Forex

Option Strategies Cheat Sheet (2024)

By Nathalie Okde

4 July 2024

Options in trading are financial contracts giving you the right, but not the obligation, to buy or sell an asset at a specific price within a certain time frame. To help you navigate the complexity of options trading, here are the best option strategies cheat sheet in 2024.

Key Takeaways

-

Options strategies are tactics investors use to profit from price movements of assets while managing risks.

-

Options give you the right, but not the obligation, to buy (call) or sell (put) an asset at a predetermined price within a specific timeframe.

-

Understanding key terminology like strike price, expiration date, and premium is crucial in options trading.

-

The options strategies cheat sheet provides a quick reference to popular options strategies for 2024.

What Are Options Strategies?

Options strategies are tactics investors use to profit from the price movements of stocks, indices, or other underlying assets while managing risks.

Options give you the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a specific timeframe.

By combining different options in various ways, you can create strategies that align with your market outlook and risk tolerance.

Options Terminology Cheat Sheet

Understanding the key terminology in options trading is crucial for successfully navigating the market. Here are some essential terms:

-

Call Option: Gives the holder the right to buy an asset at a predetermined price.

-

Put Option: Gives the holder the right to sell an asset at a predetermined price.

-

Underlying Asset: The financial instrument (e.g., stock, index, commodity) on which the option is based.

-

Strike Price: The specified price at which the underlying asset can be bought or sold.

-

Expiration Date: The date on which the option contract expires.

-

Premium: The cost of purchasing the option, paid by the buyer to the seller.

-

Time Decay: The gradual reduction in an option's value as it approaches its expiration date.

How to Choose the Right Options Trading Strategy

Before exploring the different option strategies in the cheat sheet, let's see how you can choose the right strategy for you.

-

Assess Your Market Outlook: Check if the current trend is bullish, bearish, or neutral, and choose the strategy that suits the existing trend.

-

Evaluate Your Risk Tolerance: Always consider your risk tolerance, as some strategies have higher risks than others.

-

Determine Your Timeframe: Decide whether you will trade within a short or a long timeframe.

-

Consider Implied Volatility (IV): High volatility environments are good for strategies like straddles, and low volatility environments are good for covered calls.

-

Factor in Costs and Liquidity: Select assets with high liquidity and low transaction costs to optimize trading efficiency.

Options Strategies Cheat Sheet

The options strategies cheat sheet below provides a quick reference to some popular and common options strategies in 2024.

Download Option Strategies Cheat Sheet

Option Strategies Cheat Sheet: Types of Options Strategies

Options strategies can be broadly categorized into three types: directional strategies, volatility strategies, and income strategies.

Directional Options Strategies

Directional strategies are based on the expectation that the underlying asset's price will move in a specific direction. Some examples of directional options strategies are:

-

Long Call

-

Long Put

-

Bull Call Spread

-

Bear Put Spread

-

Bull Put Spread

-

Bear Call Spread

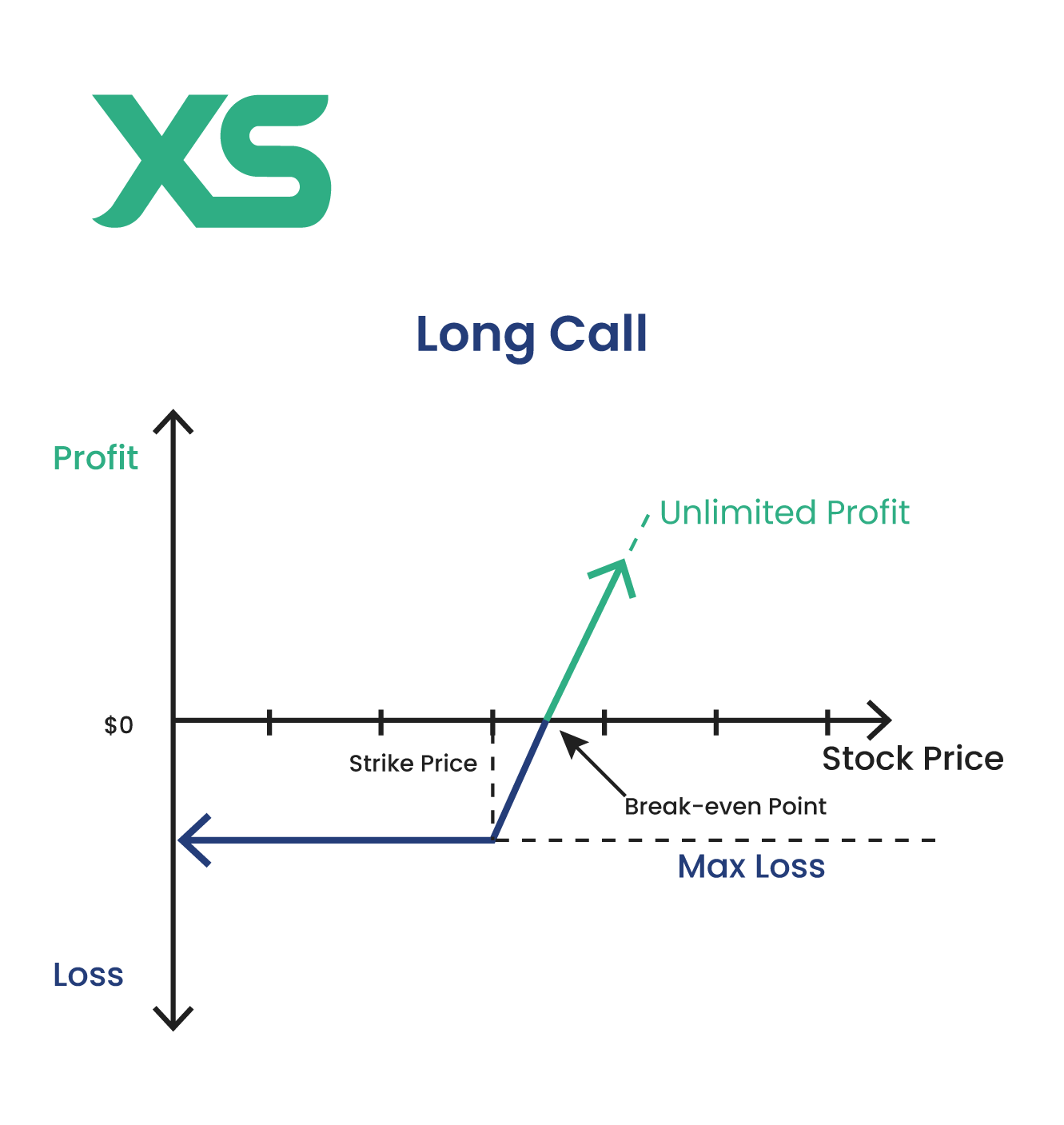

Long Call

A long-call strategy involves buying a call option, expecting the underlying asset’s price to rise. This strategy allows you to profit from upward price movements while limiting your risk to the premium paid for the option.

If the asset's price increases above the strike price, you can buy it at a lower cost and make a profit.

For example, if you buy a call option for Stock A with a strike price of $50, paying a premium of $3 per share. If Stock A's price rises to $60, you can buy it at $50 and potentially sell it at the market price, making a profit of $7 per share ($10 gain - $3 premium).

