Forex

Mirror Trading: How It Works, Benefits, and Risks

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 25 November 2024

Table of Contents

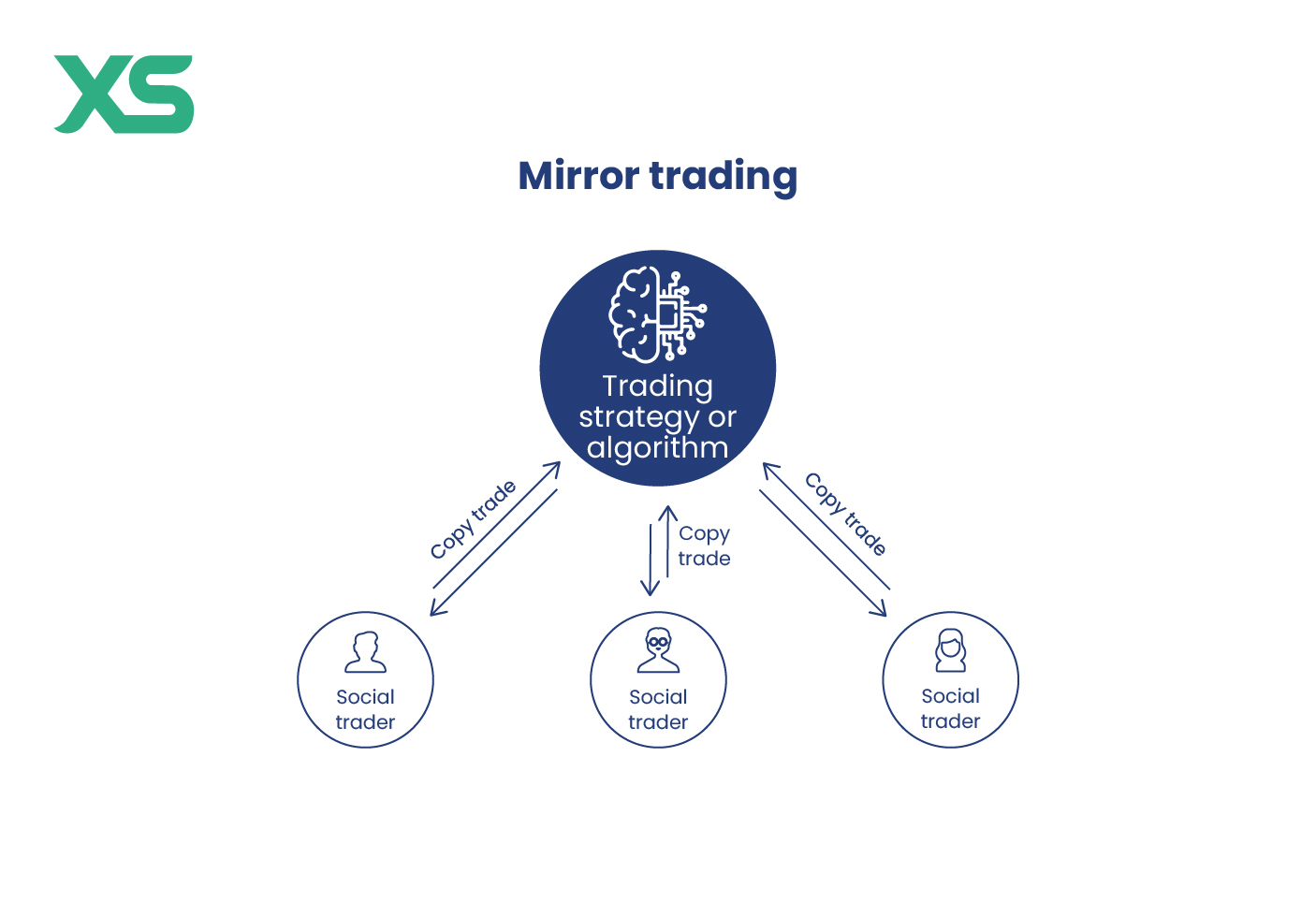

Mirror trading is a method of automated trading where an investor directly replicates or “mirrors” the trades of experienced and successful traders.

