Forex

Double Bottom Pattern: Identification, Significance, and Tips

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 27 November 2024

Table of Contents

A Double Bottom pattern is a chart pattern used in technical analysis to indicate a potential reversal in the price of an asset.

This pattern is widely recognized and utilized by traders to predict bullish reversals.

This article will discuss the Double Bottom candlestick pattern's definition, formation, and structure, compare it with similar patterns, and discuss its implications.

Key Takeaways

-

The double bottom chart pattern is a bullish reversal pattern that forms after a downtrend, signaling a potential upward trend in the asset's price.

-

It consists of two distinct bottoms with a peak (neckline) in between and is confirmed when the price breaks above the neckline.

-

Effective trading strategies using the double bottom pattern include entering long positions upon breakout, setting stop-loss orders below the second bottom, and using additional technical indicators.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Is a Double Bottom Pattern?

The double bottom pattern is a bullish reversal pattern that forms after a downtrend.

It resembles the letter "W" and indicates that the asset's price has hit a low point twice, with a moderate peak in between.

This pattern signals that the asset may be preparing for an upward trend, making it a crucial indicator for traders looking to identify potential buying opportunities.

Each bottom represents a strong support level, showing that the asset's price struggles to fall further.

The breakout above the double bottom neckline confirms the pattern and suggests the start of a new bullish trend.

