have less impact.

-

Assessing the Company’s Financial Health: Before making investment decisions, investors should analyze the company’s earnings, debt levels, and overall growth plans. A strong financial position and a clear use of funds may indicate a promising investment opportunity.

-

Watching Market Reactions: Stock prices often drop when a shelf offering is announced. This could create a buying opportunity if investors believe in the company's long-term potential. However, if too many new shares flood the market, existing shareholders' value may decline due to dilution.

Role of Underwriters in Shelf Offerings

Underwriters are key to the success of shelf offerings, acting as intermediaries between companies and investors. They help structure the offering, determine pricing, and ensure proper timing based on market conditions.

Their role includes:

-

Marketing: Promoting securities to investors and stabilizing demand.

-

Risk Mitigation: Offering firm commitments or "bought deals" to guarantee sales.

-

Regulatory Compliance: Ensuring adherence to SEC requirements and proper disclosures.

By managing these aspects, underwriters streamline the process, reduce risks, and maximize the offering's success.

Advantages and Disadvantages of Shelf Offerings

Here are the advantages and disadvantages of shelf offerings:

Advantages

-

Flexibility: Companies can time the sale of securities based on favorable market conditions.

-

Cost-Efficiency: Reduced administrative costs by avoiding multiple registration filings.

-

Market Stability: Avoids flooding the market with too many shares at once, which can depress stock prices.

Disadvantages

-

Dilution Risk: Issuing new shares can dilute existing shareholders’ equity.

-

Market Perception: Investors may perceive a shelf offering as a signal that the company needs capital, which can negatively impact stock prices.

Advantages and Disadvantages of Mixed Shelf Offerings

Here are the advantages and disadvantages of mixed shelf offerings:

Advantages

-

Versatility: Companies can offer a variety of securities to suit different investor preferences.

-

Investor Attraction: Broader appeal to different types of investors, enhancing capital raising opportunities.

-

Efficient Capital Raising: Ability to raise capital through different types of securities under one registration.

Disadvantages

-

Complexity: Managing multiple types of securities can be challenging for both the company and investors.

-

Valuation Challenges: Determining the correct value for a mixed offering can be difficult, leading to potential pricing inefficiencies.

Conclusion

Shelf offerings and mixed shelf offerings are powerful tools for a company’s capital-raising goals. By understanding these financial strategies, traders can better anticipate market movements and make informed decisions.

Follow XS for more trading insights!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

A mixed shelf offering is a flexible way for companies to raise capital by issuing various types of securities, like stocks, bonds, or warrants.

Companies can register a certain amount of these securities in advance and choose when and how to offer them over a period, typically up to three years. This allows for opportunistic fundraising based on market conditions or company needs.

An example of a shelf offering is when a company registers a certain amount of shares with the SEC but only issues some of them initially.

For instance, a tech company might file a shelf registration for $500 million worth of stock but only sell $100 million worth of shares at first, keeping the rest available for future needs.

An IPO (Initial Public Offering) is the first sale of a company's stock to the public, marking its debut on the stock market.

A shelf offering, on the other hand, involves a company registering securities to be sold at a later time, often used by established companies to raise funds when needed.

Essentially, an IPO is a one-time event, while a shelf offering provides ongoing flexibility.

Shelf offerings can impact a stock's price by potentially diluting existing shares when new ones are issued, which might lower the stock price. However, the actual effect depends on market conditions and investor perception.

If investors view the offering as a sign of growth or a strategic move, the impact might be neutral or even positive.

Companies often pursue mixed shelf offerings for their versatility and efficiency in raising capital. By using automatic mixed securities shelf registrations, they can issue securities strategically without committing to an immediate full-scale offering.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.