Forex

Inside Bar Trading Strategy: Entry and Exit Tips

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 4 November 2024

Table of Contents

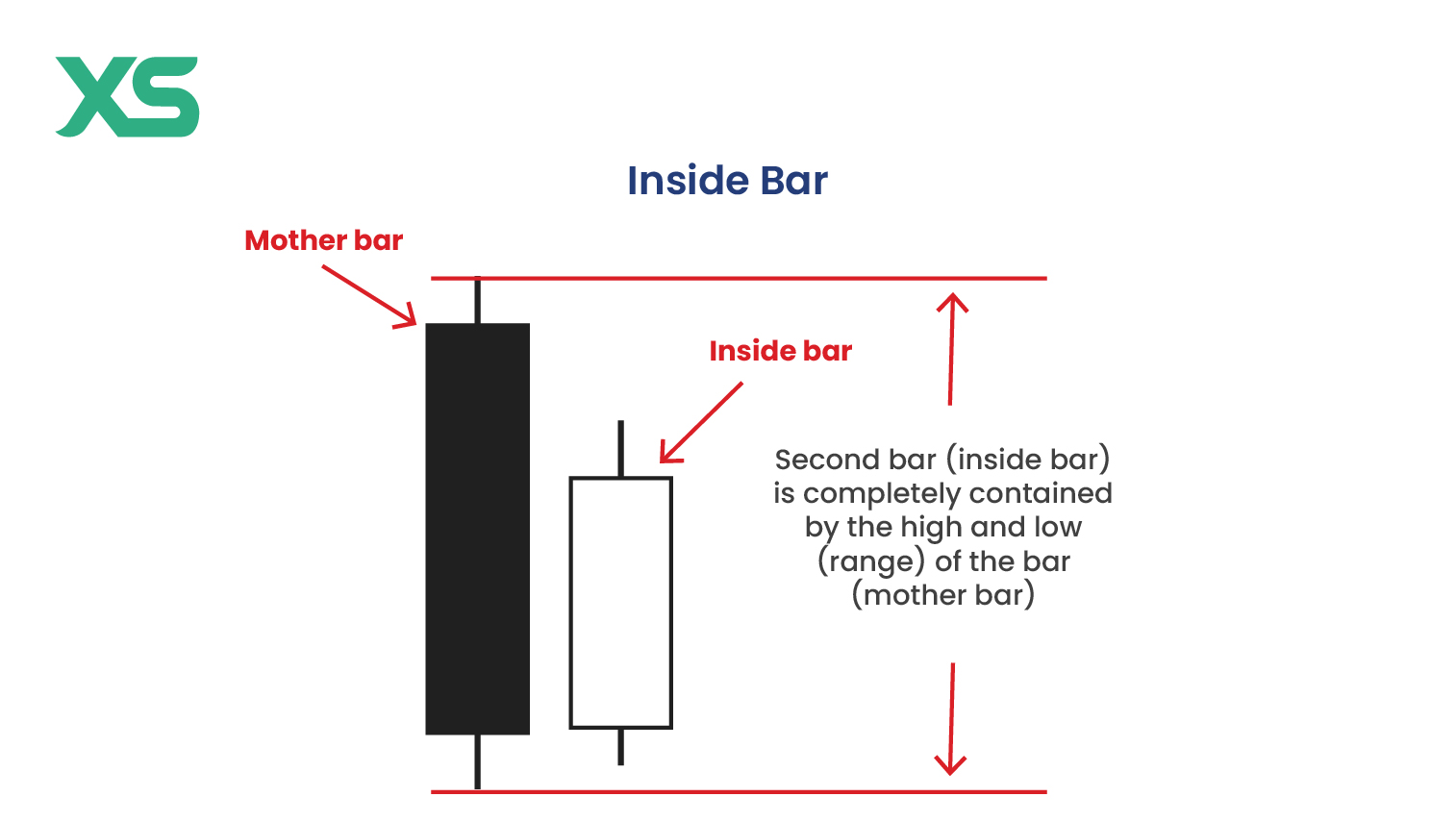

An Inside Bar pattern is a type of candlestick formation where the current bar is entirely within the previous bar's range, signaling a pause in market movement and a potential breakout.