Double Bottom Pattern Formation

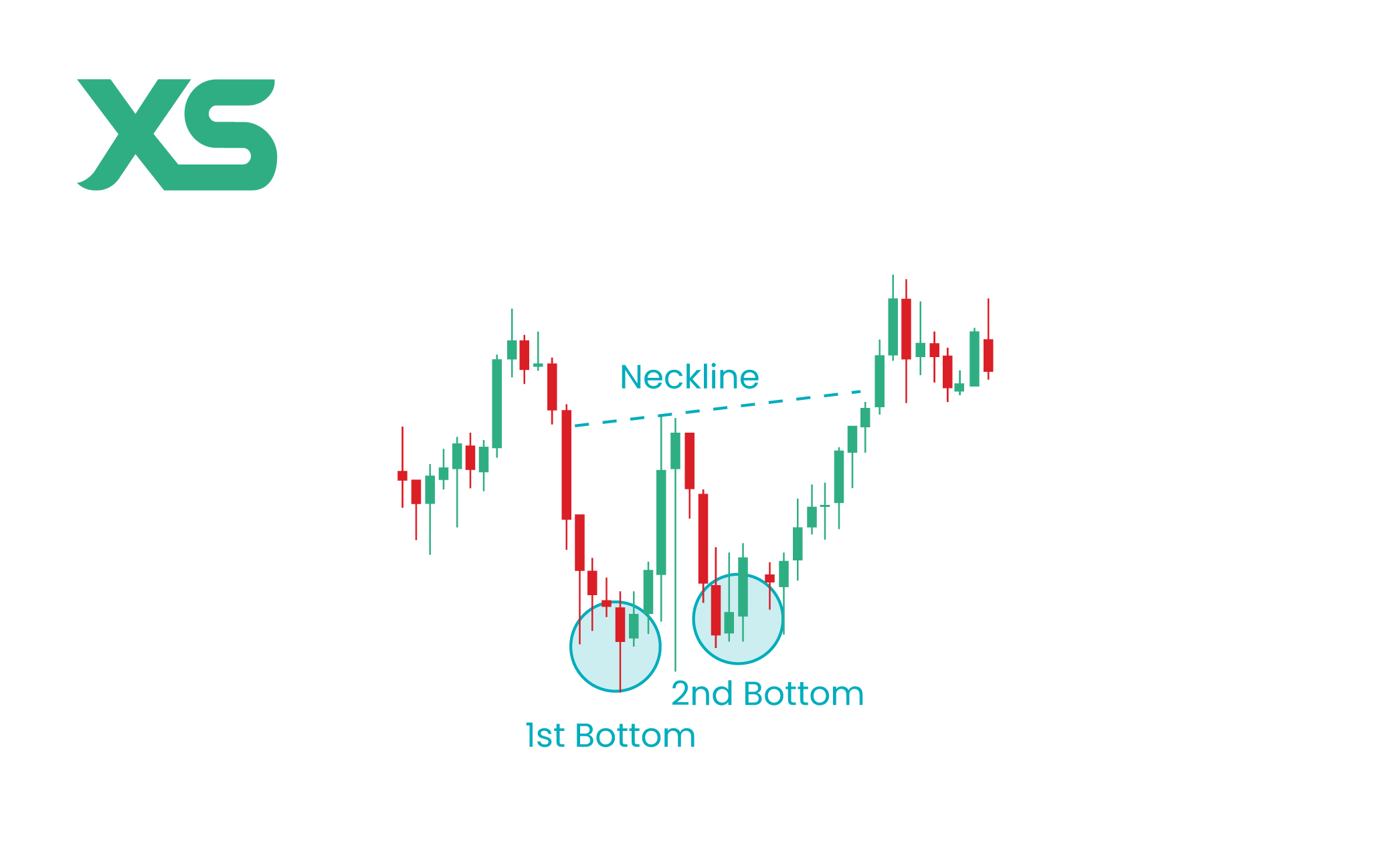

The formation of a double bottom candlestick pattern occurs in three main phases.

Initially, the price descends to a new low, creating the first bottom.

Following this, the price rebounds to form a peak called the neckline.

The final phase involves the price declining once more to approximately the same level as the first bottom, creating the second bottom.

Double Bottom Pattern Structure

Here’s a more in-depth look at how the Double Bottom pattern is structured:

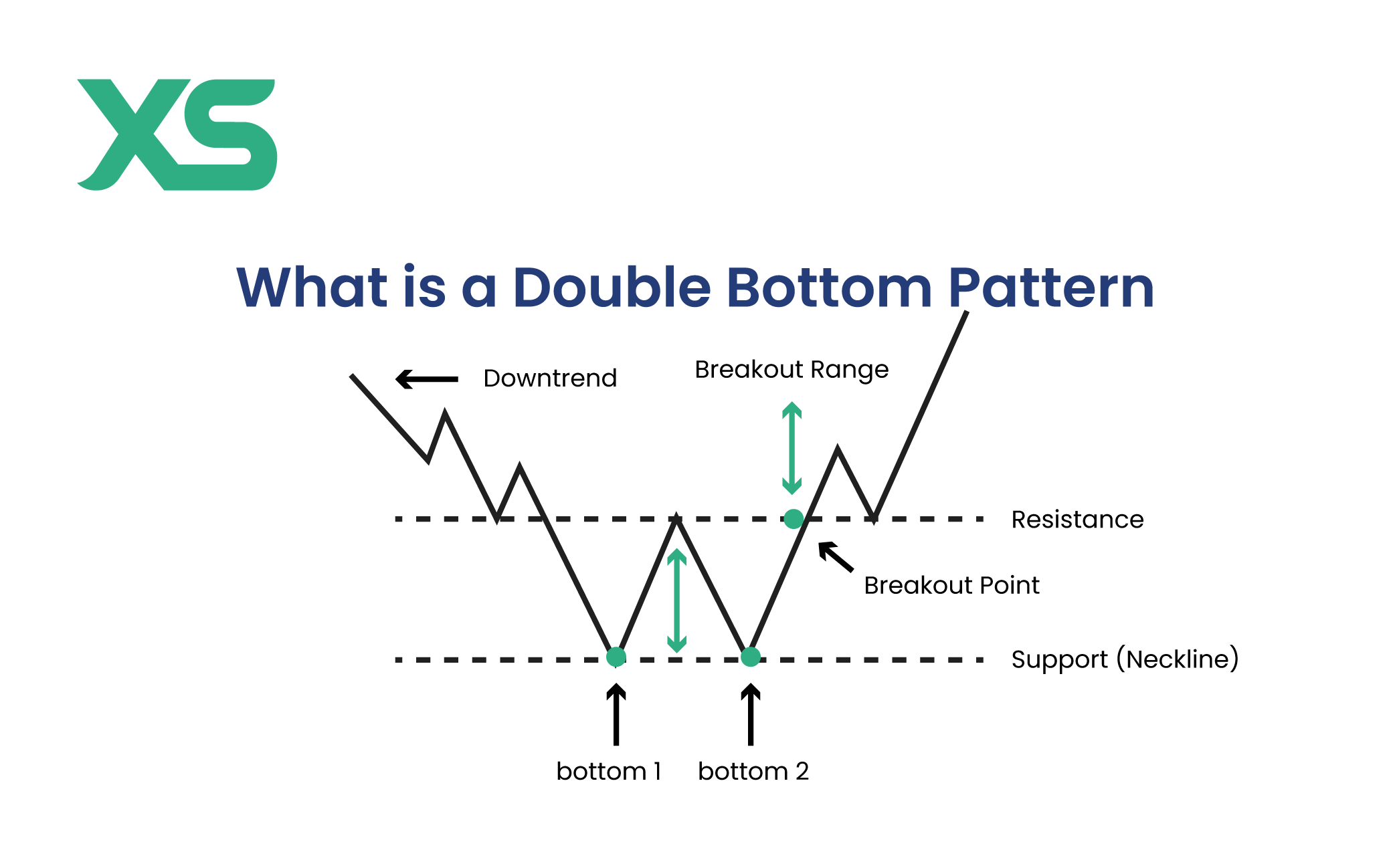

Downtrend

-

The pattern begins after a significant downward price movement, indicating a bearish market sentiment.

-

This initial decline sets the stage for the formation of the double bottom pattern.

First Bottom

-

The price hits a low point, forming the first bottom, which suggests a strong support level.

-

Traders observe this level to gauge potential buying opportunities if the price rebounds.

Neckline

-

The price rebounds from the first bottom to a peak, known as the double bottom neckline, acting as a temporary resistance level.

-

This peak represents a recovery attempt that fails to continue, leading to another price decline.

Second Bottom

-

The price falls again, forming the second bottom at a similar level to the first bottom, reaffirming the support level.

-

This second bottom indicates that the price is struggling to fall further, suggesting the potential for a reversal.

Breakout Point

-

The pattern is confirmed when the price breaks above the neckline, indicating a potential bullish reversal.

-

This breakout point signals increased buying pressure and a shift in market sentiment from bearish to bullish.

Resistance

-

The neckline serves as a resistance level that, once broken, signals the start of an upward trend.

-

Overcoming this resistance strongly indicates that the previous downtrend has ended, and a new upward trend may begin.