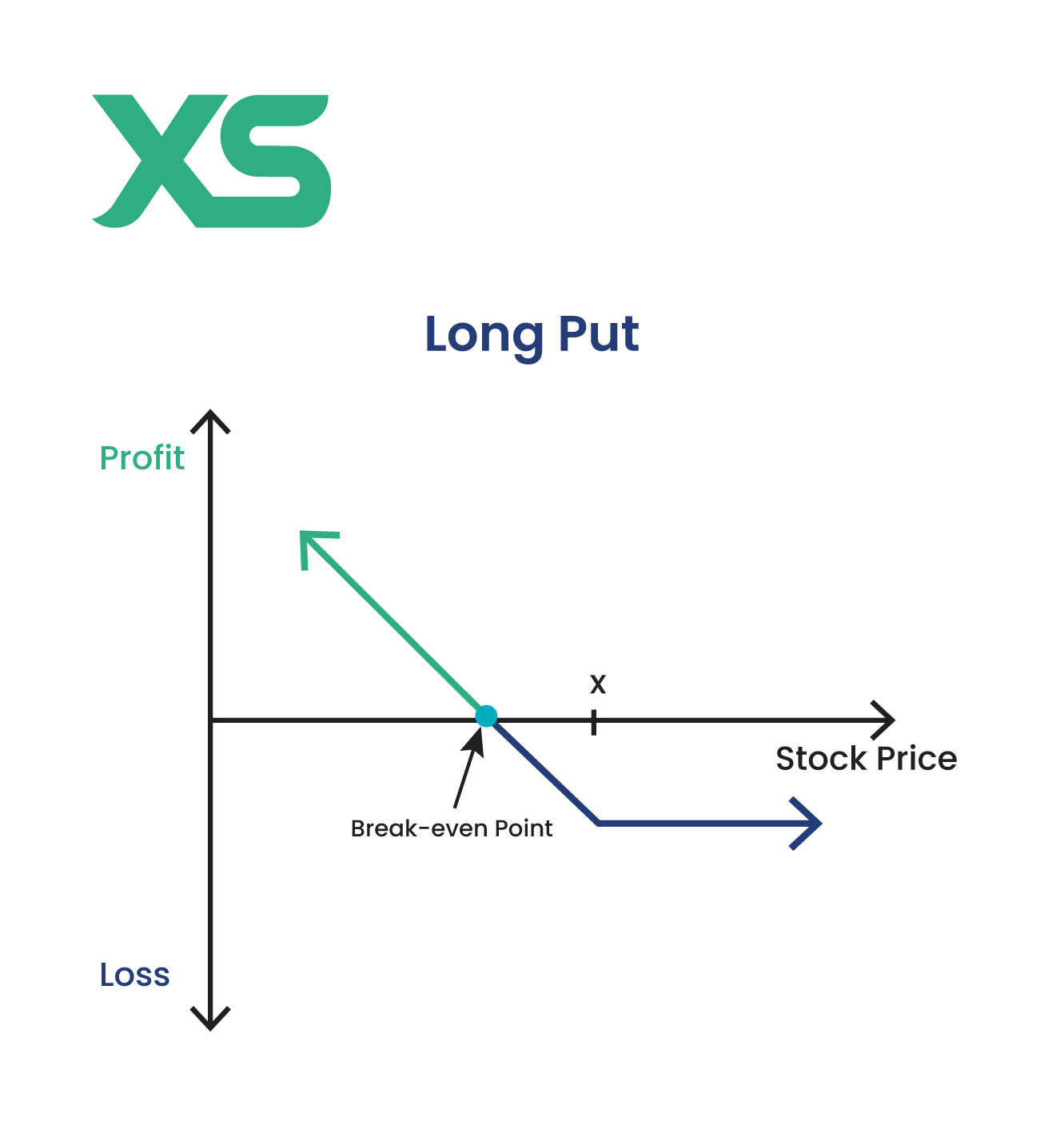

Long Put

A long put strategy involves buying a put option, expecting the underlying asset’s price to decrease. This strategy lets you benefit from downward price movements while capping your risk to the premium paid.

If the asset’s price drops below the strike price, you can sell it at a higher price, thereby securing a profit.

For example, if you buy a put option for Stock B with a strike price of $40, and pay a $2 premium. If Stock B falls to $30, you can sell it at $40, profiting $8 per share ($10 gain - $2 premium).

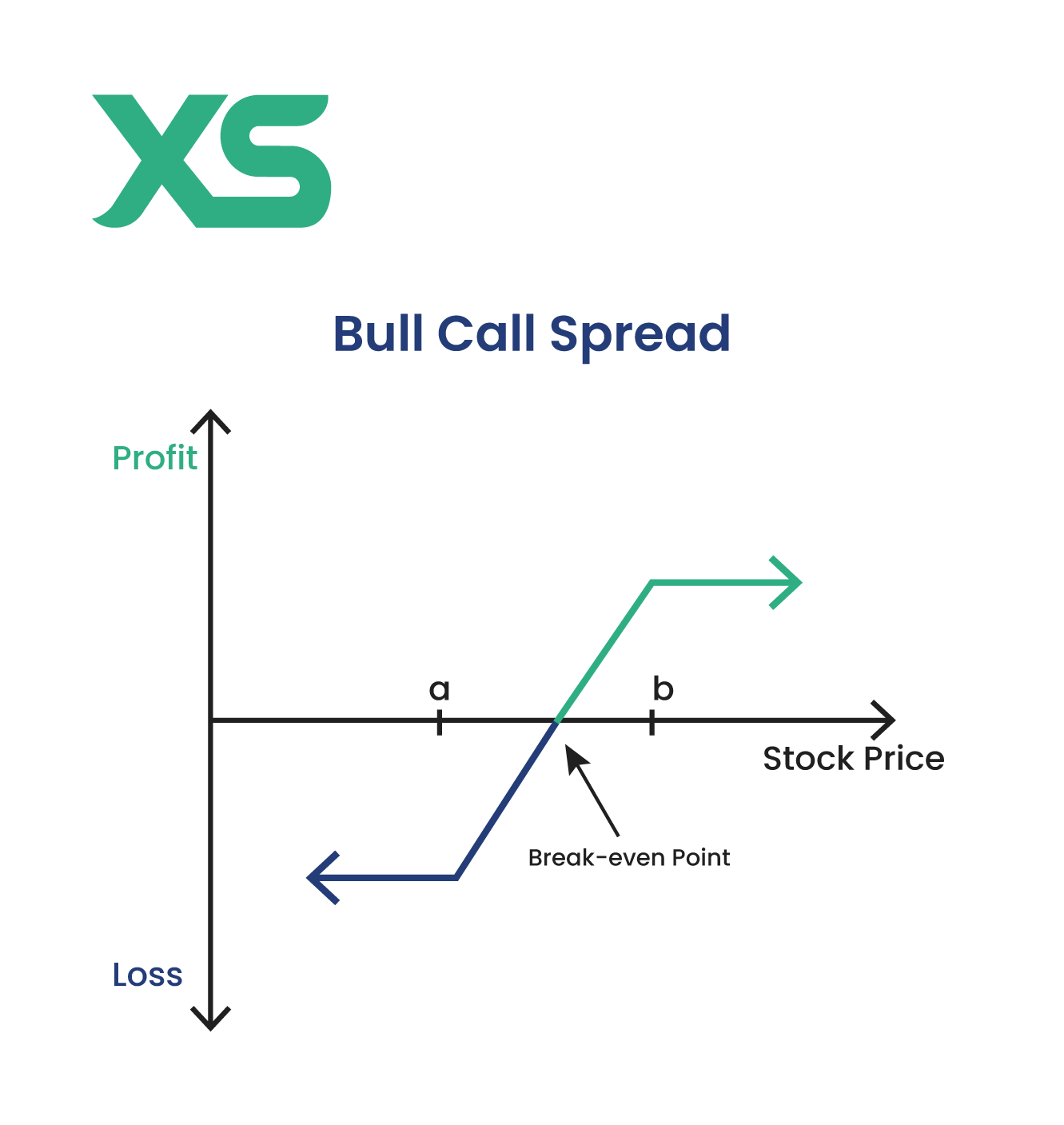

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and simultaneously selling another one at a higher strike price. This strategy is used when you expect a moderate price rise in the underlying asset.

It limits both potential gains and losses, making it a more conservative approach to bullish trading.

For example, if you buy a call option for Stock C at $20 (premium $4), sell a call at $30 (premium $2). If Stock C rises to $28, you profit $2 per share after accounting for the net premium paid ($6 gain - $4 premium cost).

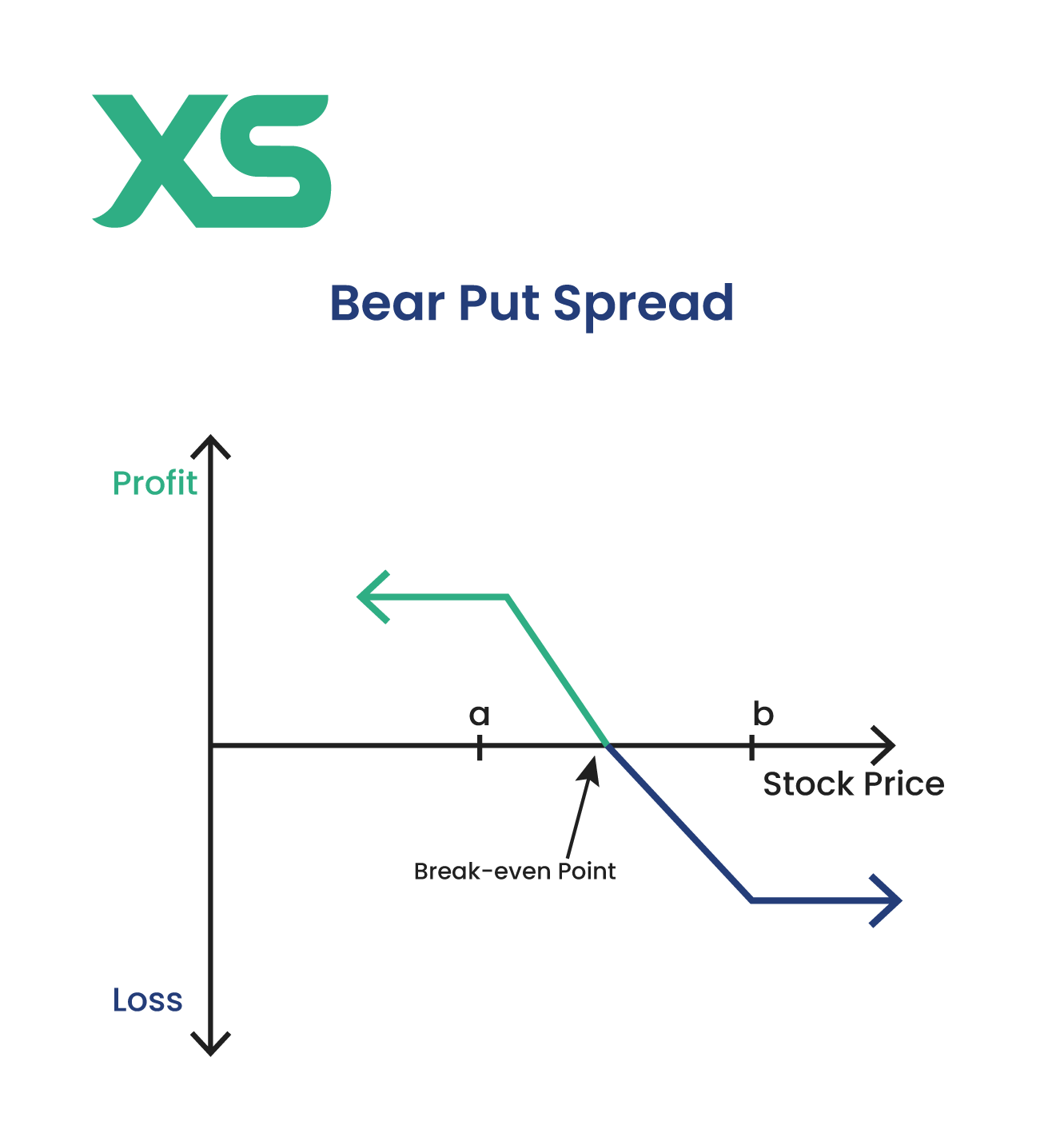

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price while selling another one at a lower strike price. This strategy is proper when anticipating a moderate price decline in the underlying asset.

