Forex

Bull Flag Pattern: Definition, Examples, and Trading Tips

Written by Sarah Abbas

Fact checked by Antonio Di Giacomo

Updated 3 December 2024

Table of Contents

A Bull Flag pattern is a bullish continuation pattern that signals a pause in an uptrend followed by a breakout.

This article will guide you through the basics of the Bull Flag pattern, including its formation, how to identify it, and practical trading strategies.

Key Takeaways

-

A Bull Flag pattern is a bullish continuation pattern that signals a pause in an uptrend followed by a breakout. It indicates that the initial bullish momentum is likely to continue after a brief consolidation period.

-

The Bull Flag pattern offers well-defined entry and exit points, making it easier for traders to plan and execute trades effectively.

-

The Bull Flag pattern applies to various markets, including stocks, forex, and cryptocurrencies.

Try a No-Risk Demo Account

Register for a free demo and refine your trading strategies.

Open Your Free Account

What Is a Bull Flag Pattern?

A Bull Flag pattern is a bullish continuation flag pattern that occurs amid an uptrend. It represents a pause in the upward movement before the trend resumes.

This pattern indicates that the initial bullish momentum will likely continue after a brief consolidation period. Understanding this pattern can greatly enhance your ability to identify profitable trading opportunities.

This pattern offers a high-probability setup for entering long positions in the market. The pattern's formation indicates that the market is taking a breather before continuing its upward trajectory, allowing traders to join the trend at a promising point.