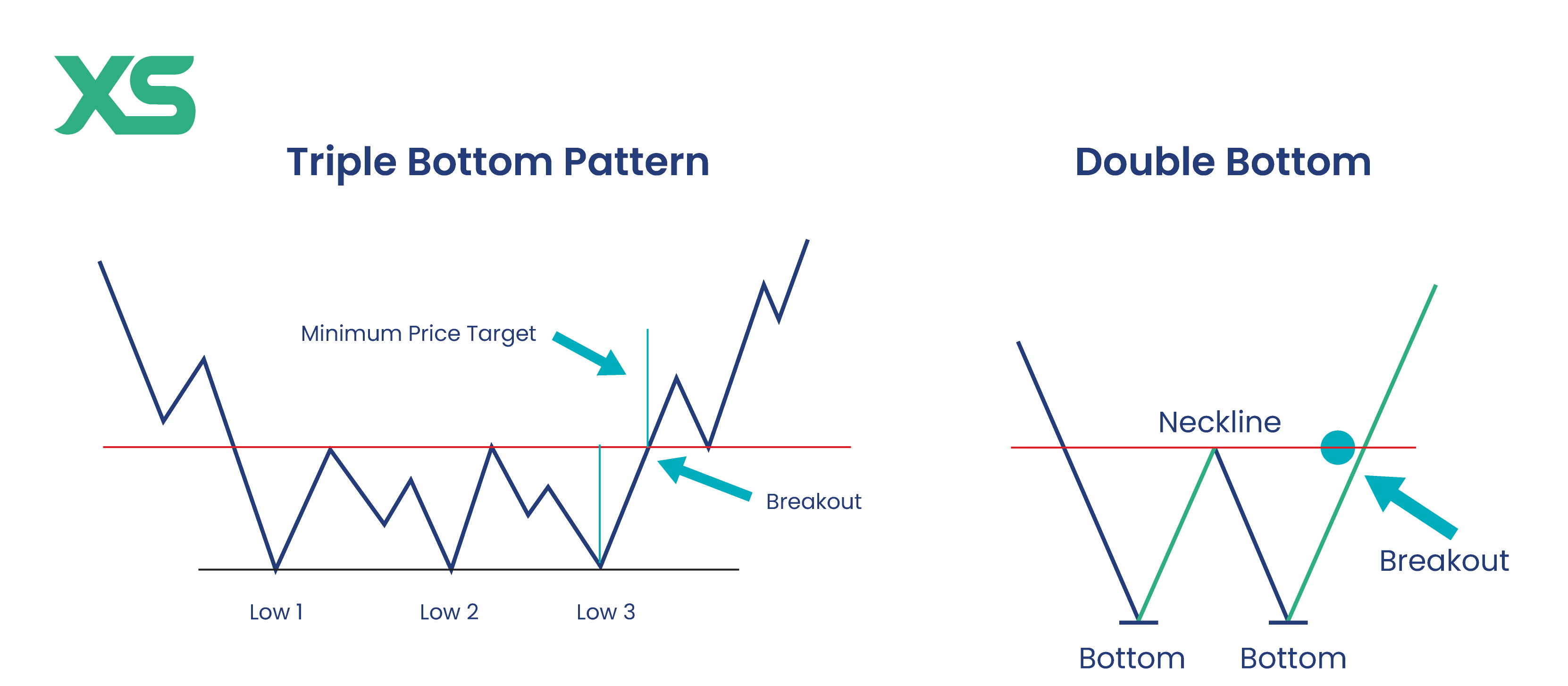

Double Bottom Pattern vs. Triple Bottom Pattern

While both the Double Bottom and Triple Bottom patterns signal a potential bullish reversal, the triple bottom pattern includes three distinct bottoms instead of two.

The triple bottom pattern tends to be stronger and more reliable due to the additional confirmation provided by the third bottom.

However, both patterns serve as useful indicators for spotting potential buying opportunities.