It provides a balanced risk-reward scenario, limiting both potential gains and losses.

For example, if you buy a put for Stock D at $60 (premium $5) and sell a put at $50 (premium $2). If Stock D falls to $52, you gain $5 per share ($10 spread difference - $5 net premium).

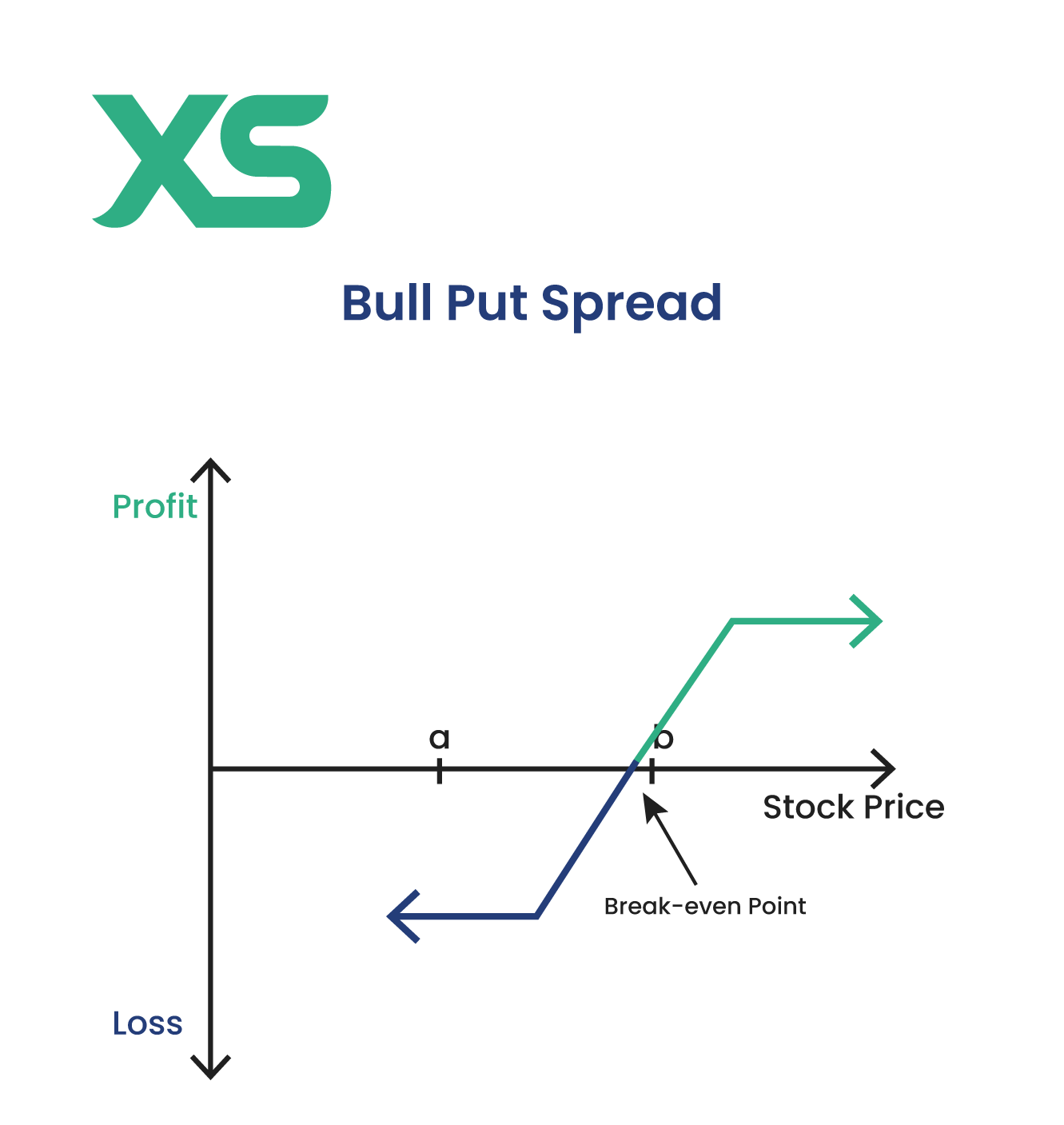

Bull Put Spread

A bull put spread involves selling a put option at a higher strike price and buying another one at a lower strike price. This strategy profits from a moderate increase in the underlying asset’s price.

It generates income through premiums while limiting potential losses, making it a conservative bullish strategy.

For example, if you sell a put for Stock E at $70 (premium $4) and buy a put at $60 (premium $1). If Stock E stays above $70, you keep a net premium of $3 per share, with a maximum loss limited to $7 per share.

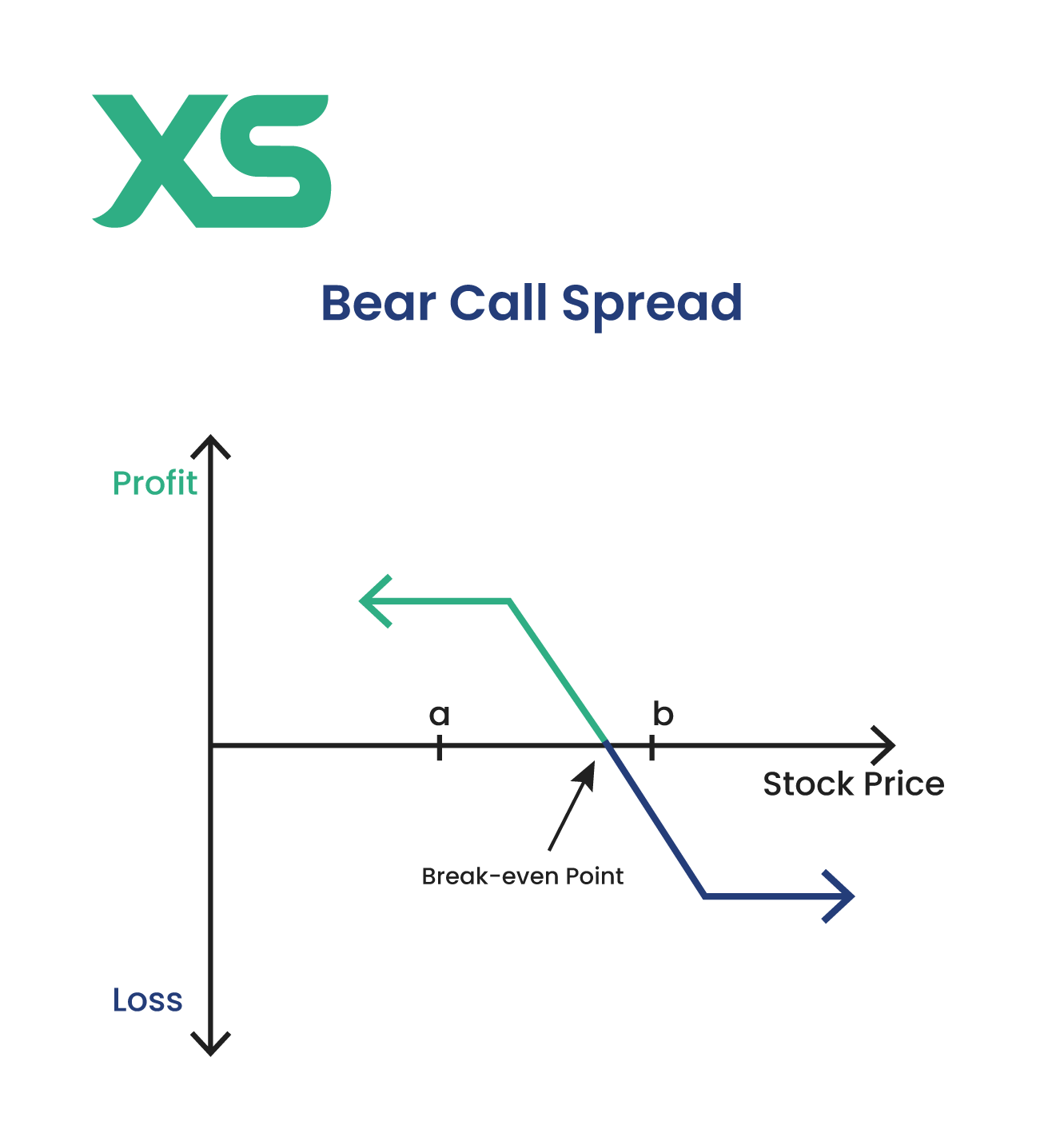

Bear Call Spread

A bear call spread involves selling a call option at a lower strike price and buying another one at a higher strike price. You employ this strategy when you expect a moderate price decrease in the underlying asset.