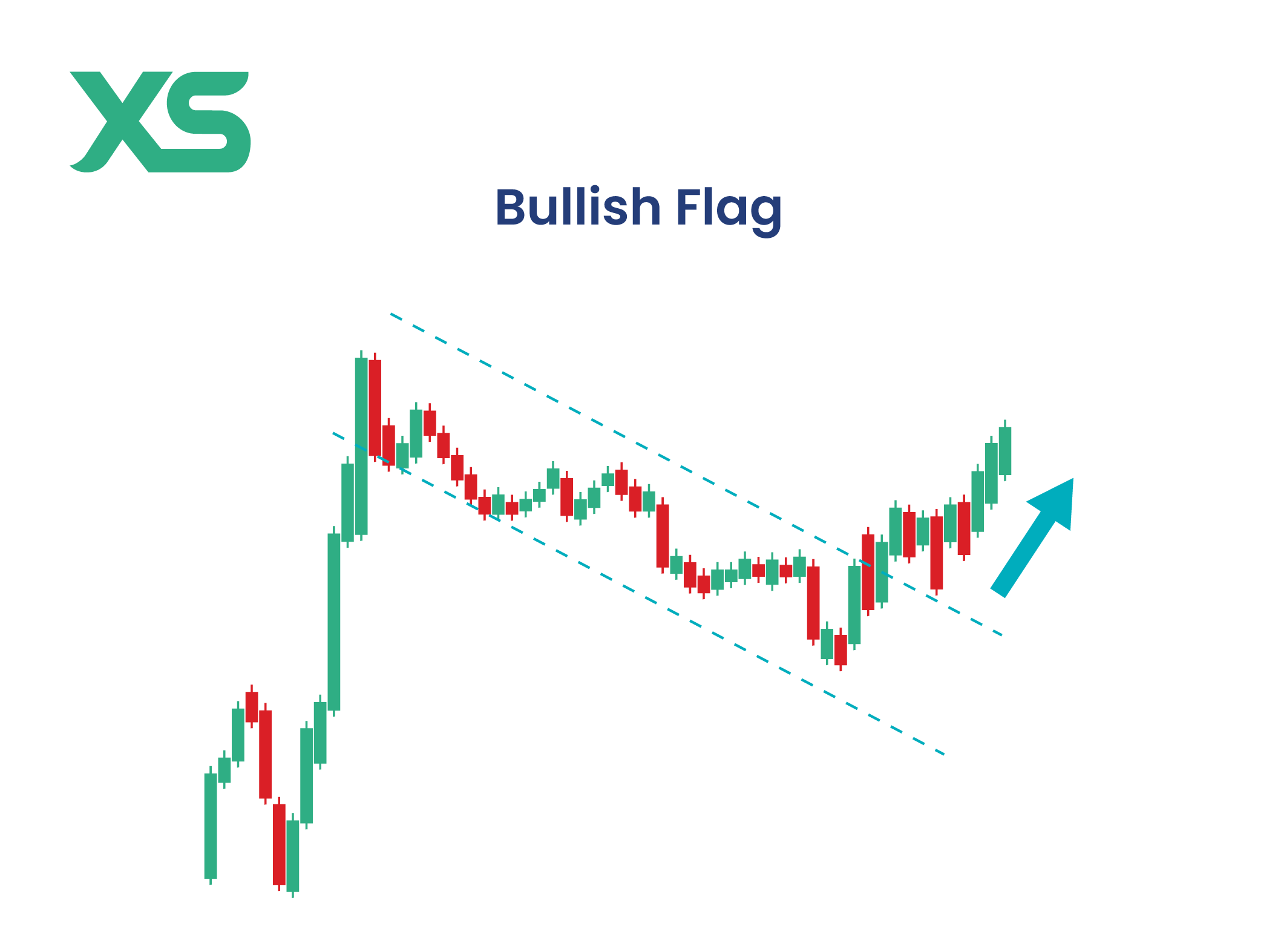

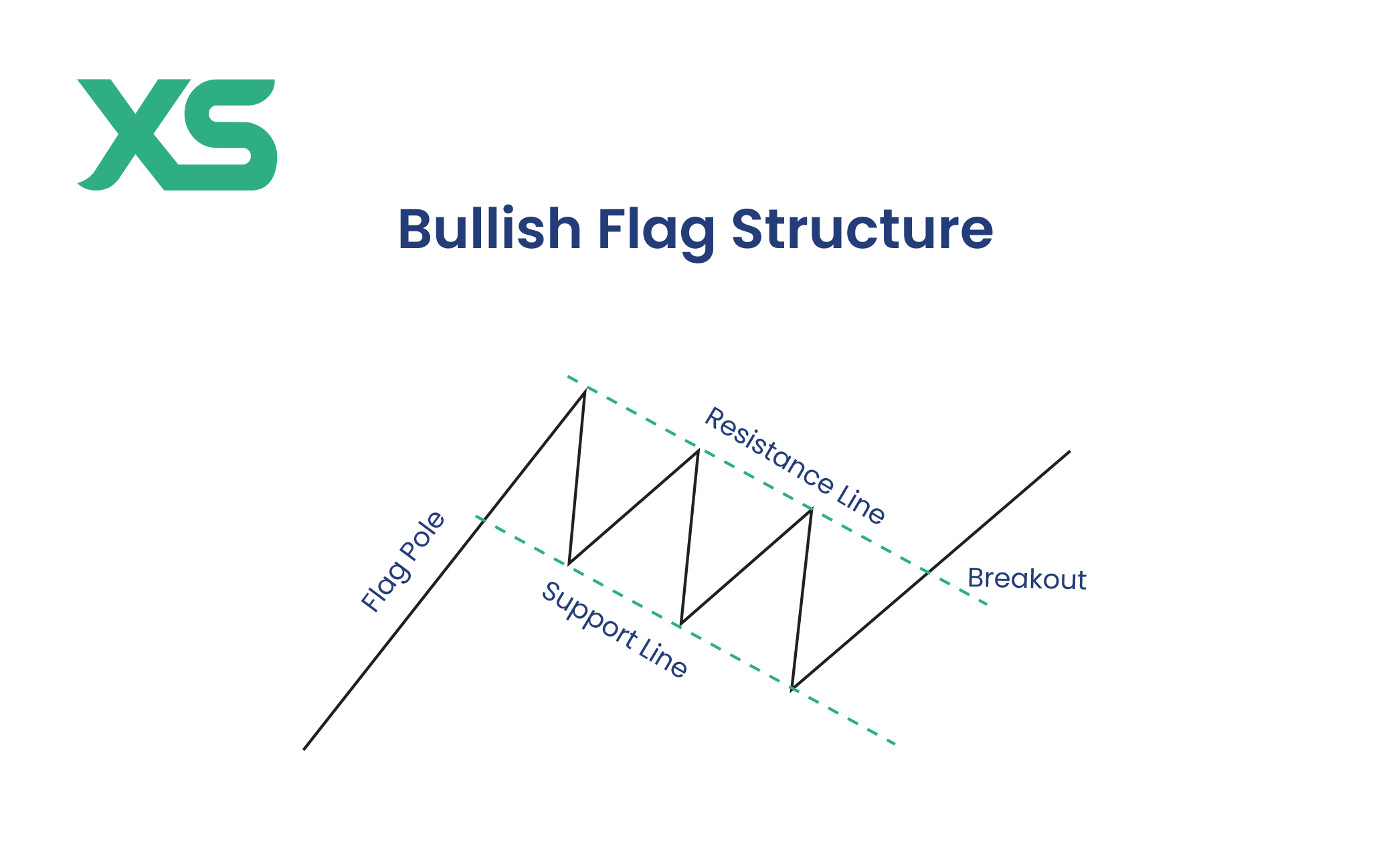

Formation of the Bull Flag Pattern

The formation of a Bull Flag pattern is a structured process that clearly visualizes a temporary pause in a bullish trend.

Initial Uptrend (Flagpole)

The formation begins with a strong, nearly vertical rise in price, known as the flagpole. This sharp upward movement reflects intense buying interest and establishes a bullish trend.

The flagpole serves as the foundation of the bullish flag setup and is characterized by large bullish candlesticks and significant trading volume.

Consolidation Phase (Flag)

Following the initial uptrend, the price enters a consolidation phase, forming the flag.

During this phase, the price moves sideways or slightly downward within a narrow range, creating a channel that slopes against the prevailing trend.

The flag typically consists of smaller candlesticks, indicating reduced volatility and lower trading volume than the flagpole.

Formation of Parallel Trendlines

As the price consolidates, it forms two parallel trendlines that define the flag's upper and lower boundaries.

These trendlines are drawn to connect the highs and lows of the consolidation phase. The flag pattern should ideally be sloped downward or moved horizontally, indicating a temporary retracement or pause in the bullish trend.

Breakout Confirmation

The Bull Flag pattern is confirmed when the price breaks out of the consolidation phase, moving above the upper trendline of the flag with increased volume.

This breakout signals the resumption of the bullish trend and the continuation of the previous upward movement.

How to Identify a Bull Flag Pattern

Identifying a Bull Flag pattern is essential for traders to capitalize on bullish flag setups. This pattern offers clear entry and exit points, making it a valuable tool in trading.

Key steps to identify a Bull Flag pattern:

-

Look for a strong uptrend: The flagpole should be a steep and nearly vertical rise in price.

-

Identify the consolidation phase: This is the flag, where the price moves sideways or slightly downward within parallel lines.

-

Watch for a breakout. The pattern is confirmed when the price breaks above the flag's upper trendline with increased volume.

Using bull flag pattern indicators such as moving averages and volume can help confirm the pattern.

For example, an increasing volume during the breakout phase adds credibility to the bullish flag trend.