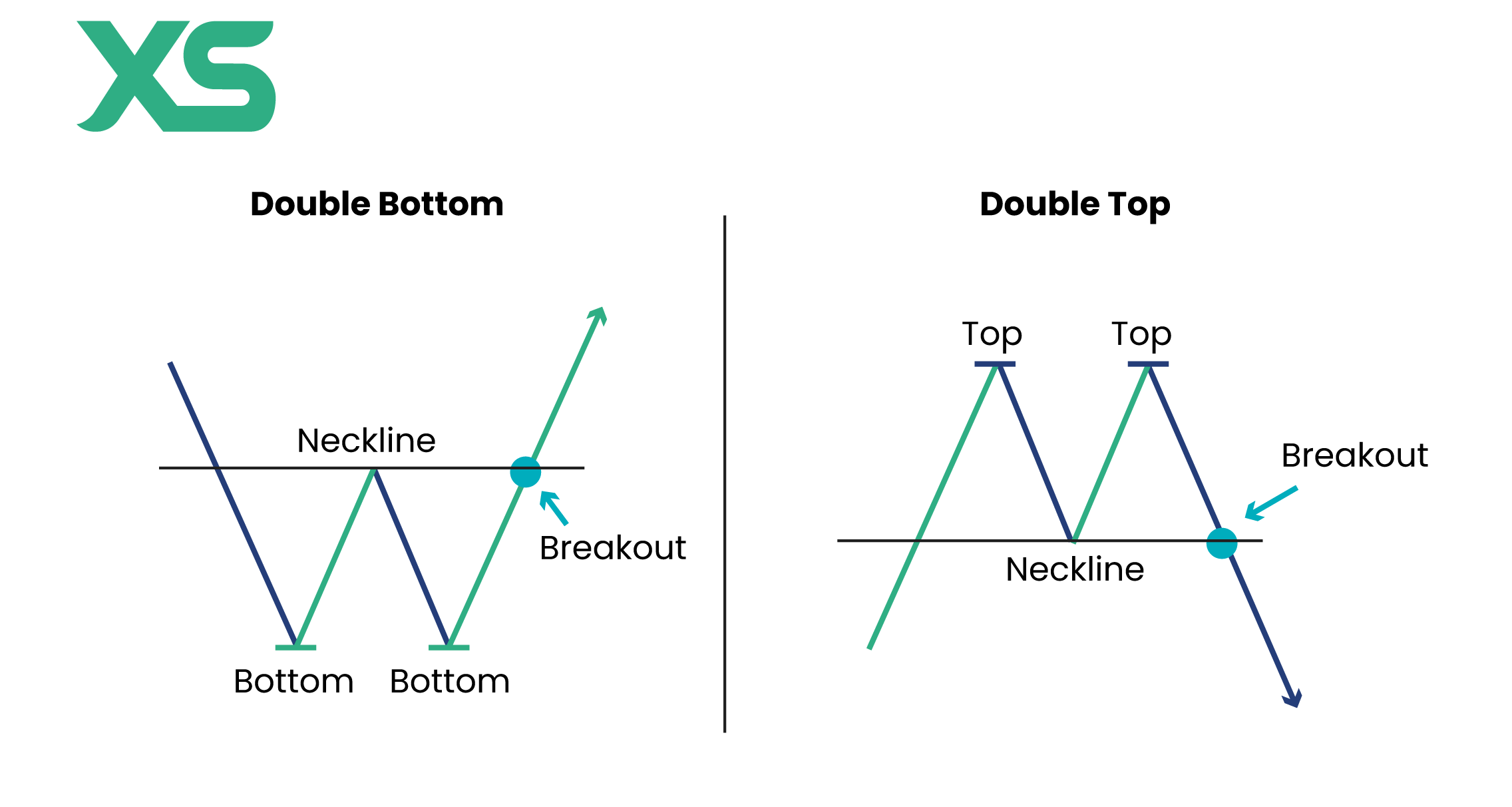

Double Bottom Pattern vs. Double Top Pattern

In contrast to the double bottom pattern, the double top pattern is a bearish reversal pattern. It consists of two peaks separated by a trough, resembling an inverted "W."

The double-top pattern indicates that an asset's price may be poised to decline after reaching resistance levels twice.

What Does the Double Bottom Pattern Indicate?

The double bottom pattern signals a significant shift in market sentiment from bearish to bullish.

This pattern indicates that an asset's price has found strong support at a particular level, preventing further declines.

After rebounding to the neckline, the price tested this support again, forming the second bottom. The second bottom reinforces the support level, suggesting that buyers are willing to enter the market at this price.

Once the price breaks above the neckline, it confirms a bullish reversal, indicating that the selling pressure has diminished and buying pressure is increasing.

This breakout suggests that the asset is poised for an upward trend, making it a crucial indicator for traders seeking to capitalize on trend reversals.

Overall, the Double Bottom pattern warns that the previous bearish trend may end, and a bullish trend may be on the horizon.

Double Bottom Pattern Variations

Double bottom patterns signal market reversals, but variations of this pattern can add complexity, influencing both the pattern's effectiveness and the strategies used to trade it.