It allows you to profit from the premiums received while capping potential losses, making it a prudent bearish strategy.

For example, suppose you sell a call for Stock F at $80 (premium $6) and buy a call at $90 (premium $2). If Stock F stays below $80, you profit $4 per share, with a maximum loss of $6 per share if it rises above $90.

Volatility Options Strategies

Volatility strategies profit from significant price movements in either direction, irrespective of the underlying asset’s direction. Some examples of volatility options strategy are:

-

Straddle

-

Strangle

-

Butterfly Spread

-

Iron Butterfly

-

Calendar Spread

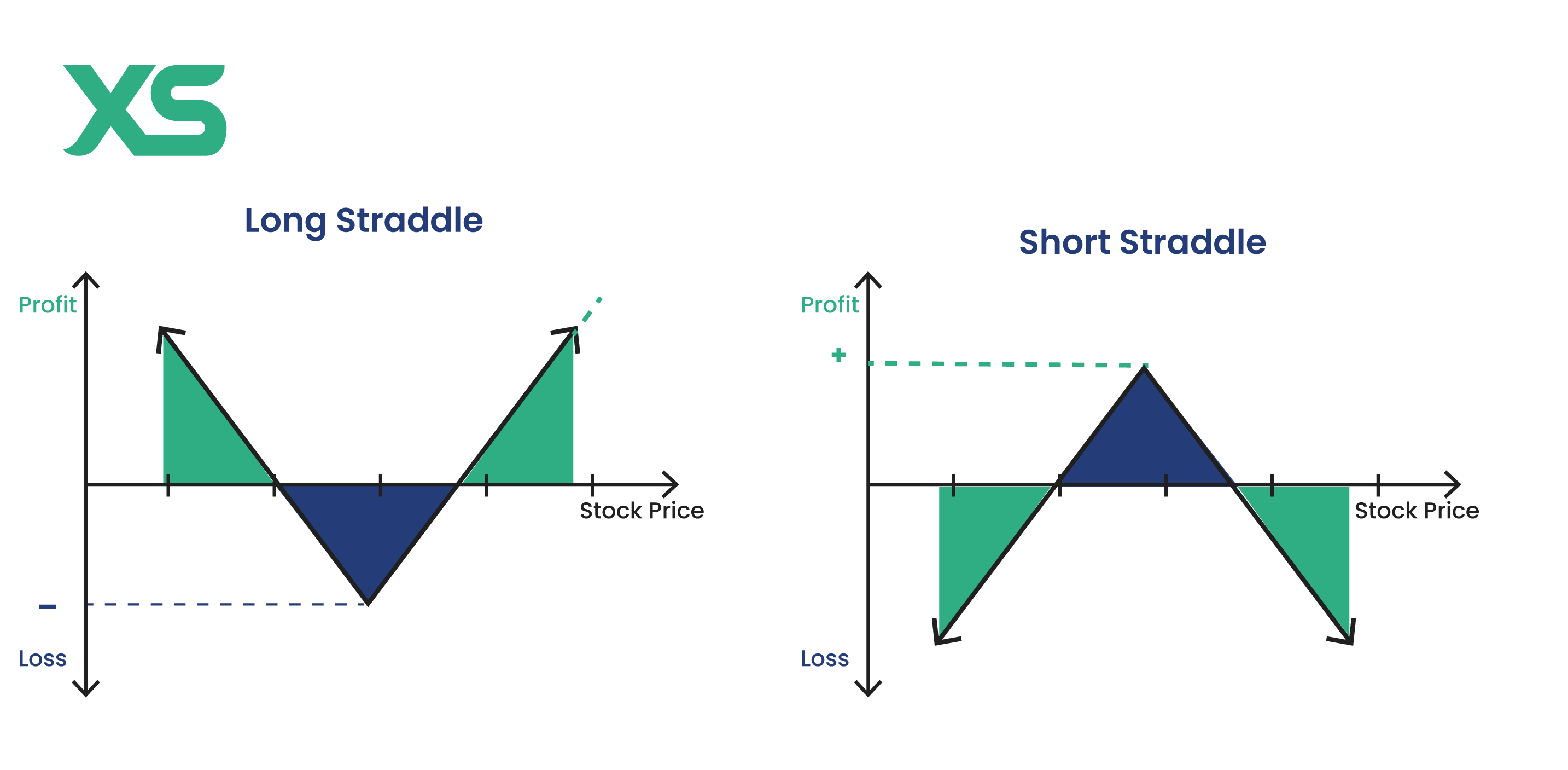

Straddle

A straddle strategy involves buying both a call and a put option at the same strike price and expiration date. This strategy is ideal when you expect significant price movements but are still determining the direction.

There are two different types of straddles: long straddle and short straddle.

A long straddle involves buying both a call and a put option at the same strike price and expiration date. However, a short straddle involves selling both a call and a put option at the same strike price and expiration date.

If the asset's price moves sharply in either direction, you can profit from the substantial price changes, covering the cost of both options.

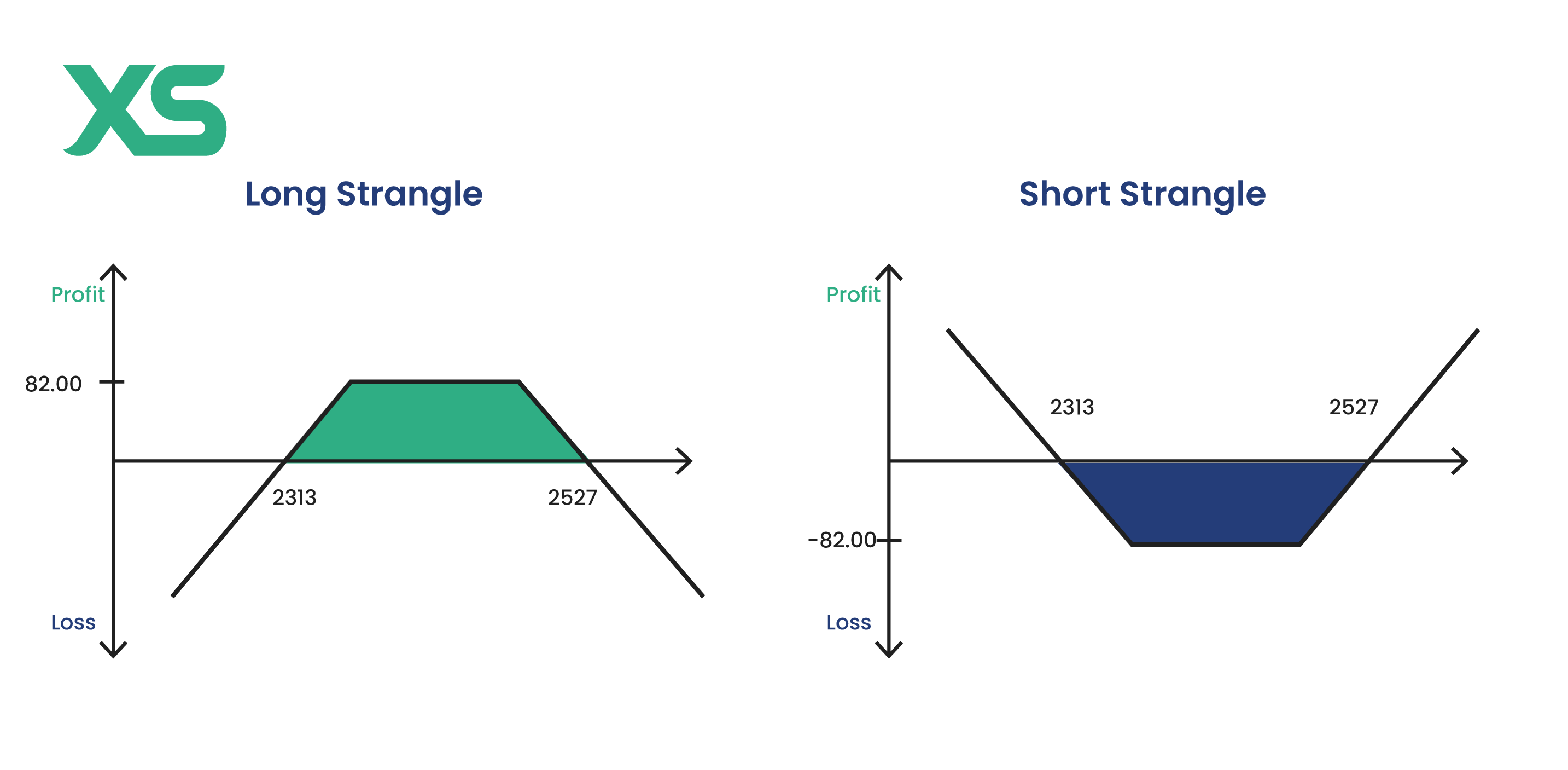

Strangle

A strangle strategy involves buying a call and a put option with different strike prices but the same expiration date. You adopt this approach when you expect significant asset price volatility but are still determining the direction.

By choosing out-of-the-money options, you lower the initial cost and profit if the asset's price significantly moves in either direction.

There are two types of strangle options: long strangle and short strangle.

A long strangle involves buying a call and a put option with different strike prices but the same expiration date, typically out-of-the-money options.

