Forex

Max Pain Options: How to Optimize Your Trading Strategies

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 14 June 2024

Table of Contents

Max pain options refer to the price level where most options contracts expire worthless, causing the least financial loss to option writers.

Understanding this concept can be a game-changer for traders looking to anticipate market movements and optimize their strategies.

Key Takeaways

-

Max pain options help predict where stock prices might move as the options expiration date approaches, providing valuable insights for traders.

-

Use the max pain point to adjust positions and optimize entry and exit points, improving overall trading performance.

-

Combining max pain analysis with technical indicators like moving averages, RSI, and MACD enhances its reliability.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Are Max Pain Options?

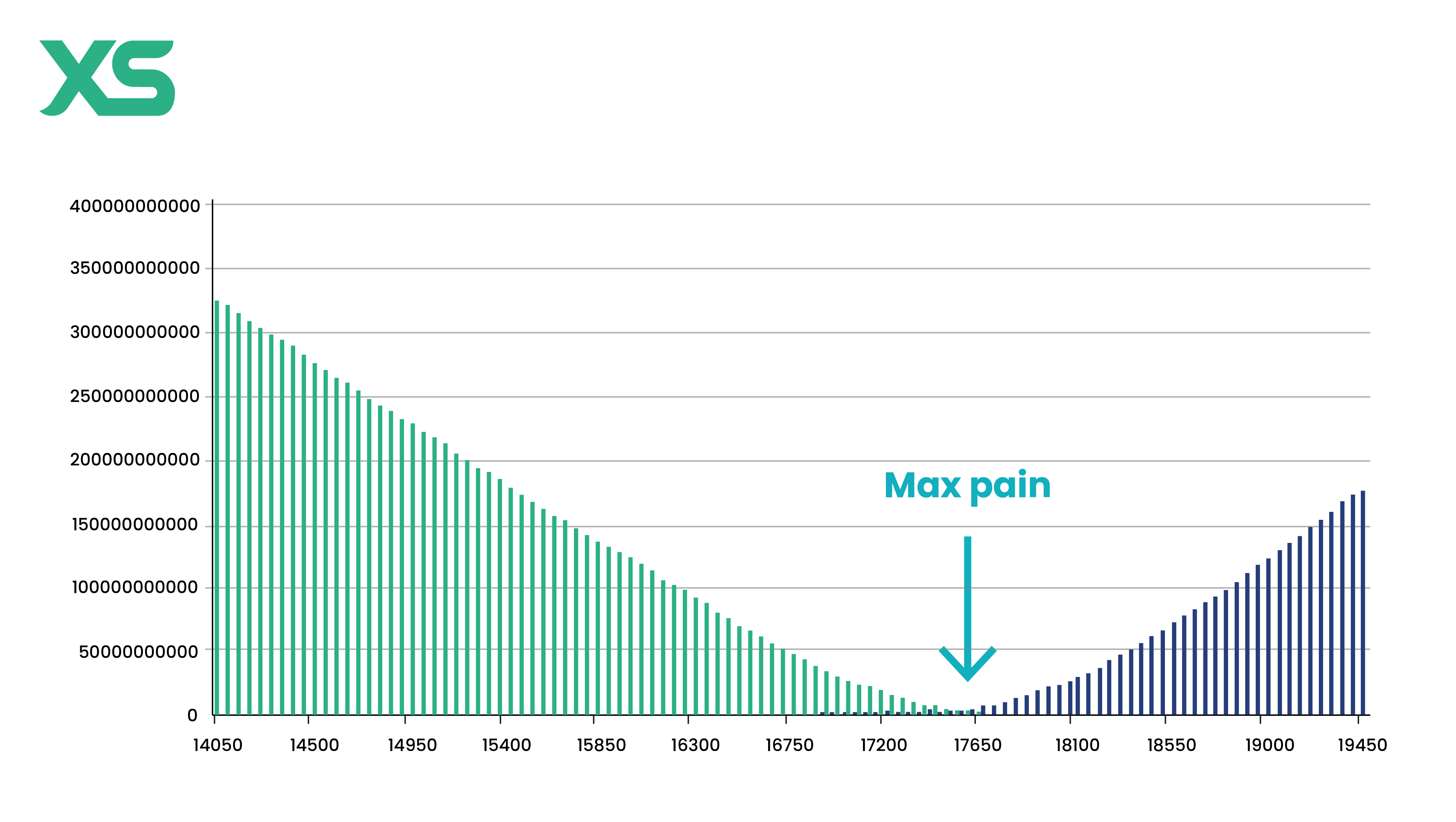

Max pain options refer to the concept of "max pain," a theory in options trading that describes the point at which options holders (both call and put options) experience the most financial loss.