This investment approach allows beginners and those with limited time to participate in the financial markets without needing extensive trading knowledge.

In this article, we’ll break down how mirror trading works, discuss the benefits of mirror trading along with potential risks, and provide guidance on selecting the best mirror trading platforms for beginners.

Key Takeaways

-

Mirror trading is an automated investment method where an investor’s account directly copies the trades of a chosen, experienced trader.

-

Mirror trading offers advantages like time savings and access to expert strategies but also comes with risks, including dependence on the selected trader and potential platform fees.

-

Choosing the right platform is essential for successful mirror trading. Reliable platforms provide transparency, security, and detailed trader profiles to help investors make informed choices.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Is Mirror Trading?

Mirror trading is a type of investing where an investor’s account automatically copies the trades of experienced or skilled traders. This means that when the chosen expert trader buys or sells an asset, the same action is instantly done in the follower’s account.

For example, an investor selects a trader to follow based on their skills or performance record. After this setup, all trades made by that expert are mirrored or copied into the investor’s account.

This method allows people to participate in the markets without needing to study or manage trades themselves actively.

Mirror trading is widely used in markets like forex and cryptocurrency, where market knowledge and constant attention are often needed to make good decisions.

Mirror Trading vs. Copy Trading

While mirror trading and copy trading are similar, there are key differences. In mirror trading vs. copy trading, the main distinction lies in the level of control and customization:

-

Mirror Trading: With mirror trading, every trade the selected trader makes is automatically replicated without any manual intervention. It’s a fully automated process where users follow entire strategies instead of individual trades.

-

Copy Trading: In copy trading, users can have more control over individual trades. For instance, they may modify specific trades, set customized stop-loss limits, or adjust trade sizes based on personal preferences.

Mirror trading provides a hands-free experience, while copy trading offers some flexibility. Mirror trading might suit investors seeking complete automation, while copy trading could appeal to those who prefer more oversight.

How Mirror Trading Works

The first thing in mirror trading is selecting a platform that hosts a wide variety of skilled traders whose strategies can be reviewed. These platforms offer detailed profiles of each trader, including their trading history, performance metrics, and risk levels.

This information helps investors pick a trader who aligns with their investment goals and risk tolerance.

Once a trader is chosen, the investor’s account is set up to follow the selected trader’s actions automatically. This involves linking the investor’s account to the trader’s account through the platform, allowing all future trades made by the expert to be mirrored in real-time.

For example, if the trader buys a particular stock or currency, the same action is immediately executed in the follower’s account.

Automation plays a key role in mirror trading. Advanced algorithms on the platform ensure that all actions are copied precisely and immediately.

Benefits of Mirror Trading

The benefits of mirror trading make it an attractive choice for various types of investors. Here are some of the major advantages:

-

Accessibility for New Investors: Mirror trading enables beginners to trade in markets they might find complex, such as forex or cryptocurrency, by relying on the expertise of successful traders.

-

Time Efficiency: Since mirror trading is fully automated, it’s perfect for those who don’t have the time to research or monitor markets.

-

Access to Proven Strategies: By mirroring top-performing traders, users gain access to successful trading strategies and techniques they may not be familiar with, including popular forex mirror trading strategies.

-

Potential for Passive Income: Mirror trading provides a potential passive income stream, allowing investors to generate returns without active management.

Risks and Challenges of Mirror Trading

Although mirror trading offers attractive advantages, there are also risks and challenges. Here’s a closer look at some potential pitfalls:

-

Market Risks and Volatility: Since markets can be unpredictable, the performance of mirrored trades can fluctuate significantly. Market conditions may impact even the most skilled traders, leading to unexpected losses.

-

Dependence on Selected Trader: The success of mirror trading heavily relies on the chosen trader’s expertise. If the trader experiences a downturn, the same will be reflected in your account.