However, a short strangle involves selling a call and a put option with different strike prices but the same expiration date.

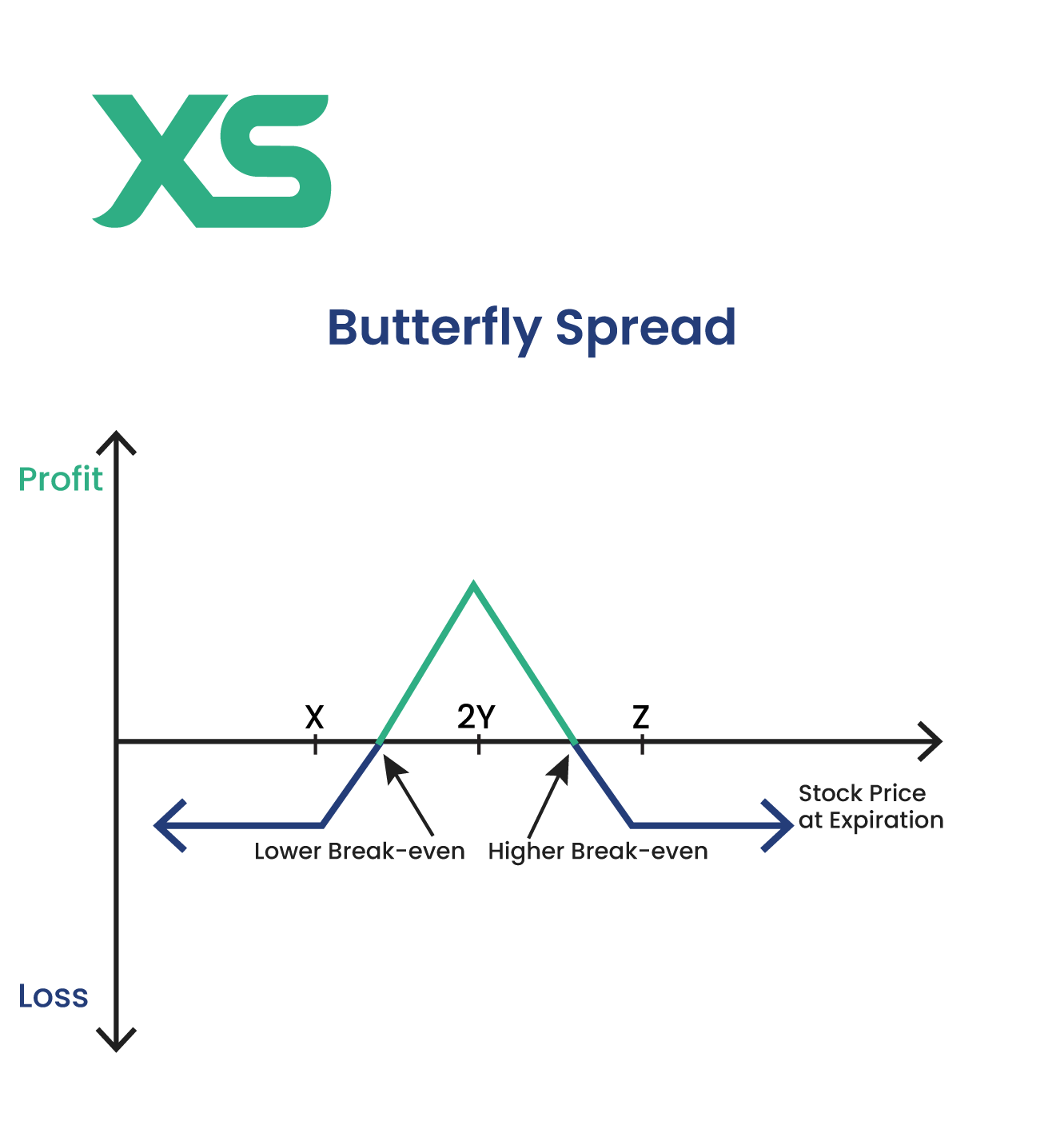

Butterfly Spread

A butterfly spread combines bull and bear spreads using three different strike prices, all with the same expiration date. You buy one option at a lower strike price, sell two possibilities at a middle strike price, and buy one at a higher strike price.

This strategy profits from low volatility, as you gain the most when the asset's price remains close to the middle strike price at expiration.

For example, suppose you buy a call for Stock I at $40 (premium $3), sell two calls at $50 (premium $5 each), and buy a call at $60 (premium $2). Maximum profit occurs if Stock I stays at $50 at expiration.

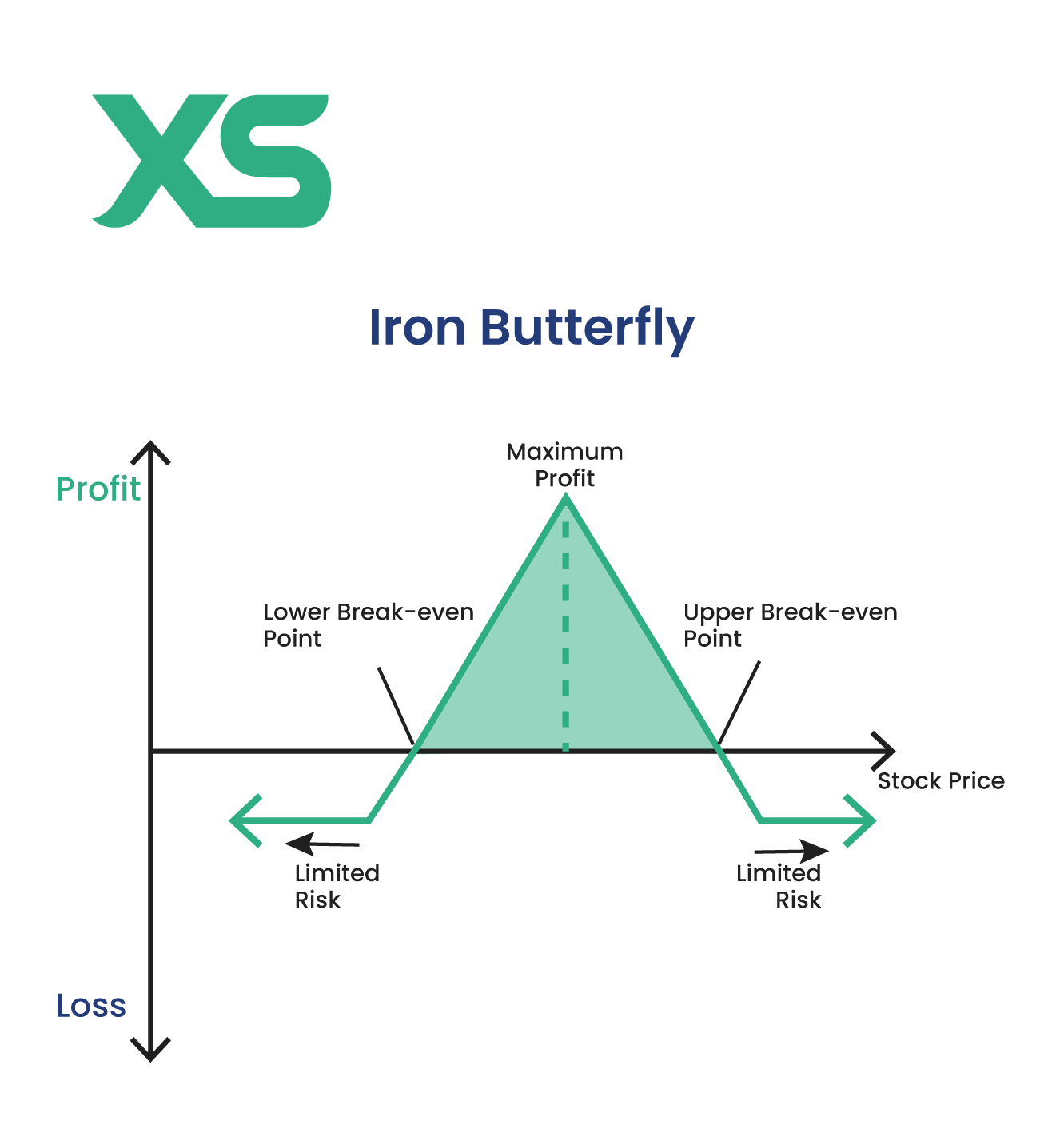

Iron Butterfly

An iron butterfly strategy involves selling a straddle (a call and a put option at the same strike price) while buying protective wings (a call option at a higher strike price and a put option at a lower strike price).

This strategy is used to profit from low volatility, generating income from the premiums while limiting potential losses through the purchased options.

For example, you sell a call and put for Stock J at $100, receiving $10 in premiums; buy a call at $110 and a put at $90, each for $2. If Stock J remains near $100, profit from the net premium while capping losses.