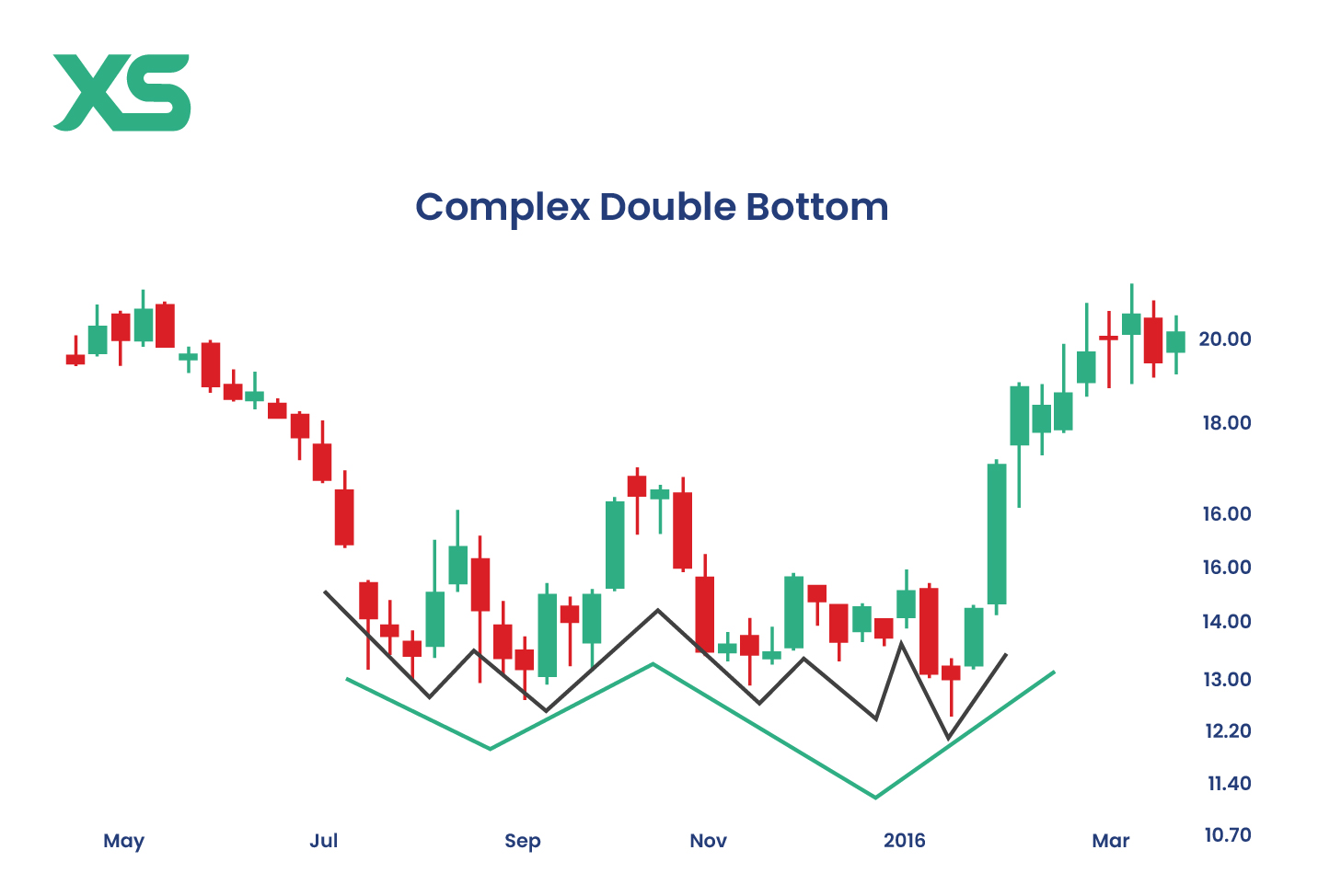

Complex Double Bottom Patterns

A complex double-bottom pattern occurs when multiple “tests” of support happen within the standard two-bottom structure.