This article will walk you through understanding, identifying, and trading Inside Bars, focusing on entry and exit strategies to enhance your trading success!

Key Takeaways

-

An Inside Bar pattern features a smaller candle within the range of a previous larger "Mother Bar," signaling market consolidation and often leading to a breakout in the direction of the trend.

-

Ideal entry points are set above or below the Inside Bar to capture potential breakouts, while exits are managed with take-profits and trailing stops to secure gains.

-

Inside Bars are most effective in trending markets and on higher time frames, such as daily or 4-hour charts, reducing the likelihood of false breakouts.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What is an Inside Bar Pattern?

An Inside Bar pattern consists of two candles or bars. The first is the "Mother Bar," which has a high and low that completely engulfs the second candle, called the "Inside Bar."

This pattern signifies a consolidation phase where the market takes a "pause," often leading to a breakout once the price breaks above or below the Inside Bar.

Inside Bars are widely used in technical analysis due to their simplicity and potential to catch strong price movements. They can be found in various time frames but are more reliable in higher ones like the daily chart.

Key Components of an Inside Bar Setup

Understanding the components of an Inside Bar setup is essential for identifying high-quality trades.

Structure: Mother Bar and Inside Bar

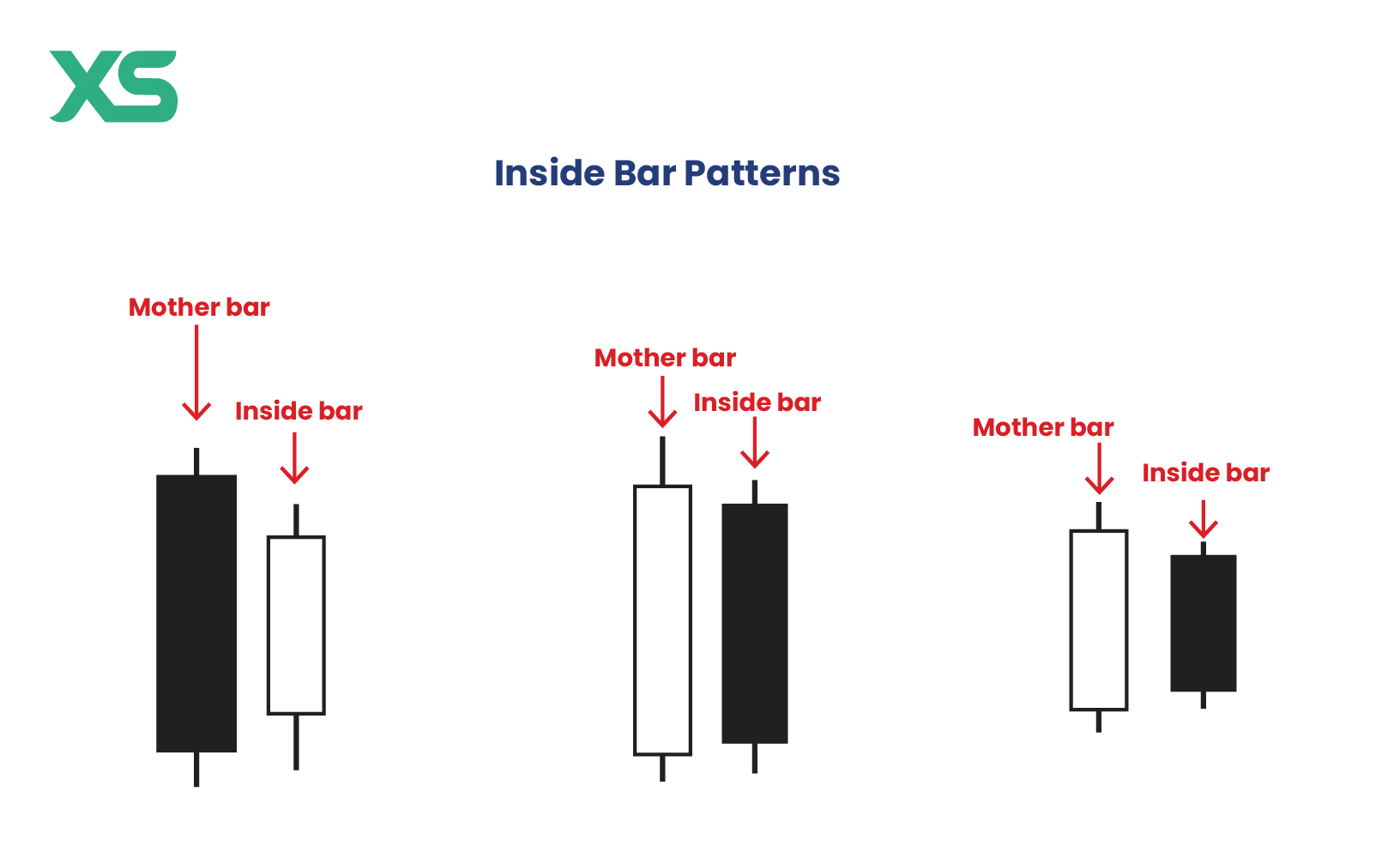

An Inside Bar pattern is defined by two specific candles: the Mother Bar and the Inside Bar.

-

Mother Bar: This is the setup's first candle, representing a larger price range. The high and low of the Mother Bar set the boundaries within which the Inside Bar forms.

-

Inside Bar: The second candle or bar appears within the high and low of the Mother Bar. It reflects market hesitation and reduced volatility, suggesting that traders are waiting for a breakout before committing to a direction.

A trend continuation is likely if the breakout aligns with the current trend, while a reversal may occur if the breakout moves against it.

Rules to Identify a Valid Inside Bar Pattern

Not all Inside Bars signal potential trades. Here are key rules to identify a valid Inside Bar pattern:

-

Complete Containment: The Inside Bar must fall within the high and low of the Mother Bar. It’s no longer a valid Inside Bar if it closes outside this range.

-

Strong Trend: Inside Bars tend to be more reliable when the market is in a strong upward or downward trend.

-

Lower Volatility: The Inside Bar typically has a smaller range, indicating reduced volatility. Look for quiet, narrow Inside Bars for optimal setups.

-

Avoid Clusters: Avoid multiple Inside Bars clustered together. The first Inside Bar following a strong Mother Bar is often the most effective.