Essentially, it’s the price level at which most option contracts expire worthless, resulting in the fewest payouts by option sellers.

This concept is handy for traders because it can help predict where the stock price might move as the options expiration date approaches.

By understanding what max pain is and how it operates within the context of the options market, traders can better anticipate potential price movements and adjust their positions accordingly.

How is Max Pain Calculated?

Max pain calculation involves determining the point at which the combined value of all open call and put options for a given stock is minimized. Here’s a step-by-step guide to calculating max pain:

-

List All Strike Prices: Identify all the strike prices for option contracts on a particular stock.

-

Calculate Payoffs: For each strike price, calculate the payoff for both calls and put options if the stock price expires at that strike price.

-

Sum the Payoffs: Add the total payoffs for calls and puts at each strike price.

-

Identify Max Pain Point: The max pain point is the strike price where the total payoff to options holders is the lowest.

Example Calculation:

-

Assume a stock has strike prices at $50, $55, and $60.

-

Calculate the total value of the call and put options at each strike price.

-

Sum these values to find where the total loss is maximized for options holders.

Why is Max Pain Important for Options Traders?

Understanding max pain is crucial for options traders because it can influence market behavior and help strategize trades effectively.

Impact of Max Pain on Options Pricing

The max pain theory suggests that as the expiration date for options approaches, the stock price tends to move toward the max pain point.

This happens because option sellers (often big financial institutions) might try to nudge the stock price toward this level to minimize their payouts.

This push can affect the pricing of options, making it a crucial factor to consider when planning your trades.

How Max Pain Influences Market Behavior

Max pain can have a significant impact on market behavior, especially as the options expiration date gets closer.

As the price gravitates toward the max pain point, you might notice increased volatility and trading volume. This is because traders are adjusting their positions to either mitigate losses or maximize gains.

And therefore, by keeping an eye on max pain, you can better anticipate these market movements.

Max Pain Theory: How It Affects Options Trading Strategies

The max pain theory can be a powerful tool for shaping your options trading strategies.

Predicting Price Movements

One of the main benefits of the max pain theory is its ability to help predict price movements as the options expiration date approaches.

The idea is that the stock price tends toward the max pain point, where the largest number of options expire worthless. Knowing where this point is, you can anticipate potential price changes and plan your trades accordingly.

Adjusting Positions

The max pain point isn’t just a passive observation; it’s a tool you can actively use to adjust your positions. If the max pain point suggests a potential price drop, you might consider closing out some of your bullish positions or even taking a bearish stance.

Conversely, if the max pain point is above the current price, you might look for opportunities to buy in anticipation of a rise.

Optimizing Entry and Exit Points

Knowing the max pain point can also help you optimize your entry and exit points for trades.

For instance, if you’re looking to enter a trade, doing so when the stock price is near the max pain point might give you a better entry price, as there’s potential for a rebound.

Similarly, planning your exit around the max pain point can help you maximize your profits or minimize your losses.

Incorporating Max Pain into a Broader Strategy

While the max pain theory is useful, it works best when combined with other trading strategies and indicators.

For example, you can use moving averages, RSI, or MACD in conjunction with the max pain point to confirm trends and make more informed decisions.

Identifying Optimal Trading Points Using Max Pain

Identifying optimal trading points using max pain involves:

-

Monitoring Strike Prices: Keep an eye on the strike prices with the highest open interest.

-

Observing Price Movements: Watch how the stock price moves as it approaches the options expiration date.

-

Adjusting Trades Accordingly: Use the max pain point as a guide to enter or exit trades, ensuring you capitalize on the price movements.

Identifying optimal trading points using max pain involves closely monitoring the maximum pain level as the expiration date approaches.

By understanding how the stock price tends to gravitate toward the max pain point, you can strategically time your entries and exits to capitalize on potential price movements, maximizing profits and minimizing risks.

Max Pain in Different Market Conditions

Max pain behaves differently under various market conditions:

-

Bullish Markets: In bullish markets, the stock price might still gravitate toward the max pain point but could settle higher due to strong upward momentum.