Here’s how it works:

-

Multiple Support Tests: Rather than two distinct lows, a complex double bottom can show price testing the support level multiple times, possibly with minor retracements between each test.

-

Extended Consolidation: These patterns tend to form over a longer period as the price consolidates, allowing more buyers to accumulate before a breakout.

-

Trading Impact: Complex double bottoms can provide a more reliable signal due to additional support tests, indicating stronger resistance to further declines. However, longer formations also require patience and potentially wider stop-losses.

Failed Double Bottom Patterns

A failed double bottom occurs when a pattern initially looks like a double bottom but then fails to achieve a breakout above the neckline.

Common reasons for failure include weak buying pressure, a lack of volume, or external market factors that suddenly increase selling pressure.

-

False Breakouts: The price might briefly break above the neckline, only to fall back, invalidating the pattern.

-

Volume Weakness: Without significant volume during the breakout, the double bottom is more likely to fail, as it may lack the buying momentum necessary for a sustained move.

-

Trading Impact: Recognizing early signs of a failed double bottom—such as weak volume or a lack of follow-through after the breakout—can help traders exit trades or tighten stop-losses.

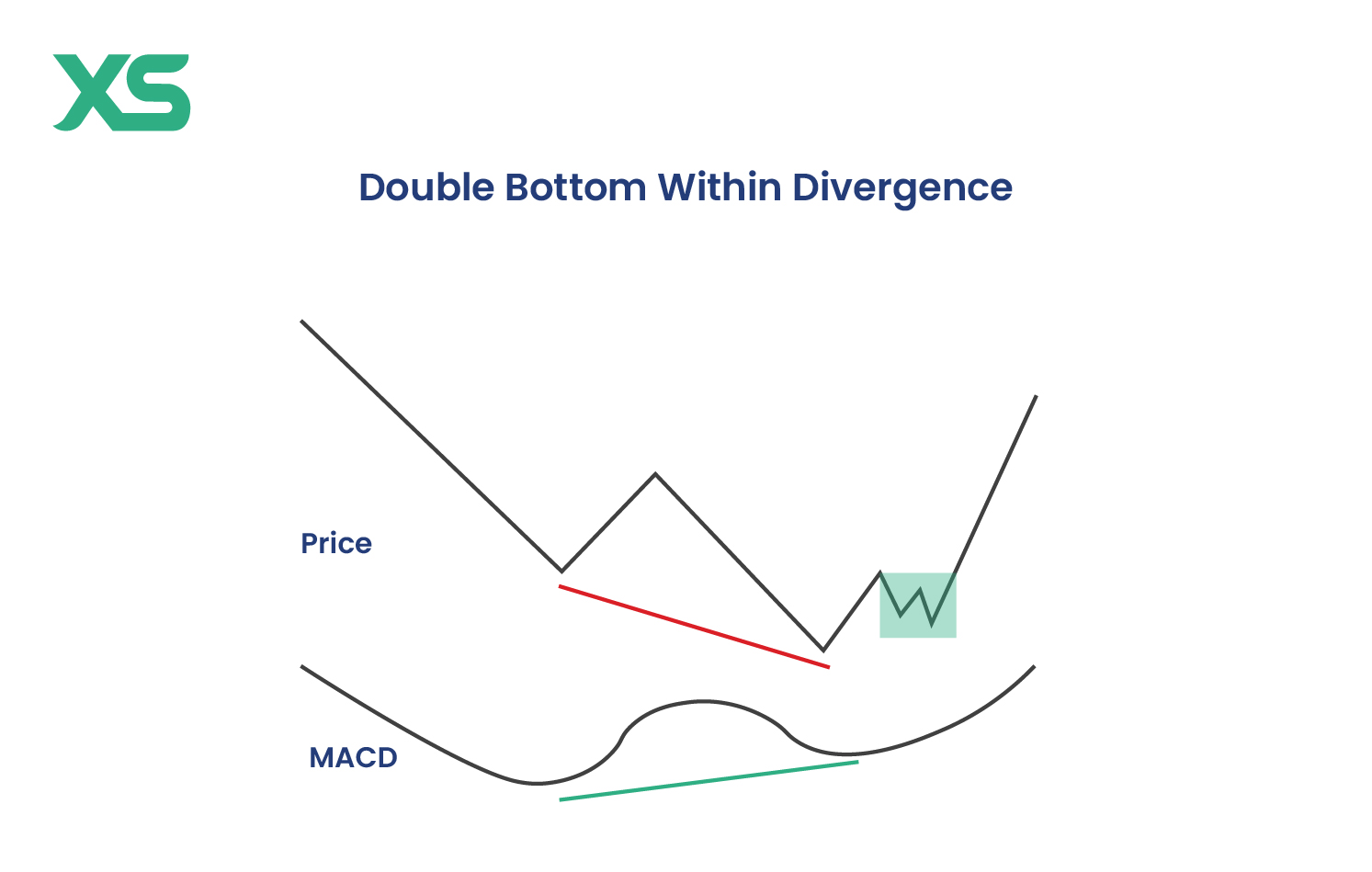

Double Bottom with Divergence

A double bottom pattern with divergence occurs when the price action forms a double bottom, but technical indicators, like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), do not align.

-

Divergence in Indicators: For instance, if the price forms a second bottom at a similar level, but RSI does not reach as low as during the first bottom, it suggests a weakening of downward momentum.

-

Improved Reversal Signal: Divergence between price action and indicators can strengthen the reversal signal, as it indicates that selling pressure is diminishing.

-

Trading Impact: Divergence can make double bottoms more powerful, signaling that the downtrend is losing strength. This can be an effective way to confirm the pattern before committing to a trade.

Trading Strategies Using the Double Bottom Pattern

Trading the Double Bottom pattern effectively involves a combination of accurate identification, timely execution, and strategic risk management.

Here is a Double Bottom pattern strategy to consider:

-