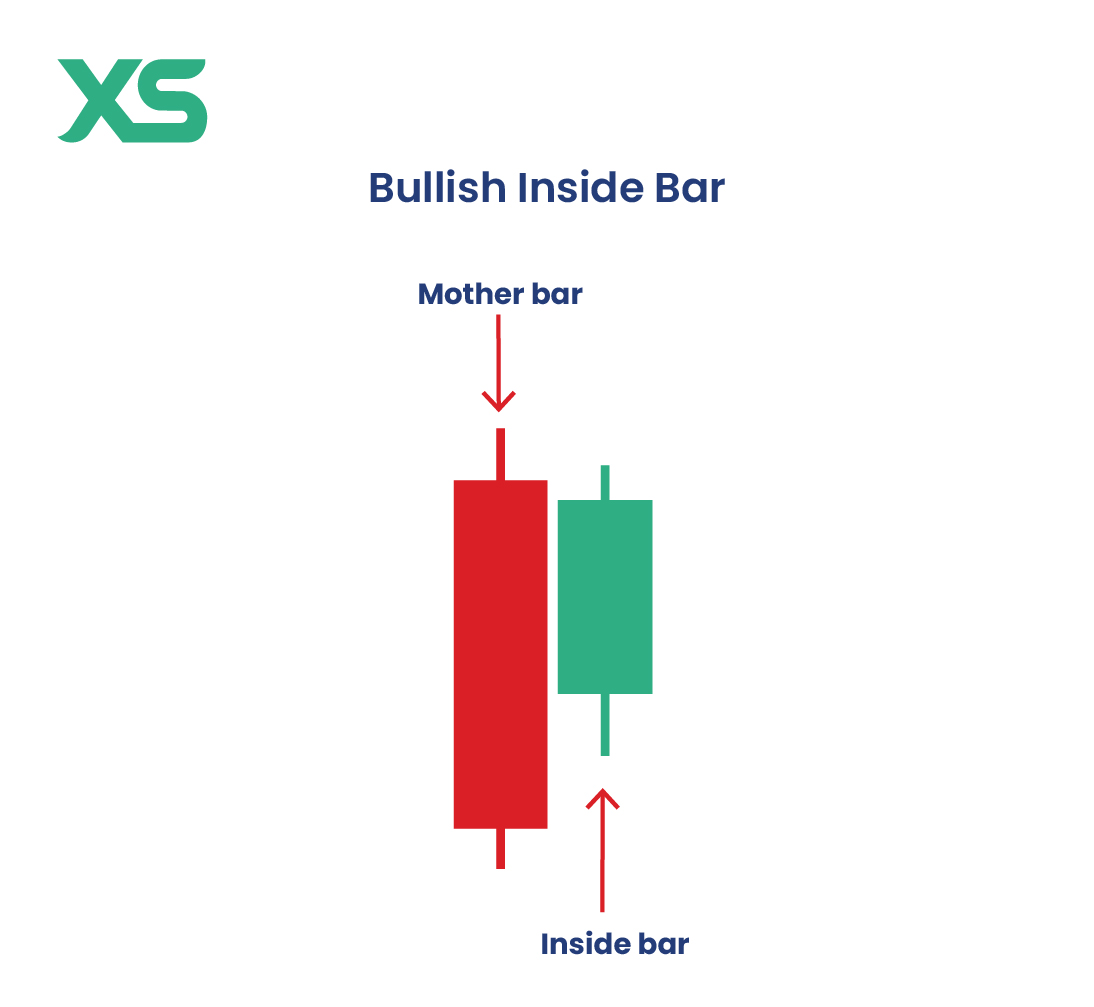

Bullish Inside Bar

A Bullish Inside Bar can be found within an uptrend, signaling a temporary pause or consolidation in price before a potential breakout in the same direction.

When the price breaks above the high of the Inside Bar, it suggests that buyers are regaining control, often resulting in a continuation of the upward trend.

Traders see this as a bullish signal, positioning it as an entry point to capture further upward movement.

Bullish Inside Bars are most effective when they appear after a retracement or consolidation within a strong uptrend.