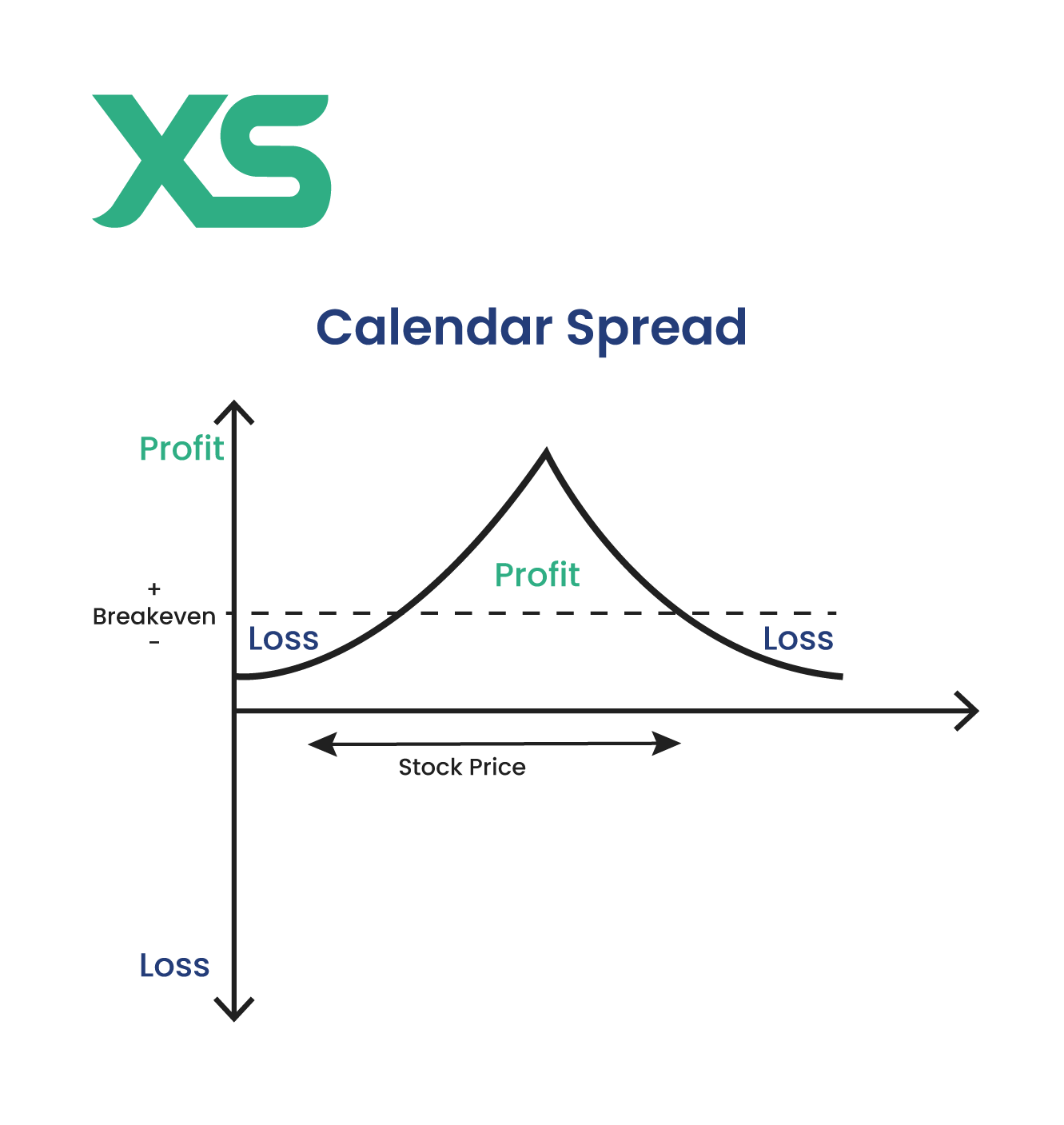

Calendar Spread

A calendar spread involves buying and selling options with the same strike price but different expiration dates. Typically, you sell a short-term option and buy a longer-term option.

This strategy profits from time decay and changes in volatility, as the short-term option expires faster while the longer-term option retains its value.

For example, suppose you sell a one-month call for Stock K at $70 (premium $3), and buy a six-month call at $70 (premium $5). If Stock K stays near $70, the short-term option expires worthless, and you profit from the time decay.

Income Options Strategies

Income strategies are designed to generate regular income through options premiums. Some examples of income strategies are:

-

Covered Call

-

Protective Put

-

Iron Condor

-

Cash-Secured Put

-

Diagonal Spread

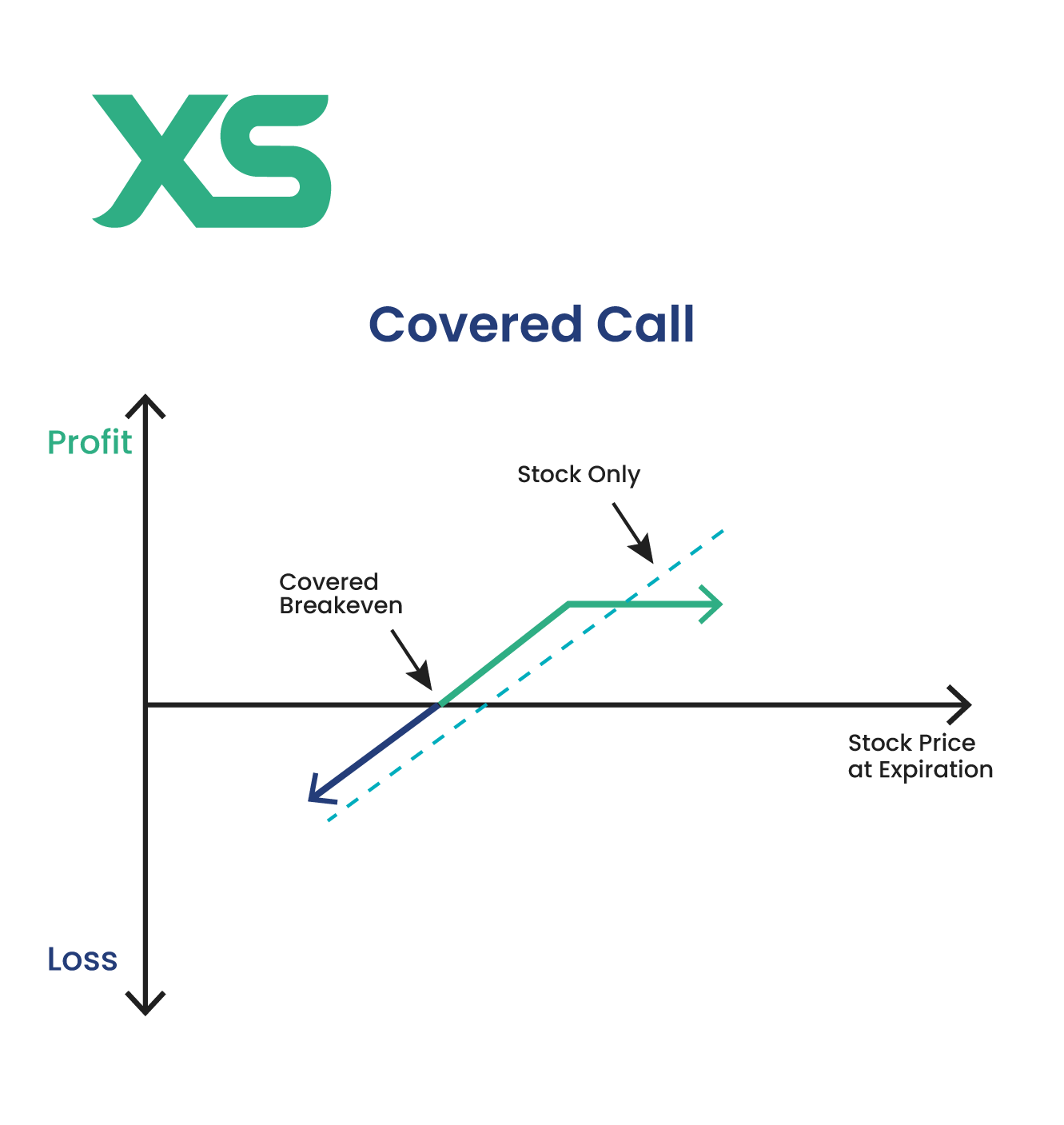

Covered Call

A covered call strategy involves owning the underlying asset and selling a call option against it. This approach generates additional income from the premium received for the sold call.

It's ideal for moderately bullish investors who want to earn extra income while holding the stock. If the stock price rises above the strike price, you may have to sell your shares but still benefit from the premium collected.

For example, you own 100 shares of Stock A, currently trading at $50 per share. You sell a call option with a strike price of $55 for a premium of $2 per share.

-

If Stock A remains below $55 at expiration, you keep the shares and the $200 premium (100 shares x $2).

-

If Stock A rises above $55, you sell your shares at $55, gaining both the stock appreciation from $50 to $55 and the $200 premium.