-

Bearish Markets: In bearish markets, the price may drop towards the max pain point or even lower, influenced by the overall negative sentiment.

-

Sideways Markets: In sideways markets, the price often stays close to the max pain point, as there’s no strong directional bias.

Combining Max Pain with Other Indicators

Combining your max pain analysis with other technical indicators can make it even more reliable.

For example, moving averages can help you confirm trends and spot potential reversals.

The Relative Strength Index (RSI) identifies overbought or oversold conditions, giving you a clearer picture of market sentiment.

The Moving Average Convergence Divergence (MACD) indicator can show momentum and potential buy/sell signals.

By mixing these indicators with the max pain point, you can create a more well-rounded and informed trading strategy.

How to Use Max Pain in Your Trading Strategy

Understanding max pain is one thing, but effectively integrating it into your trading strategy requires a nuanced approach. Here’s how you can leverage max pain in options to optimize your trades:

-

Determine Key Levels:

-

Start by identifying the max pain point using available tools like a max pain calculator. This helps you pinpoint the strike price where options holders might incur the maximum financial loss.

-

-

Monitor Open Interest:

-

Track the open interest at various strike prices to understand where large volumes of options contracts exist. These levels often correspond to maximum pain levels that might influence price movement.

-

-

Combine with Volatility Indicators:

-

Use volatility indicators like the Implied Volatility (IV) and Historical Volatility (HV) alongside max pain theory to gauge potential price swings. This combination can signal whether prices are likely to stay near the max pain level or deviate significantly.

-

-

Adjust Based on Market Sentiment:

-

Evaluate market sentiment to decide if max pain will hold or if external factors might push the price away from this point. For instance, strong bullish sentiment might override the gravitational pull towards max pain.

-

Advanced Techniques: Using Max Pain with Options Greeks

For more advanced traders, combining max pain with Options Greeks—Delta, Gamma, Theta, and Vega—can enhance the precision of their trading strategies:

-

Delta Neutral Strategies:

-

Consider using Delta-neutral strategies around the max pain level. These strategies can help you hedge against significant price movements, ensuring your portfolio remains balanced regardless of the market's direction.

-

-

Gamma Scalping:

-

Use Gamma scalping techniques to adjust your positions as the stock price approaches the max pain point. This can help capitalize on small price movements and reduce risk.

-

-

Theta Decay Management:

-

As expiration nears, Theta decay accelerates, particularly around the maximum pain point. Traders can use this to their advantage by adjusting positions to benefit from time decay.

-

-

Vega and Volatility Trading:

-

When volatility is high, Vega plays a crucial role. Analyze how volatility changes as the stock price moves toward the max pain point and adjust your positions accordingly.

-

Common Misconceptions About Max Pain

-

Max pain is not a guarantee that the stock price will hit the max pain point, it’s a tendency observed in the market.

-

Relying solely on max pain without considering other indicators and market conditions can lead to inaccurate predictions.

-

Market conditions change, and so should trading strategies. Max pain should be part of a flexible trading approach.

Conclusion

In conclusion, understanding and utilizing max pain options can significantly enhance your trading strategy. By grasping the concept of max pain, learning how it’s calculated, and recognizing its impact on options pricing and market behavior, traders can better anticipate market movements and optimize their trades.

Follow XS for more educational content!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

Max pain in the options chain refers to the price level at which most options contracts will expire worthless, causing the least financial loss to option writers. It's a key point that traders watch to predict potential price movements.

The maximum pain point in options is the price at which the combined value of all open call and put options is minimized. This is where most options expire worthless, reducing payouts for sellers.

No, stocks do not always go to the max pain point. While there's a tendency for prices to gravitate towards this level near expiration, other market factors can influence the final price.

Max pain is generally more reliable for options with high open interest and volume. However, it may be less effective for illiquid options or those with low open interest, where other factors, such as market sentiment and fundamental analysis, play a more critical role.

The max pain for Bitcoin options is the price level at which most Bitcoin options contracts would expire worthless. This concept applies similarly to Bitcoin as it does to traditional stocks.

Calculating max pain involves determining the strike price at which the combined value of all open call and put options is minimized. Various online tools, known as max pain calculators, can simplify this process by automatically analyzing the open interest and payouts for each strike price.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.