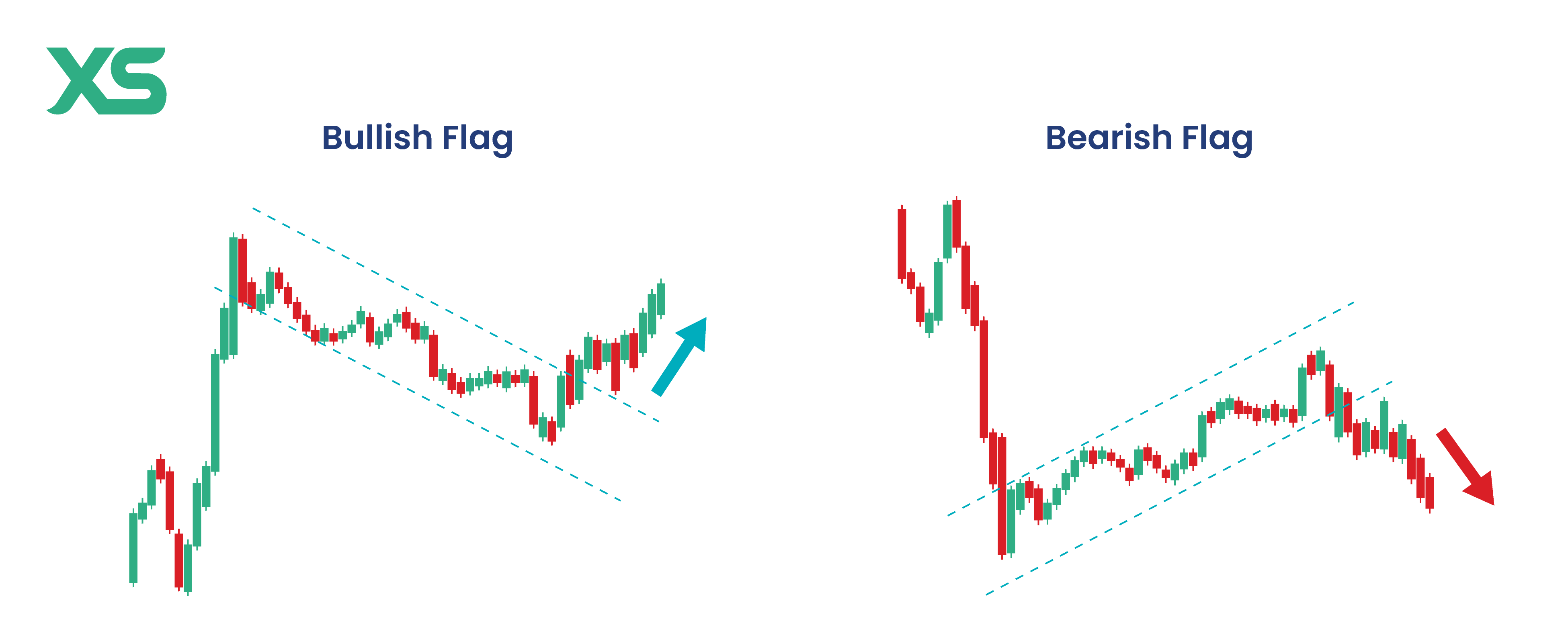

Bullish vs. Bearish Flag Pattern

While both patterns share similarities in structure—a flagpole followed by a flag—they signal opposite market trends.

Here are the key differences between a Bullish Flag and a Bearish Flag pattern:

-

Trend Direction:

-

Bullish Flag Pattern: Indicates a continuation of an upward trend.

-

Bearish Flag Pattern: Indicates a continuation of a downward trend.

-

-

Market Sentiment:

-

Bullish Flag Pattern: Reflects strong buying interest and market optimism. Traders are taking a pause before pushing prices higher.

-

Bearish Flag Pattern: Reflects strong selling pressure and market pessimism. The market pauses briefly before continuing to push prices lower.

-

-

Breakout Direction:

-

Bullish Flag Pattern: Breaks out above the upper trendline of the flag, signaling a return to the uptrend.

-

Bearish Flag Pattern: Breaks out below the lower trendline of the flag, signaling a return to the downtrend.

-

Understanding these differences can help traders make better-informed decisions.

For example, recognizing a bullish flag setup can allow one to enter a long position anticipating a breakout.

Conversely, spotting a bearish flag pattern can help traders prepare for potential short-selling opportunities.