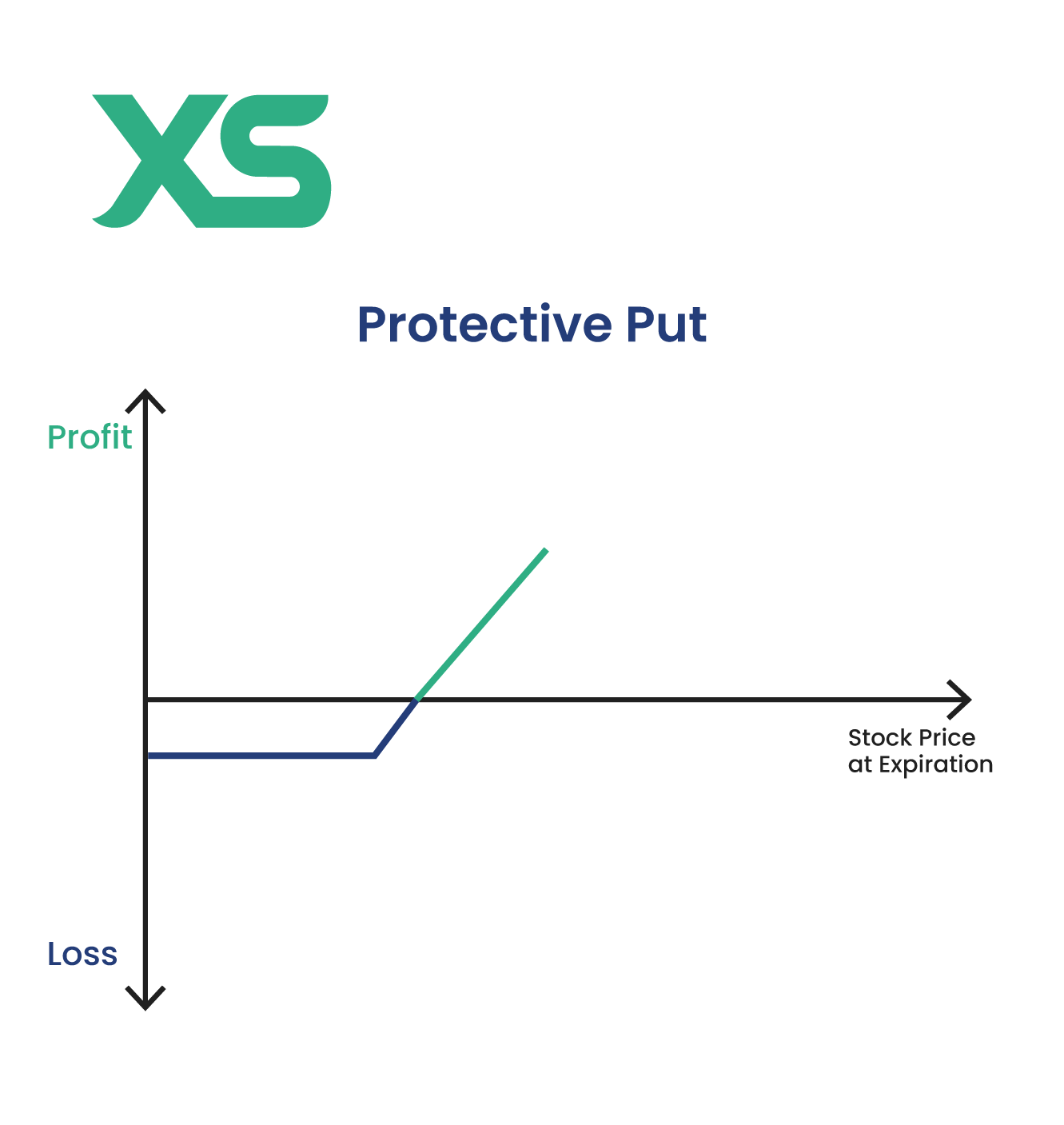

Protective Put

A protective put strategy involves buying a put option while holding the underlying asset. This strategy is like an insurance policy, providing a safety net if the asset's price falls.

It allows you to limit potential losses while maintaining the upside potential. If the stock price drops, the put option gains value, offsetting the loss on the stock.

For example, you own 100 shares of Stock B, currently trading at $70 per share. You buy a put option with a strike price of $65 for a premium of $3 per share.

If Stock B drops to $60, the put option increases in value, allowing you to sell the stock at $65, limiting your loss to the $5 per share difference (from $70 to $65) plus the $3 premium, rather than a larger loss if you held the stock without protection.

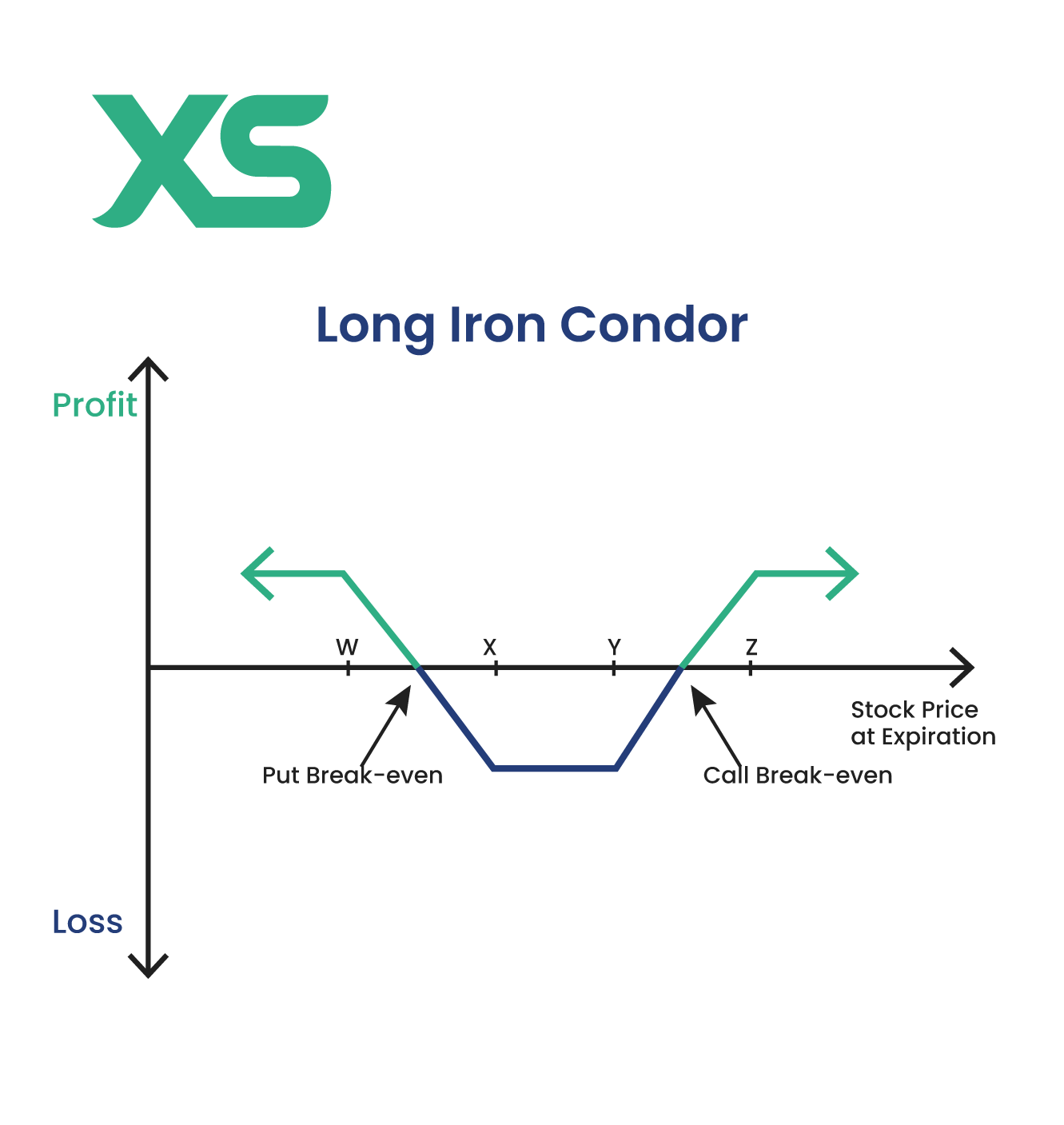

Iron Condor

An iron condor strategy involves selling an out-of-the-money call and put option while buying a further out-of-the-money call and put options to limit risk. This strategy profits from low volatility, collecting premiums as long as the asset's price stays within a specific range.

It offers a balanced approach with limited risk and reward, making it a popular choice for income generation.

For example, you sell a call option for Stock C with a strike price of $110 for a $3 premium and a put option with a strike price of $90 for a $3 premium. Simultaneously, you buy a call option at a strike price of $120 for $1 and a put option at a strike price of $80 for $1.

If Stock C stays between $90 and $110, all options expire worthless, and you keep the net premium of $4. The maximum loss occurs if Stock C moves beyond $120 or below $80, but this is capped due to the protective options.

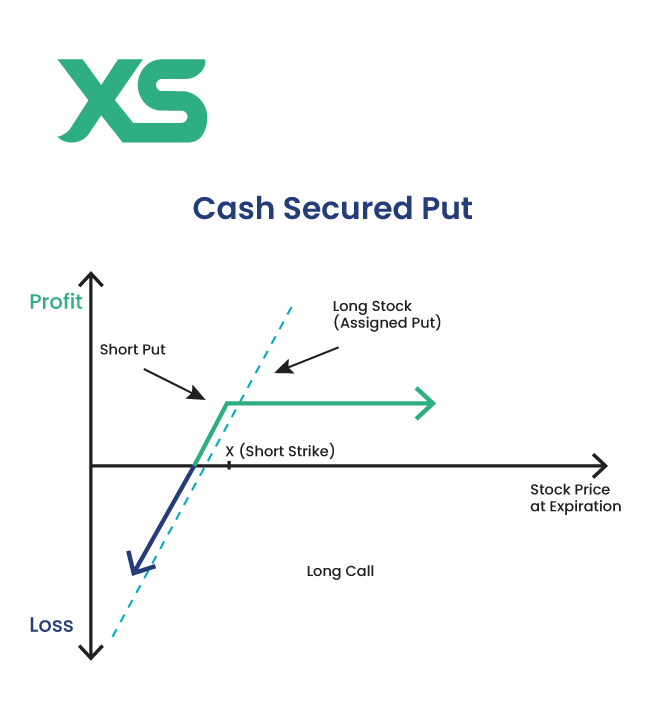

Cash-Secured Put

A cash-secured put strategy involves selling a put option while holding enough cash to buy the underlying asset if the option is exercised. This strategy generates income through the premium received from selling the put.