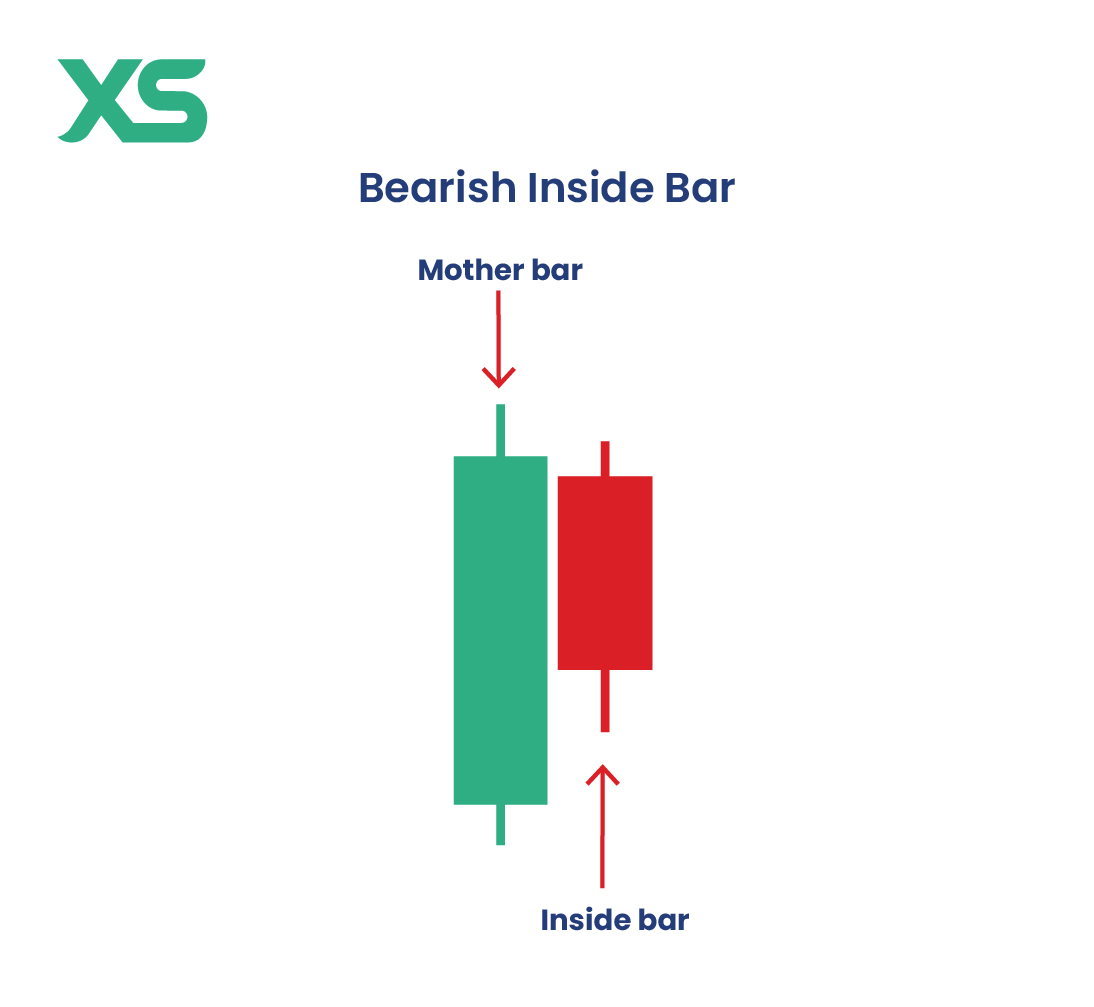

Bearish Inside Bar

A Bearish Inside Bar appears within a downtrend, indicating a momentary consolidation or pause before a potential continuation of the downward movement.

If the price breaks below the low of the Inside Bar, it signals that sellers are regaining control, making it likely for the downtrend to continue.

Traders often use Bearish Inside Bars as entry points for short trades, especially if they appear after a retracement or consolidation in a strong downtrend, as they can provide opportunities to capture additional downside movement.