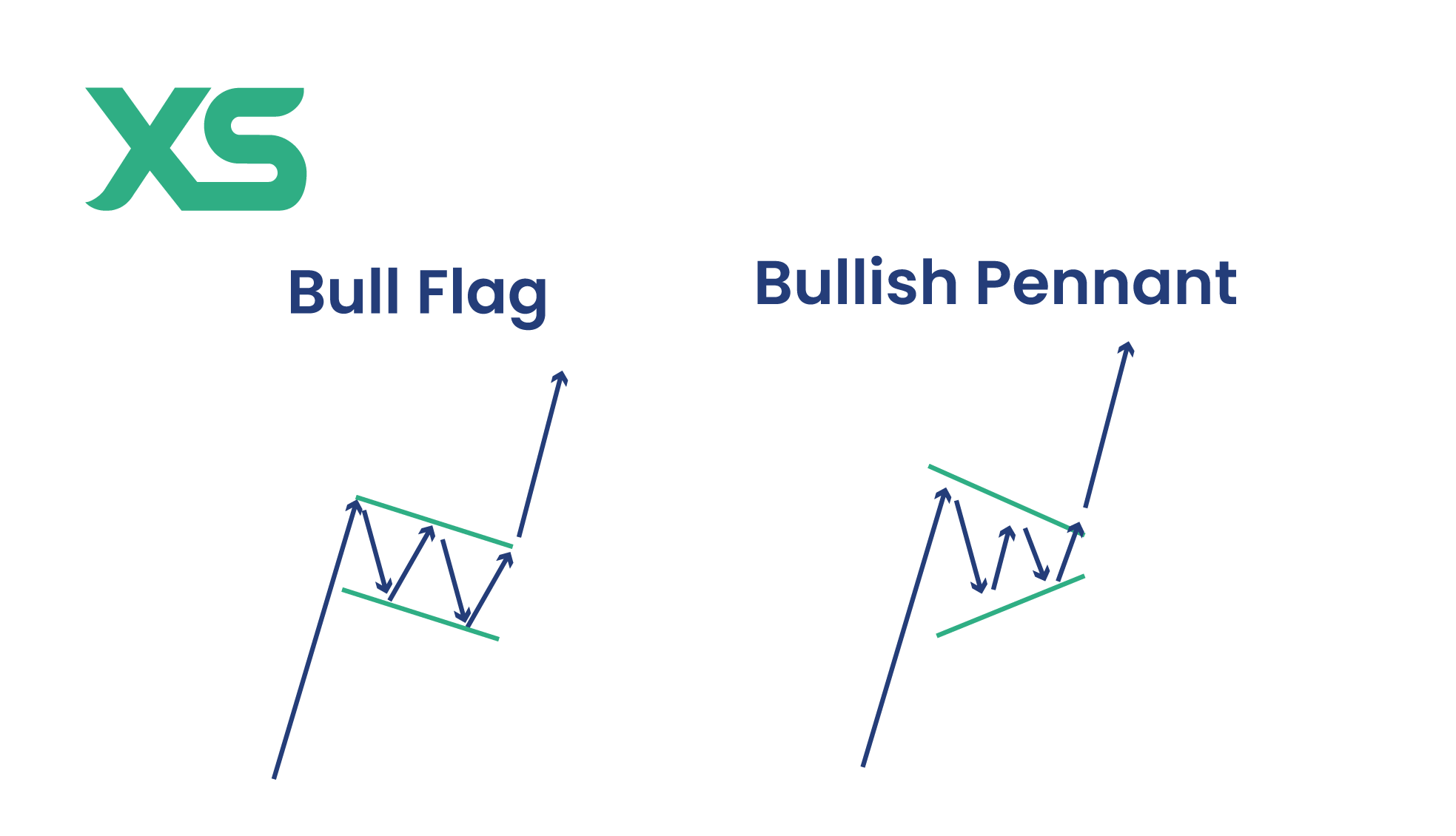

Bullish Flag vs. Bullish Pennant Pattern

While both patterns signal bullish continuation, the bullish flag and bullish pennant patterns have distinct visual differences and slightly different formation criteria.

-

Shape and Structure:

-

Bullish Flag: Features parallel trendlines forming rectangular shapes during the consolidation phase.

-

Bullish Pennant: Features converging trendlines forming a small symmetrical triangle during consolidation.

-

-

Consolidation Behavior:

-

Bullish Flag: The consolidation phase moves sideways or slightly downward, maintaining a relatively consistent width.

-

Bullish Pennant: The consolidation phase shows a contracting price range, with higher lows and lower highs, forming a tighter structure.

-

-

Market Psychology:

-

Bullish Flag: Reflects a temporary pause where traders take profits before increasing prices.

-

Bullish Pennant: Indicates a brief consolidation period with indecision before the trend resumes.

-

Trading Strategies for Bull Flag Patterns

Trading Bull Flag patterns can be highly profitable if approached with the right strategies.

Here are some effective strategies for trading Bull Flag patterns:

1. Entry Point

The ideal entry point for a Bull Flag pattern is when the price breaks above the flag's upper trendline with increased volume.

This breakout signals the continuation of the bullish trend. Entering at this point helps you join the uptrend at the beginning of the next leg higher.

2. Stop-Loss Placement

To manage risk, place a stop-loss order just below the flag's lower trendline. This ensures that your losses are minimized if the breakout fails and the price reverses.

The stop-loss level should be set at a point where the pattern would be invalidated if the price reaches it, typically just below the lowest point of the consolidation phase.

3. Profit Target

Set a profit target based on the height of the flagpole. Measure the distance from the start of the flagpole to the top, then project this distance from the breakout point above the flag.

This gives you a realistic target for the next upward move. For instance, if the flagpole is 10 points high, set your profit target 10 points above the breakout level.

4. Using Bull Flag Pattern Indicators

Complement the Bull Flag pattern with additional technical indicators to confirm the strength of the breakout.

Indicators such as moving averages can help identify the overall trend, while volume indicators like the On-Balance Volume (OBV) or Volume Weighted Average Price (VWAP) can validate the breakout's strength. An increasing volume during the breakout phase is a strong bullish signal.