It’s a conservative approach for bullish investors, allowing you to potentially buy the stock at a lower price while earning income.

For example, you sell a put option for Stock D with a strike price of $40 for a premium of $3 per share.

You have $4,000 in cash to buy 100 shares if the option is exercised. If Stock D stays above $40, the option expires worthless, and you keep the $300 premium.

If Stock D falls below $40, you buy the stock at a net cost of $37 per share ($40 strike price minus the $3 premium), effectively buying the stock at a discount while earning the premium.

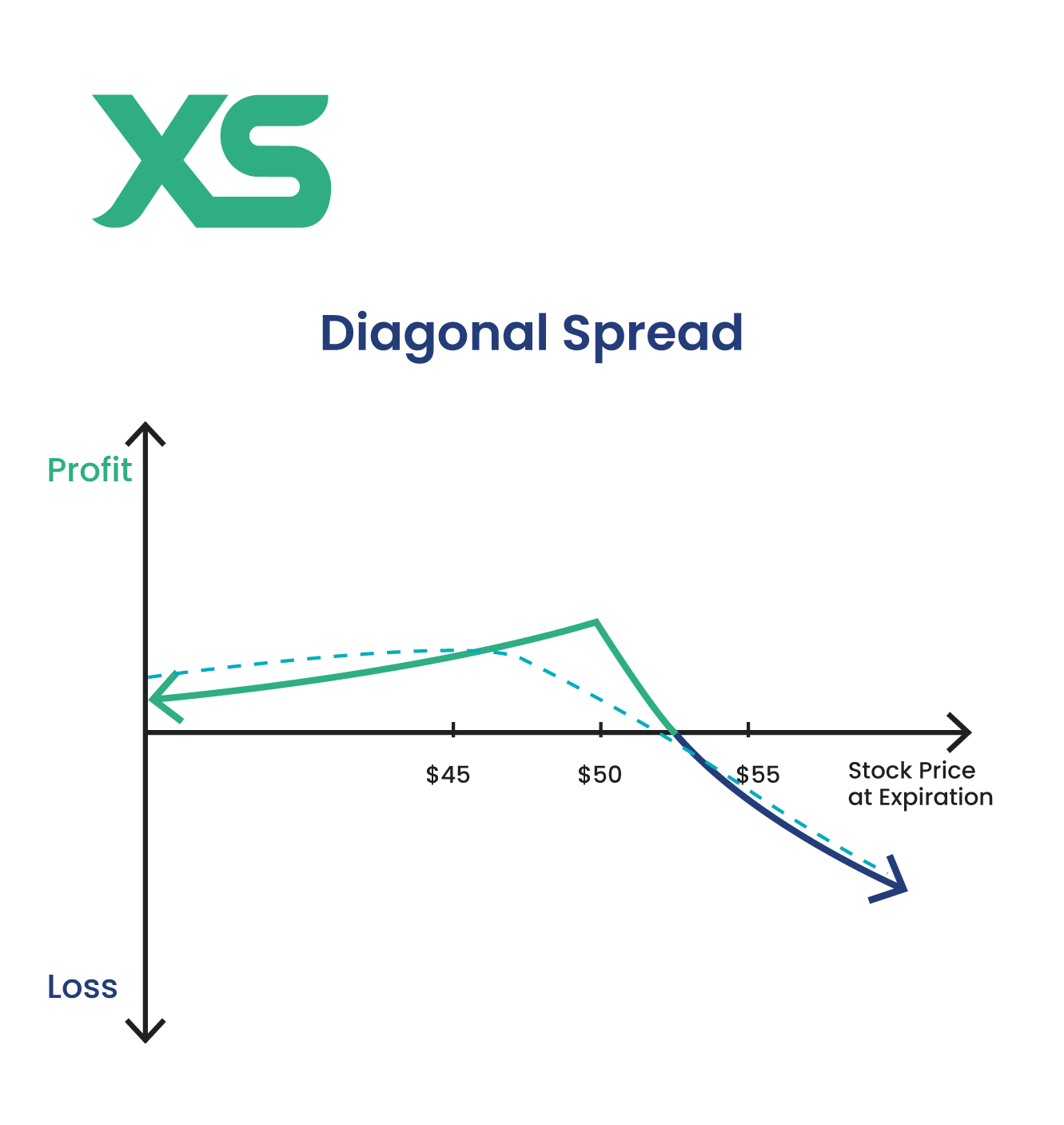

Diagonal Spread

A diagonal spread strategy combines a long-term and a short-term options position with different strike prices and expiration dates. Typically, you buy a longer-term option and sell a shorter-term option at a different strike price.

This strategy generates income from the short-term option while maintaining a longer-term outlook on the underlying asset, balancing income generation with potential capital appreciation.

For example, You buy a call option for Stock E with a strike price of $50 expiring in six months for a $5 premium. At the same time, you sell a call option with a strike price of $55 expiring in one month for a $2 premium.

If Stock E's price rises slowly, the short-term option may expire worthless, allowing you to collect the $2 premium, while the longer-term call retains its value.

This strategy benefits if the stock gradually appreciates, enabling you to sell additional short-term options while maintaining the longer-term position.

The Greeks Options Strategies Cheat Sheet for Traders

"The Greeks" in options trading are financial metrics that describe an option's price sensitivity to various factors.

These metrics are essential for understanding how options are expected to perform under different market conditions and are very useful for market analysis.

The main Greeks are Delta, Gamma, Theta, Vega, and Rho.

Delta

Delta measures the sensitivity of an option's price to changes in the underlying asset's price. It ranges from -1 to 1:

-

Call options have positive Delta values, indicating their prices increase when the underlying asset's price rises.

-

Put options have negative Delta values, indicating their prices increase when the underlying asset's price falls.

Gamma

Gamma measures Delta's rate of change with respect to changes in the underlying asset's price. It helps traders understand the stability of Delta:

-

High Gamma indicates that Delta could change rapidly, leading to more significant price swings.

-

Low Gamma suggests that Delta is more stable.

Theta

Theta measures the sensitivity of an option's price to the passage of time, also known as time decay. It is usually negative for both call and put options:

-

High Theta means the option's price is expected to decrease rapidly as expiration approaches.

-

Low Theta indicates slower time decay.

Vega

Vega measures the sensitivity of an option's price to changes in the volatility of the underlying asset:

-

High Vega means that the option's price is more sensitive to changes in volatility.

-

Low Vega indicates that the option's price is less affected by volatility changes.

Rho

Rho measures the sensitivity of an option's price to changes in interest rates:

-

Positive Rho for call options indicates that their prices increase when interest rates rise.

-

Negative Rho for put options indicates that their prices increase when interest rates fall.

Common Mistakes to Avoid in Options Trading

Now that you went through the breakdown of the option strategies cheat sheet, you must make sure to avoid these mistakes when trading.

-

Ignoring Implied Volatility (IV): Check IV before trading; buy when low, sell when high.

-

Mismanaging Time Decay (Theta): Monitor time decay effects, especially on short-term options.

-

Over-Leveraging Positions: Avoid excessive leverage; use defined-risk strategies.

-

Not Setting Stop-Loss Orders: Always set stop-losses to protect against unexpected moves.

-

Failing to Diversify Strategies: Use different strategies for varying market conditions.

-

Lack of a Clear Exit Plan: Define exit criteria before entering trades to avoid emotional decisions.

-

Overtrading or Chasing Losses: Stick to a disciplined trading plan and avoid impulsive decisions.

Ignoring the Greeks: Understand the Greeks to better manage risk and reward.

Option Strategies Cheat Sheet: Conclusion

Options trading offers various strategies to suit different market conditions and investment goals.

Understanding and applying these strategies can enhance your trading performance, manage risks effectively, and capitalize on market opportunities.

Use the options strategies cheat sheet to maximize profits and limit losses. Join XS to excel in your trading journey!

FAQs

1. What Is the Best Strategy for Options Trading?

The best strategy depends on your market outlook and risk tolerance. Covered calls might be ideal for conservative traders, while straddles or strangles could be more suitable for those expecting significant price movements.

2. What Is the Trick for Options Trading?

The key to successful option trading is understanding the underlying asset, market conditions, and how different strategies can help you achieve your financial goals while managing risk effectively.

3. What Is the 3 30 Formula?

The 3 30 formula suggests risking no more than 3% of your total capital on a single trade while aiming for a 30% return on your entire capital.

4. Is There Any No-Loss Option Strategy?

No strategy guarantees no loss, but some strategies, like protective puts, are designed to minimize potential losses by hedging your positions. Risk management and proper strategy selection are crucial to reducing losses in options trading.

5. How to Download the Option Strategies Cheat Sheet in HD?

To download the option strategies sheet infographic above, follow these steps:

-

Click on “Download Option Strategies Cheat Sheet” below the infographic. The image will open in a new window.

-

Right-click on the image.

-

Then click “save as image” in the drop-down menu. The image will be then downloaded.