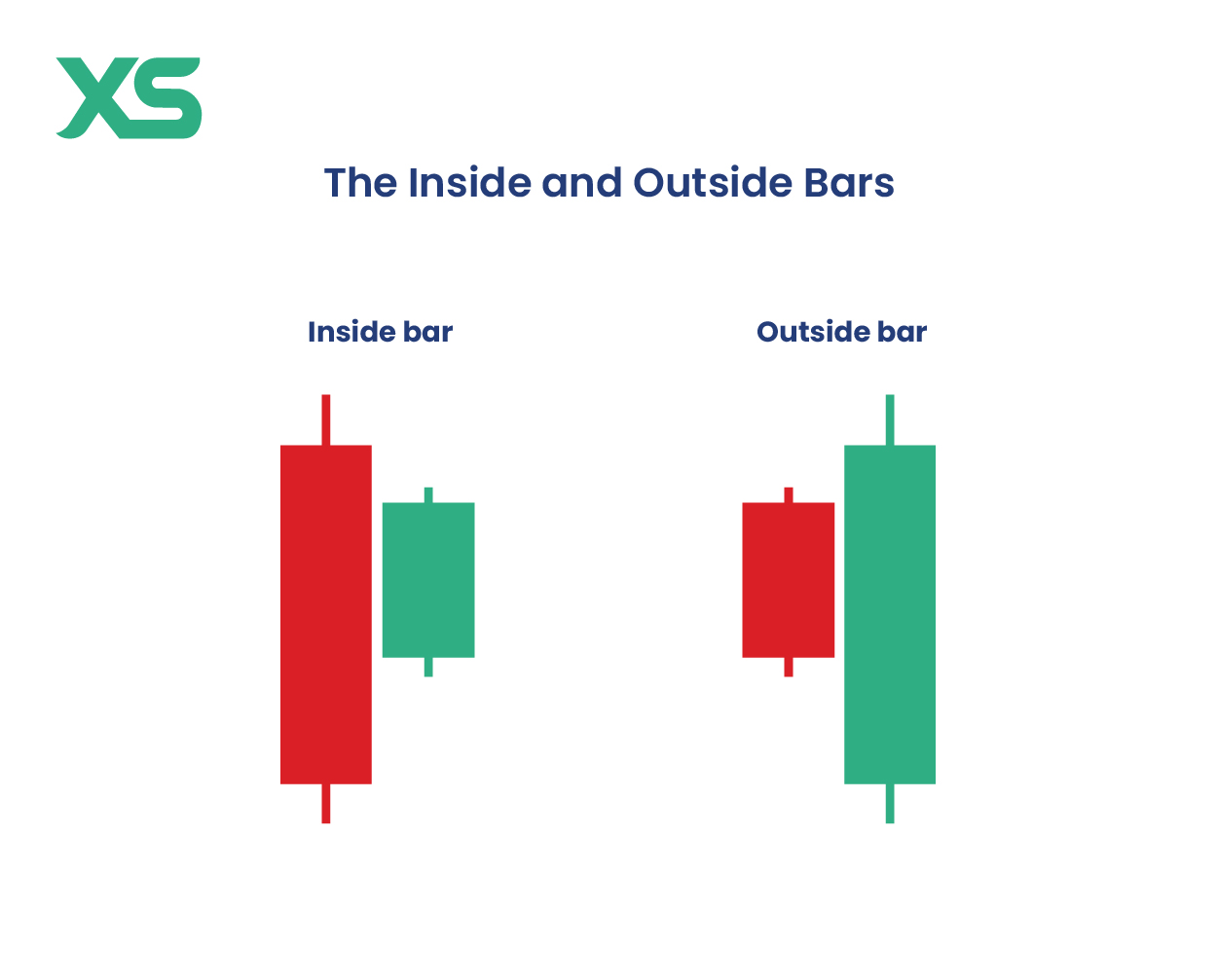

Inside Bar vs. Outside Bar

An Outside Bar is the opposite of an Inside Bar. Unlike the Inside Bar, where the second candle is within the range of the first, an Outside Bar occurs when the second candle has a higher high and a lower low than the previous bar.

It signals an expansion of volatility rather than consolidation and can indicate strong buying or selling pressure.

-

Inside Bar: Represents consolidation, often indicating a potential breakout in the direction of the main trend.

-

Outside Bar: Indicates a reversal or a continuation of high volatility, often leading to quick market moves.

For traders, choosing between trading Inside Bars and Outside Bars depends on the preferred market conditions. Inside Bars suit traders who are looking for breakout setups, while Outside Bars can be beneficial for reversal trades.

Differences Between Inside Bar and Engulfing Bar

A common question is understanding the differences between Inside Bar and Engulfing Bar patterns, as both involve two candles.