-

Lack of Personalization: Unlike traditional trading, where you can make adjustments, mirror trading does not allow customization of individual trades. This means you can’t manually intervene if you disagree with a specific trade.

-

Platform Reliability and Security: Selecting a reliable platform is essential, as technical failures can impact trade execution. Additionally, platforms with weak security may expose user accounts to risk.

-

Fee Structure: Platforms often charge a management or performance fee, which may reduce your net returns. Always understand the platform’s fee structure before investing.

Choosing the Right Mirror Trading Platform

Selecting the right platform is key to successful mirror trading. Here are some factors to consider:

-

User-Friendly Interface: Look for platforms that are easy to navigate, especially if you’re new to trading. Top platforms offer a clean, intuitive interface that guides users through each step.

-

Performance and Trader Data: Leading platforms provide historical performance metrics, risk levels, and strategy details for each trader. This transparency is crucial for making informed decisions.

-

Reliability and Security: Ensure the platform has strong security protocols.

-

Fee Transparency: Platforms can have varying fee structures, such as fixed monthly fees or performance-based charges. Make sure to understand these fees, as they can impact returns.

Some of the best mirror trading platforms for beginners offer demos or trial accounts, allowing new users to test the system before investing real funds.

Mirror Trading Strategies

Mirror trading offers various strategies that investors can use to match their financial goals and risk preferences.

These strategies are typically chosen based on the trader's trading style and expertise.

Trend-Following Strategy

In this method, traders identify the general direction or trend of the market, whether prices are moving up or down, and make trades to follow that trend.

By mirroring traders specializing in trend-following, investors can benefit from a strategy that performs well when markets are steadily rising or falling.

Scalping

Scalping is another popular strategy, especially among traders focusing on short-term gains.

This high-frequency approach involves making multiple small trades within a short period, capturing quick gains from minor price changes.

Scalping requires a highly active trader, but the automation of mirror trading ensures each quick trade is reflected in the follower’s account instantly.

Range-Bound Approach

This approach is best used when stable markets move within a limited price range. In this method, traders buy and sell assets based on expected highs and lows within a defined price range.

Mirroring traders who use range-bound strategies can help limit exposure to major market swings, as this method relies on price stability rather than significant upward or downward trends.

Algorithm-Based Strategies

Lastly, many mirror trading platforms offer algorithm-based strategies, where trades are guided by advanced algorithms designed to respond to market signals and indicators.

These algorithmic strategies are designed to adapt to changing conditions, often eliminating emotional decision-making and making trades more efficient.

For investors interested in forex or cryptocurrency mirror trading, algorithm-based strategies can provide a balanced and systematic approach that reacts to complex market signals in real-time.

Each mirror trading strategy offers distinct advantages and aligns with different market conditions. Choosing the right approach involves understanding personal risk tolerance and the targeted market, as each strategy can offer unique benefits based on the investor’s goals and market conditions.

Bottom Line

Mirror trading is an innovative approach that facilitates access to financial markets, allowing investors to replicate the strategies of experienced traders. By understanding how mirror trading works, the benefits of mirror trading, and potential risks, investors can make informed decisions.

The possibilities are broad, with many options in forex mirror trading strategies and mirror trading for cryptocurrency. However, success in mirror trading requires a strong understanding of the platforms, traders, and strategy involved.

Follow XS for more educational content!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

Mirror trading replicates a trader's entire strategy automatically, while copy trading allows more control, letting followers adjust individual trades if desired.

Yes, mirror trading is popular with beginners because it lets them follow skilled traders without needing advanced knowledge of the markets.

Yes, losses are possible, as mirrored trades are subject to market risks and depend on the performance of the chosen trader.

Check their past performance, risk levels, trading style, and consistency. Many platforms provide detailed profiles and metrics for each trader.

The minimum varies by platform but often starts around $100 to $500. It’s important to check each platform’s specific requirements.

Fees, such as management or performance fees, reduce overall returns. Choosing a platform with transparent fees helps in estimating net profits.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.