Enter Long Position: Initiate a buy order when the price breaks above the neckline, signaling a confirmed bullish reversal. This entry point offers a strong potential for upward movement.

-

Set Stop-Loss: Place a stop-loss order slightly below the second bottom to manage risk and protect your capital. This helps to limit potential losses if the pattern fails and the price declines.

-

Measure Target: Estimate potential price targets by measuring the pattern's height (from the bottom to the neckline) and projecting it upward from the breakout point. This projection helps determine potential profit levels.

-

Combine Indicators: Enhance your trading strategy by using additional technical indicators, such as moving averages or Relative Strength Index (RSI).

-

Monitor Volume: Confirm the breakout with higher trading volume, as increased volume adds reliability to the pattern. Higher volume indicates strong buying interest, supporting the bullish reversal.

Tips for Trading the Double Bottom Pattern

-

Wait for Confirmation: Ensure that the pattern is confirmed by a break above the neckline before entering a trade.

-

Analyze Volume: Higher trading volume during the breakout increases the reliability of the pattern.

-

Set Stop-Loss Orders: Protect your capital by placing stop-loss orders below the second bottom.

-

Use Additional Indicators: Enhance your strategy by combining the double bottom pattern with other technical indicators.

-

Stay Informed: Monitor market news and events that could impact the asset's price movement.

Conclusion

The Double Bottom pattern, characterized by two distinct bottoms and a breakout above the neckline, signals a shift in market sentiment from bearish to bullish.

Understanding its formation, structure, and implications allows you to develop effective trading strategies and improve your decision-making process.

Follow XS for more educational content!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

Yes, the double bottom pattern is a bullish reversal pattern.

The double bottom pattern is generally considered reliable, especially when confirmed with additional technical indicators and high trading volume during the breakout.

A double bottom pattern is invalidated if the price fails to break above the neckline or if the price falls significantly below the second bottom.

The win rate of the double bottom pattern varies depending on market conditions and the specific asset, but it is typically considered to have a high success rate when properly identified and confirmed.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.