What Time Frame is Best to Trade a Bull Flag Pattern?

The ideal time frame to trade a Bull Flag pattern depends on your trading style and objectives.

1. Short-Term (1-15 Minute Charts)

-

For Day Traders: Quick opportunities within a single trading session, ideal for capturing rapid price moves.

-

Drawback: Increased noise and risk of false breakouts.

2. Mid-Term (30-Minute to 4-Hour Charts)

-

For Swing Traders: Patterns take longer to form, offering more reliable signals with less market noise.

-

Drawback: Requires patience, as trades may take days to develop fully.

3. Long-Term (Daily to Weekly Charts)

-

For Position Traders: Strong trend reliability with potential for larger moves.

-

Drawback: Extended holding periods, as patterns can take weeks to complete.

Advantages and Disadvantages of Bull Flag Pattern

Understanding the pros and cons of the Bull Flag pattern can help traders use it more effectively.

Advantages

-

Clear Entry and Exit Points

-

The Bull Flag pattern provides well-defined entry and exit points, making it easier for traders to plan their trades and manage risk.

-

-

Easy to Identify with Practice

-

The pattern’s distinctive flagpole and flag formation make it easy to recognize with practice, allowing traders to spot bullish setups efficiently.

-

-

Versatile Across Markets

-

The Bull Flag pattern can be applied in various markets, including stocks, forex, and cryptocurrencies, making it a versatile tool for traders.

-

Disadvantages

-

False Breakouts Can Lead to Losses

-

False breakouts are a risk, as they can lead to losses if the price fails to continue the uptrend after breaking out.

-

-

Requires Strong Initial Trend for Reliability

-

The pattern relies on a strong initial trend for reliability, meaning it may not be as effective in weak or choppy markets.

-

-

Market Conditions Can Affect Pattern Performance

-

Changing market conditions, such as volatility or news events, can impact the performance and reliability of the Bull Flag pattern.

-

Tips for Trading Bull Flag Patterns

-

Practice Pattern Recognition: Use historical data to practice identifying bull flag patterns.

-

Combine with Other Indicators: Use bull flag pattern indicators like moving averages and RSI for confirmation.

-

Monitor Volume: Increased volume during the breakout phase adds validity to the bullish flag trend.

-

Manage Risk: Always use stop-loss orders to protect your capital.

These bull flag trading tips can help improve your success rate and minimize risks.

Common Mistakes to Avoid When Trading Bull Flag Patterns

Traders often face challenges when trading bull flag patterns. Some common pitfalls include:

-

Entering Prematurely: Jumping into a trade before a confirmed breakout can lead to losses if the price fails to break above the upper trendline.

-

Ignoring Volume Indicators: Volume is critical in validating a bull flag breakout; entering trades without considering volume increases the risk of false breakouts.

-

Setting Incorrect Stop-Losses: Placing stop-losses too close to the consolidation range may lead to premature exits.

Avoiding these mistakes can improve trade outcomes and reduce losses.

Conclusion

So, a Bull Flag pattern is a bullish continuation pattern that indicates a pause in an uptrend before the price resumes its upward movement.

You can capitalize on bullish flag setups in various markets by recognizing the pattern's formation, using effective trading strategies, and being aware of its advantages and disadvantages.

Follow XS for more educational content!

Get the latest insights & exclusive offers delivered straight to your inbox.

Table of Contents

FAQs

The Bull Flag pattern is generally considered reliable, especially when accompanied by strong volume during the breakout. However, its reliability depends on the strength of the initial trend and market conditions.

The price resumes upward movement after a Bull Flag pattern, continuing the prior uptrend. The breakout from the flag signals a potential continuation of the bullish trend.

Flag Pattern Theory involves recognizing and trading flag patterns, which are consolidation patterns that indicate a brief pause before the price continues toward the prevailing trend. This theory helps traders identify potential continuation points in both bullish and bearish markets.

Yes, Bull Flag patterns can be applied to stocks, forex, commodities, and cryptocurrencies. However, they tend to work best in trending markets where price moves consistently in one direction, allowing for more reliable breakouts.

The duration of a Bull Flag pattern varies depending on the time frame used. In shorter time frames, it may last minutes or hours, while on daily or weekly charts, it could last days or weeks. The duration is usually linked to the strength of the initial trend.

This written/visual material is comprised of personal opinions and ideas and may not reflect those of the Company. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. XS, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Our platform may not offer all the products or services mentioned.