-

Inside Bar: The Inside Bar falls within the high and low of the Mother Bar, signaling consolidation.

-

Engulfing Bar: This pattern involves the second candle completely engulfing the first, closing higher in a bullish engulfing or lower in a bearish engulfing. It signals strong buying or selling momentum.

While Inside Bars suggest potential breakouts, Engulfing Bars hint at momentum shifts, making Engulfing Bars more suitable for reversal signals, and Inside Bars ideal for breakout strategies.

How to Trade Inside Bars

Trading Inside Bars can be highly profitable if executed with a proper entry and exit strategy.

Inside Bar Entry Points

Inside Bar entry points are critical for maximizing profits while managing risk. Here’s how to identify and approach entry setups:

-

Breakout Entry: A classic method for trading Inside Bars is to set a stop order slightly above or below the Inside Bar. If the price breaks out above the high, enter a long position; if it breaks below the low, consider a short position.

-

Limit Orders: For traders who prefer counter-trend entries, placing a limit order to enter at the high or low of the Inside Bar after a breakout can offer a better entry price.

-

Confluence Factors: For stronger entries, combine the Inside Bar with other indicators like moving averages, support/resistance levels, or trend lines. Using these tools can confirm the breakout’s reliability and add confidence to the trade.

Exit Strategies for Inside Bar Trades

Knowing when to exit is just as important as finding a good entry.

-

Take Profit at Set Levels: Set a take-profit order at a level that provides a favorable risk-to-reward ratio, typically 1:2 or 1:3.

-

Trail Your Stop: Moving the stop loss with the trend can help secure profits. For instance, if the market moves in your favor, adjust the stop loss below the Inside Bar’s low (for long trades) or above its high (for short trades).

-

Reversal Signals: Pay attention to reversal signals or other candlestick patterns that may indicate the end of the trend. For example, a bearish engulfing pattern after a bullish Inside Bar breakout could indicate a potential reversal.

Common Mistakes to Avoid in Inside Bar Trading

Even experienced traders can fall into common pitfalls when trading Inside Bars. Here are some key mistakes to watch out for:

-

Ignoring the Market Trend: Inside Bars work best in strong trends. Avoid trading them in choppy, sideways markets, as breakouts are less reliable.

-

Trading Too Many Inside Bars: Not all Inside Bars are high-quality signals. Prioritize setups that appear after a strong trend or pullback, and avoid clusters of Inside Bars, as they tend to indicate indecision.

-

Entering Too Early: Wait for a clear breakout above or below the Inside Bar before entering. Entering before a breakout confirmation can lead to losses if the price reverses.

-

Setting Stop Losses Too Tight: Placing a stop loss right at the Mother Bar or Inside Bar can result in premature exits due to minor market fluctuations. Allow some breathing room below or above the pattern.

-

Overlooking Confluence: For stronger trades, combine Inside Bars with other indicators, like moving averages or support/resistance, to confirm breakout reliability.

Conclusion

By learning how to trade Inside Bars and recognizing their structure, traders can improve accuracy in predicting price movements and managing risk. Remember, successful trading with Inside Bars relies on carefully identifying Inside Bar patterns, understanding market conditions, and applying a well-structured exit plan.

Follow XS for more educational content!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

Daily and 4-hour charts are the most reliable for trading Inside Bars, as they reduce noise and offer stronger signals. However, day traders can use lower time frames, but these may produce more false signals.

Inside Bar patterns are reliable in strong trending markets and higher time frames. In consolidating markets, however, they may lead to more false signals.

Yes, Inside Bars can be used in day trading, especially on 1-hour or 15-minute charts, though they may be more prone to false signals than on higher time frames.

To avoid false breakouts, combine Inside Bars with trend indicators like moving averages or support and resistance levels. Higher time frames also help reduce false signals.

Leverage can amplify profits with Inside Bar strategies, but it also increases risk. It's best to use low leverage until you gain experience with this strategy.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.